Long-Duration Targeted Improvements and Resegmentation Impact Summary

Long-Duration Targeted Improvements

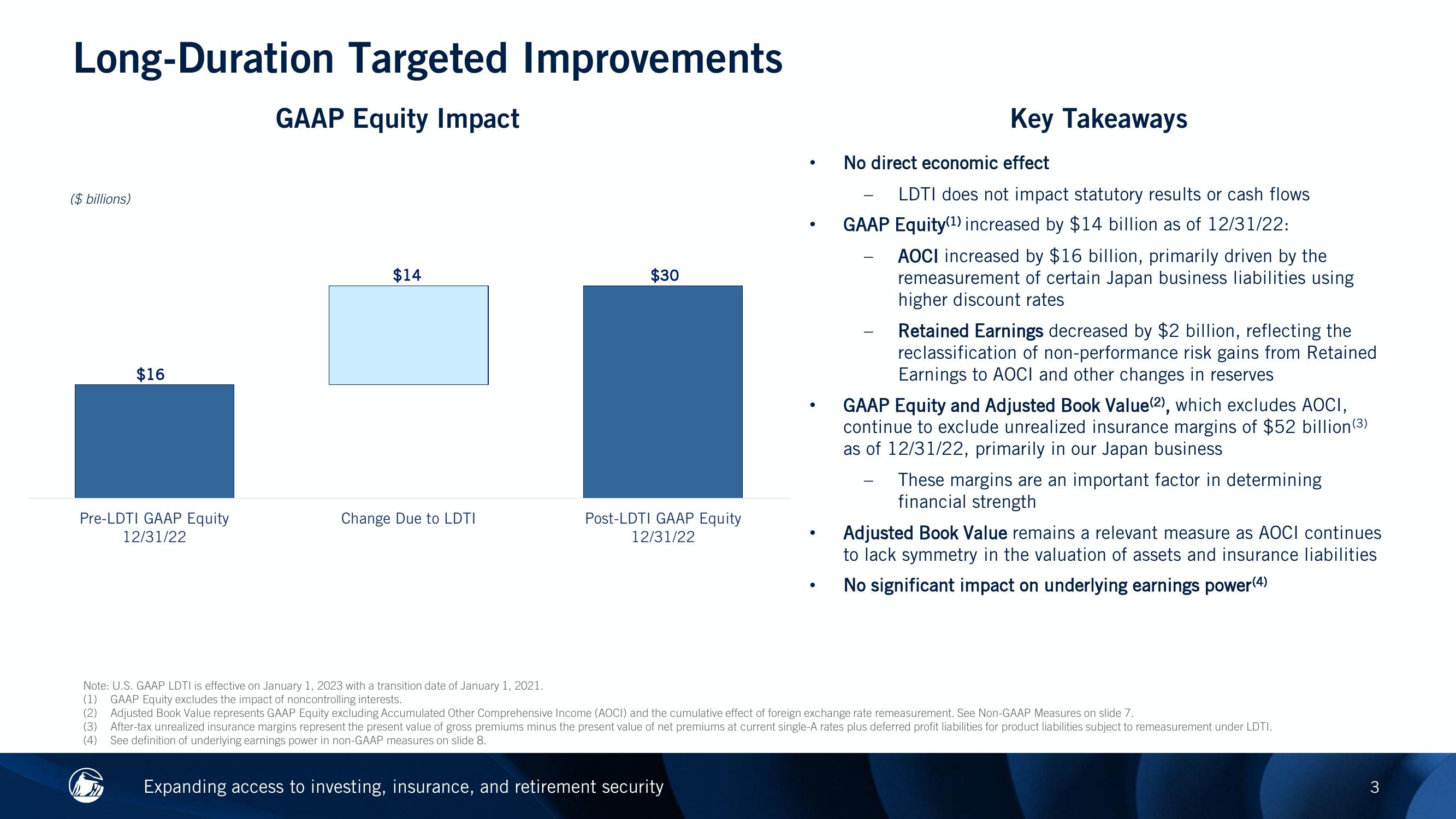

GAAP Equity Impact

($ billions)

$16

Pre-LDTI GAAP Equity

12/31/22

$14

H

Change Due to LDTI

$30

Post-LDTI GAAP Equity

12/31/22

●

●

●

●

Key Takeaways

No direct economic effect

LDTI does not impact statutory results or cash flows

GAAP Equity (¹) increased by $14 billion as of 12/31/22:

AOCI increased by $16 billion, primarily driven by the

remeasurement of certain Japan business liabilities using

higher discount rates

Retained Earnings decreased by $2 billion, reflecting the

reclassification of non-performance risk gains from Retained

Earnings to AOCI and other changes in reserves

GAAP Equity and Adjusted Book Value(2), which excludes AOCI,

continue to exclude unrealized insurance margins of $52 billion (3)

as of 12/31/22, primarily in our Japan business

These margins are an important factor in determining

financial strength

Adjusted Book Value remains a relevant measure as AOCI continues

to lack symmetry in the valuation of assets and insurance liabilities

No significant impact on underlying earnings power(4)

Note: U.S. GAAP LDTI is effective on January 1, 2023 with a transition date of January 1, 2021.

(1) GAAP Equity excludes the impact of noncontrolling interests.

(2) Adjusted Book Value represents GAAP Equity excluding Accumulated Other Comprehensive Income (AOCI) and the cumulative effect of foreign exchange rate remeasurement. See Non-GAAP Measures on slide 7.

(3) After-tax unrealized insurance margins represent the present value of gross premiums minus the present value of net premiums at current single-A rates plus deferred profit liabilities for product liabilities subject to remeasurement under LDTI.

(4) See definition of underlying earnings power in non-GAAP measures on slide 8.

Expanding access to investing, insurance, and retirement security

3View entire presentation