Credit Suisse Investment Banking Pitch Book

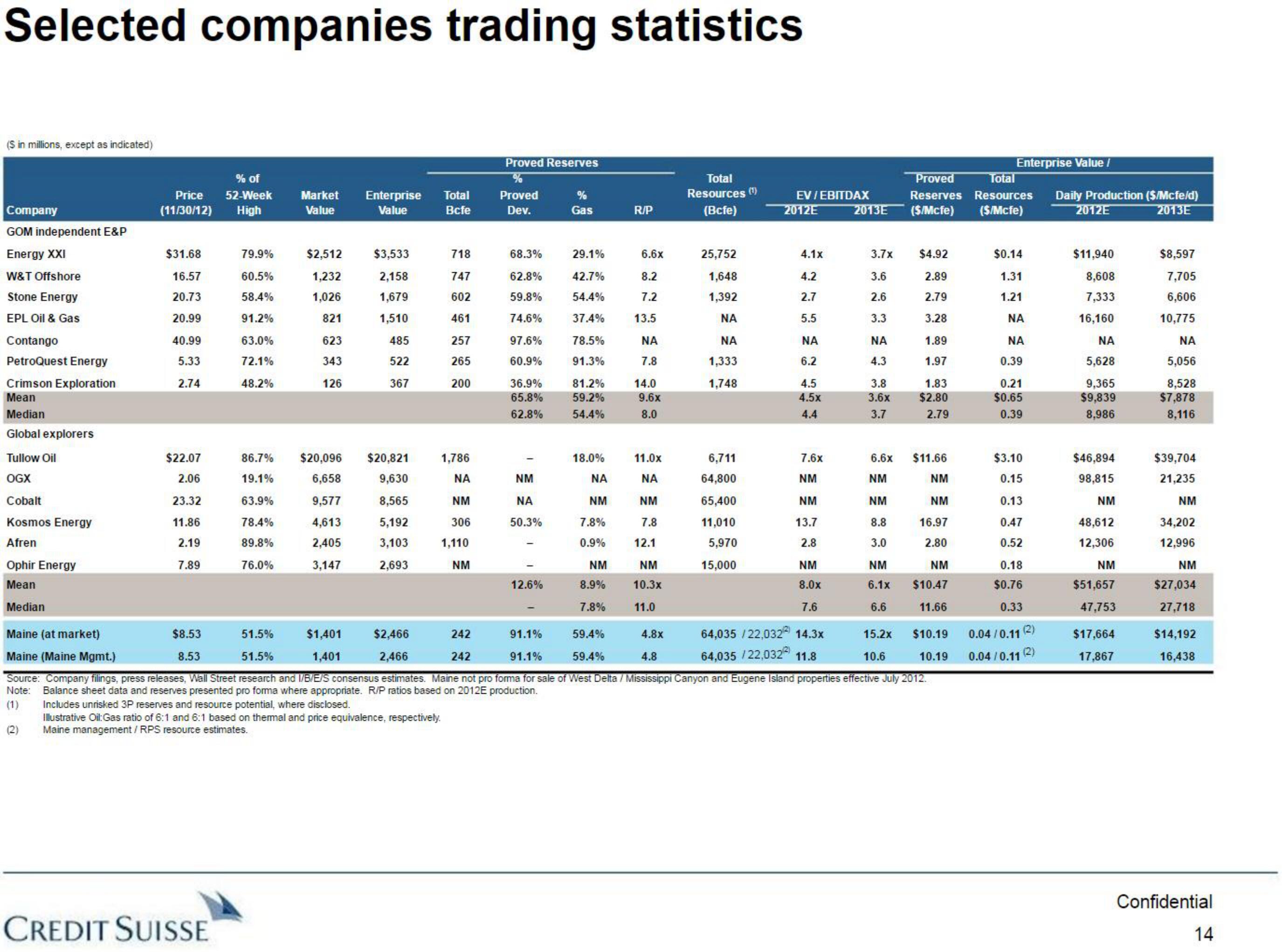

Selected companies trading statistics

(S in millions, except as indicated)

