Maersk Investor Presentation Deck

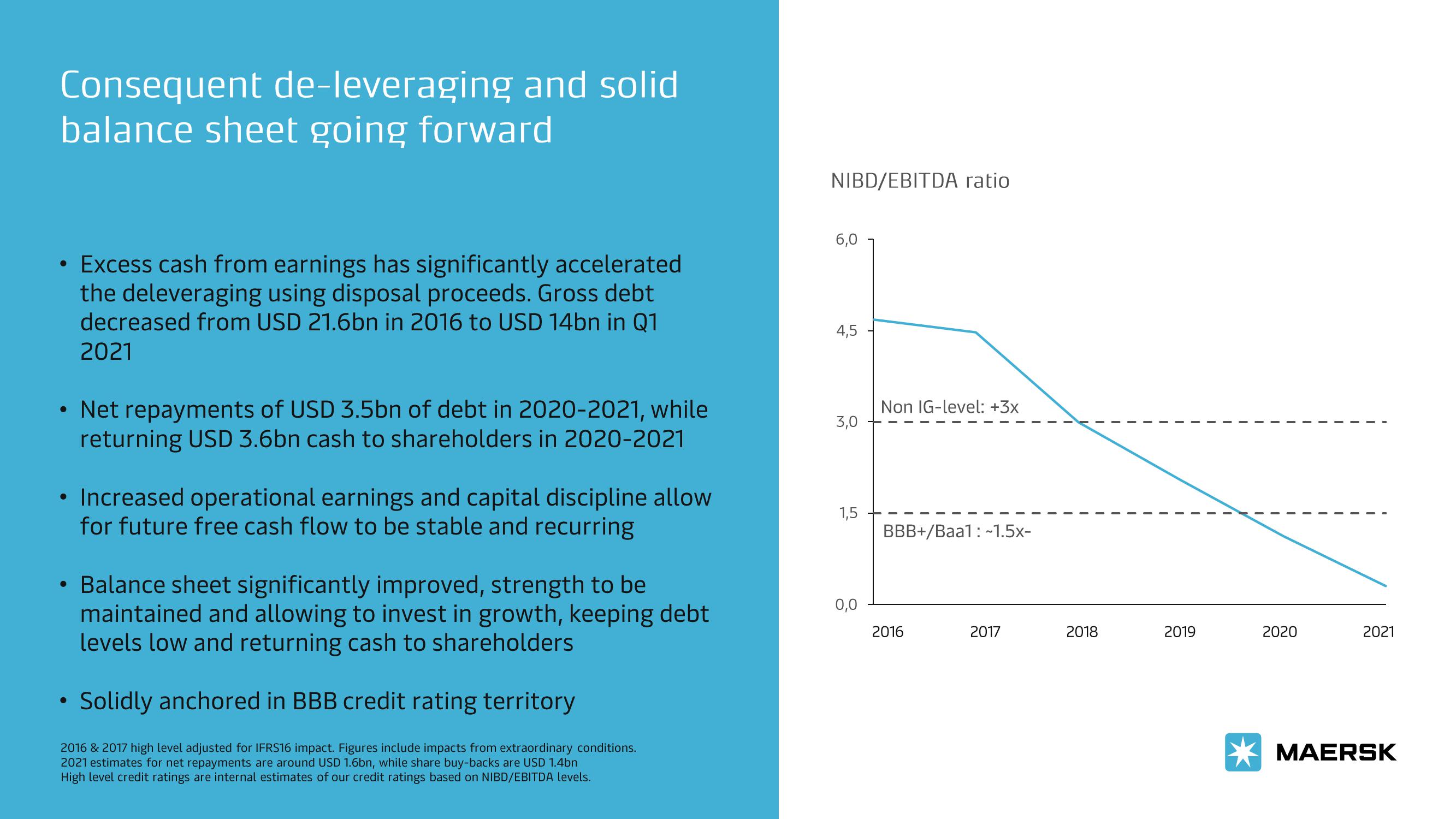

Consequent de-leveraging and solid

balance sheet going forward

●

●

Excess cash from earnings has significantly accelerated

the deleveraging using disposal proceeds. Gross debt

decreased from USD 21.6bn in 2016 to USD 14bn in Q1

2021

Net repayments of USD 3.5bn of debt in 2020-2021, while

returning USD 3.6bn cash to shareholders in 2020-2021

●

Increased operational earnings and capital discipline allow

for future free cash flow to be stable and recurring

●

• Balance sheet significantly improved, strength to be

maintained and allowing to invest in growth, keeping debt

levels low and returning cash to shareholders

Solidly anchored in BBB credit rating territory

2016 & 2017 high level adjusted for IFRS16 impact. Figures include impacts from extraordinary conditions.

2021 estimates for net repayments are around USD 1.6bn, while share buy-backs are USD 1.4bn

High level credit ratings are internal estimates of our credit ratings based on NIBD/EBITDA levels.

NIBD/EBITDA ratio

6,0

4,5

3,0

1,5

0,0

Non IG-level: +3x

BBB+/Baal: -1.5x-

2016

2017

2018

2019

2020

2021

MAERSKView entire presentation