Altus Power SPAC Presentation Deck

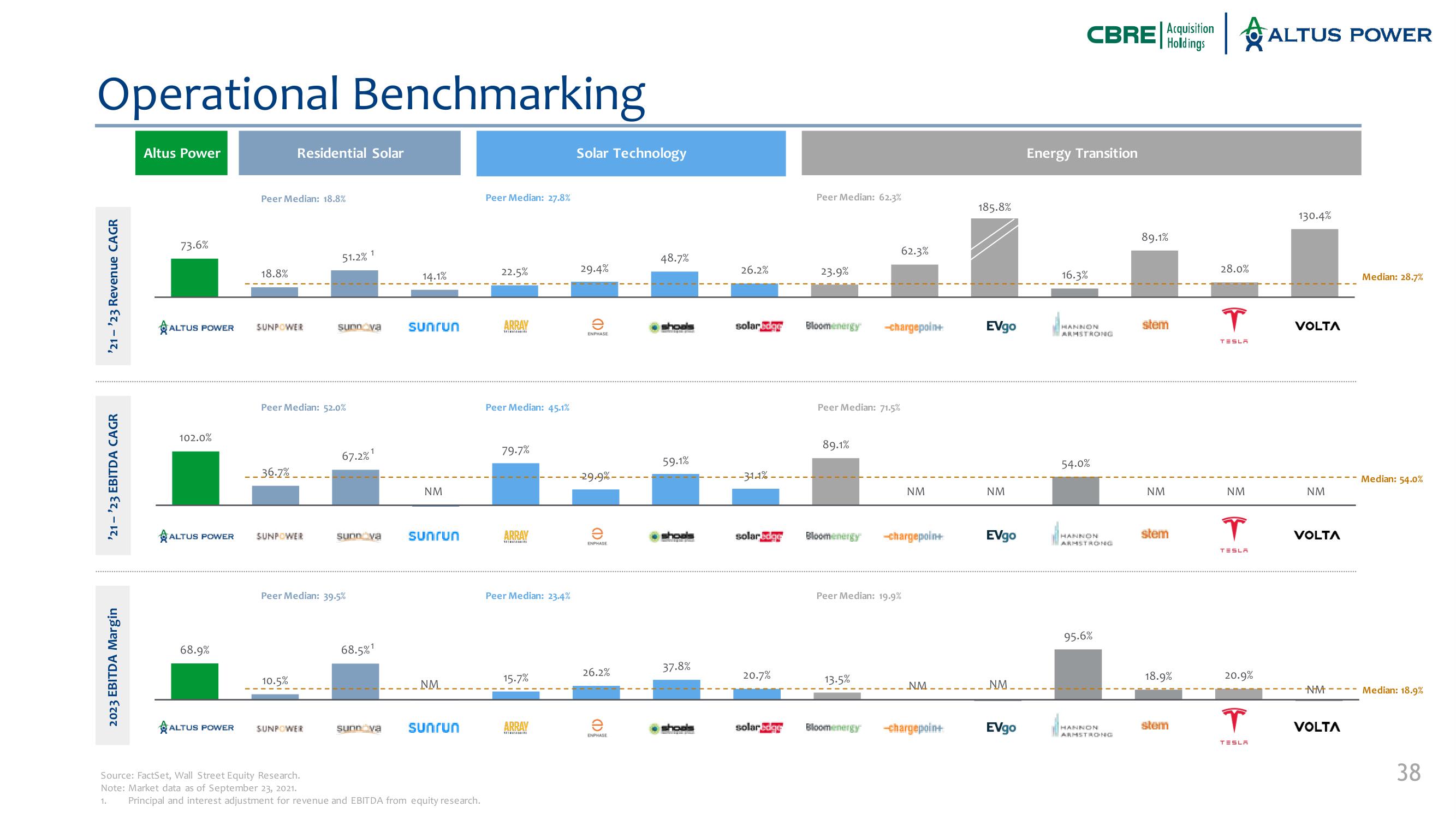

Operational Benchmarking

'21-'23 Revenue CAGR

'21-'23 EBITDA CAGR

2023 EBITDA Margin

Altus Power

73.6%

ALTUS POWER

102.0%

ALTUS POWER

68.9%

ALTUS POWER

Peer Median: 18.8%

18.8%

Residential Solar

SUNPOWER

--36.7%

Peer Median: 52.0%

SUNPOWER

10.5%

51.2% 1

sunn va

SUNPOWER

67.2%¹

Peer Median: 39.5%

sunn va

68.5%¹

sunn va

14.1%

sunrun

NM

sunrun

NM

sunrun

Source: FactSet, Wall Street Equity Research.

Note: Market data as of September 23, 2021.

1.

Principal and interest adjustment for revenue and EBITDA from equity research.

Peer Median: 27.8%

22.5%

ARRAY

Peer Median: 45.1%

79.7%

ARRAY

Peer Median: 23.4%

15.7%

ARRAY

1: Welas

Solar Technology

29.4%

e

ENPHASE

29.9%-

ENPHASE

26.2%

ENPHASE

48.7%

shoals

59.1%

shouls

37.8%

shouls

26.2%

solar.edge

---31.-1% -.

solaradge

20.7%

Peer Median: 62.3%

23.9%

Bloomenergy

89.1%

Peer Median: 71.5%

62.3%

-chargepoin+

13.5%

Bloomenergy -chargepoin+

Peer Median: 19.9%

solaradge Bloomenergy

NM

NM.

-chargepoin+

185.8%

EVgo

NM

EVgo

NM-

EVgo

CBRE Acquisition

Holdings

Energy Transition

16.3%

HANNON

ARMSTRONG

54.0%

HANNON

ARMSTRONG

95.6%

HANNONING

89.1%

stem

NM

stem

18.9%

stem

28.0%

T

TESLA

NM

T

TESLA

20.9%

T

TESLA

A

ALTUS POWER

130.4%

VOLTA

NM

VOLTA

NM

VOLTA

Median: 28.7%

Median: 54.0%

Median: 18.9%

38View entire presentation