Company

GOM independent E&P

Energy XXI

W&T Offshore

Stone Energy

EPL Oil & Gas

Contango

PetroQuest Energy

Crimson Exploration

Mean

Median

Global explorers

Tullow Oil

OGX

Cobalt

Kosmos Energy

Afren

Ophir Energy

Mean

Median

% of

Price 52-Week

(11/30/12) High

(2)

$31.68

16.57

20.73

20.99

40.99

5.33

2.74

$22.07

2.06

23.32

11.86

2.19

7.89

79.9%

60.5%

58.4%

91.2%

63.0%

72.1%

48.2%

CREDIT SUISSE

Market Enterprise Total

Value

Value

Bcfe

$2,512

1,232

1,026

821

623

343

126

$3,533

2,158

1,679

1,510

485

522

367

86.7% $20,096 $20,821

19.1%

6,658

9,630

63.9%

9,577

8,565

78.4%

4,613

5,192

89.8%

2,405

3,103

76.0%

3,147

2,693

$1,401

1,401

718

747

602

461

257

265

200

1,786

ΝΑ

NM

306

1,110

NM

Proved Reserves

%

Proved

Dev.

68.3%

62.8%

59.8%

74.6%

97.6%

60.9%

36.9%

65.8%

62.8%

NM

ΝΑ

50.3%

12.6%

Gas

29.1%

42.7%

54.4%

37.4%

78.5%

91.3%

81.2%

59.2%

54.4%

18.0%

ΝΑ

NM

7.8%

0.9%

NM

8.9%

7.8%

R/P

6.6x

8.2

7.2

13.5

ΝΑ

7.8

14.0

9.6x

8.0

11.0x

ΝΑ

NM

7.8

12.1

NM

10.3x

11.0

Total

Resources (¹)

(Bcfe)

25,752

1,648

1,392

ΝΑ

ΝΑ

1,333

1,748

6,711

64,800

65,400

11,010

5,970

15,000

EV/EBITDAX

2012E

4.1x

4.2

2.7

5.5

ΝΑ

6.2

4.5

4.5x

4.4

7.6x

NM

NM

13.7

2.8

NM

8.0x

7.6

64,035 /22,032² 14.3x

64,035/22,032 11.8

2013E

3.7x

3.6

2.6

3.3

ΝΑ

4.3

3.8

3.6x

3.7

Maine (at market)

$8.53

51.5%

$2,466

242

4.8x

91.1%

91.1%

59.4%

59.4%

8.53

51.5%

2,466

242

4.8

Maine (Maine Mgmt.)

Source: Company filings, press releases, Wall Street research and I/B/E/S consensus estimates. Maine not pro forma for sale of West Delta / Mississippi Canyon and Eugene Island properties effective July 2012.

Note: Balance sheet data and reserves presented pro forma where appropriate. R/P ratios based on 2012E production.

(1)

Includes unrisked 3P reserves and resource potential, where disclosed.

Illustrative Oil: Gas ratio of 6:1 and 6:1 based on thermal and price equivalence, respectively.

Maine management / RPS resource estimates.

Proved

Total

Reserves Resources Daily Production ($/Mcfe/d)

($/Mcfe) ($/Mcfe)

2012E

2013E

$4.92

2.89

2.79

3.28

1.89

1.97

1.83

$2.80

2.79

6.6x $11.66

NM

NM

NM

NM

8.8

16.97

2.80

3.0

NM

6.1x

6.6

15.2x

10.6

NM

$10.47

11.66

Enterprise Value /

$10.19

10.19

$0.14

1.31

1.21

ΝΑ

ΝΑ

0.39

0.21

$0.65

0.39

$3.10

0.15

0.13

0.47

0.52

0.18

$0.76

0.33

0.04/0.11

0.04/0.11

(2)

(2)

$11,940

8,608

7,333

16,160

ΝΑ

5,628

9,365

$9,839

8,986

$46,894

98,815

NM

48,612

12,306

NM

$51,657

47,753

$17,664

17,867

$8,597

7,705

6,606

10,775

ΝΑ

5,056

8,528

$7,878

8,116

$39,704

21,235

NM

34,202

12,996

NM

$27,034

27,718

$14,192

16,438

Confidential

14View entire presentation