DigitalOcean Results Presentation Deck

ņ Non-GAAP Diluted Net Income per Share

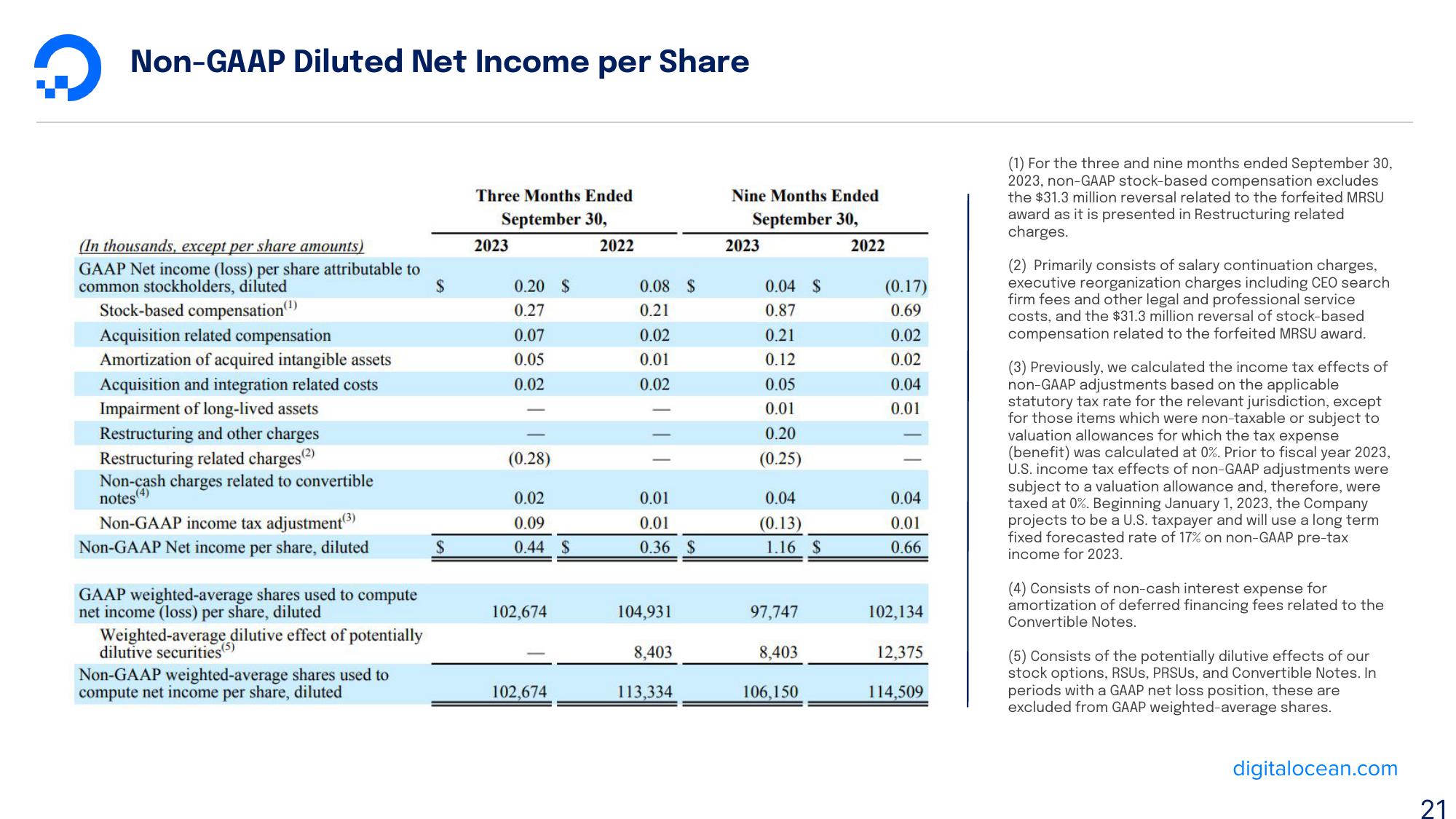

(In thousands, except per share amounts)

GAAP Net income (loss) per share attributable to

common stockholders, diluted

$

Stock-based compensation(¹)

Acquisition related compensation

Amortization of acquired intangible assets

Acquisition and integration related costs

Impairment of long-lived assets

Restructuring and other charges

Restructuring related charges(2)

Non-cash charges related to convertible

notes (4)

Non-GAAP income tax adjustment (3)

Non-GAAP Net income per share, diluted

GAAP weighted-average shares used to compute

net income (loss) per share, diluted

Weighted-average dilutive effect of potentially

dilutive securities (5)

Non-GAAP weighted-average shares used to

compute net income per share, diluted

$

Three Months Ended

September 30,

2022

2023

0.20 S

0.27

0.07

0.05

0.02

(0.28)

0.02

0.09

0.44 $

102,674

102,674

0.08 $

0.21

0.02

0.01

0.02

0.01

0.01

0.36 $

104,931

8,403

113,334

Nine Months Ended

September 30,

2022

2023

0.04 $

0.87

0.21

0.12

0.05

0.01

0.20

(0.25)

0.04

(0.13)

1.16 S

97,747

8,403

106,150

(0.17)

0.69

0.02

0.02

0.04

0.01

0.04

0.01

0.66

102,134

12,375

114,509

(1) For the three and nine months ended September 30,

2023, non-GAAP stock-based compensation excludes

the $31.3 million reversal related to the forfeited MRSU

award as it is presented in Restructuring related

charges.

(2) Primarily consists of salary continuation charges,

executive reorganization charges including CEO search

firm fees and other legal and professional service

costs, and the $31.3 million reversal of stock-based

compensation related to the forfeited MRSU award.

(3) Previously, we calculated the income tax effects of

non-GAAP adjustments based on the applicable

statutory tax rate for the relevant jurisdiction, except

for those items which were non-taxable or subject to

valuation allowances for which the tax expense

(benefit) was calculated at 0%. Prior to fiscal year 2023,

U.S. income tax effects of non-GAAP adjustments were

subject to a valuation allowance and, therefore, were

taxed at 0%. Beginning January 1, 2023, the Company

projects to be a U.S. taxpayer and will use a long term

fixed forecasted rate of 17% on non-GAAP pre-tax

income for 2023.

(4) Consists of non-cash interest expense for

amortization of deferred financing fees related to the

Convertible Notes.

(5) Consists of the potentially dilutive effects of our

stock options, RSUS, PRSUS, and Convertible Notes. In

periods with a GAAP net loss position, these are

excluded from GAAP weighted-average shares.

digitalocean.com

21View entire presentation