KKR Real Estate Finance Trust Investor Presentation Deck

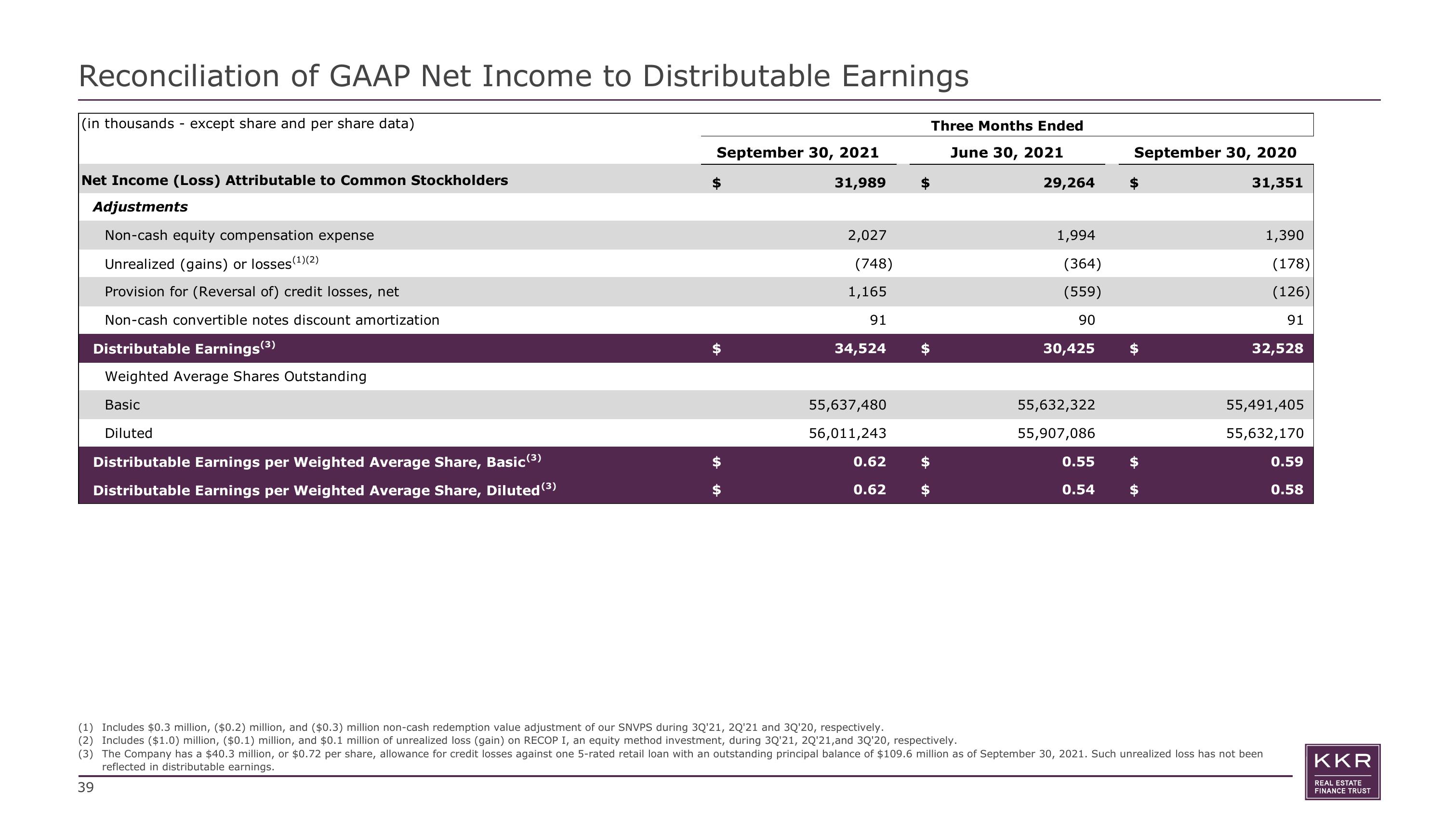

Reconciliation of GAAP Net Income to Distributable Earnings

(in thousands - except share and per share data)

Net Income (Loss) Attributable to Common Stockholders

Adjustments

Non-cash equity compensation expense

Unrealized (gains) or losses (¹)(2)

Provision for (Reversal of) credit losses, net

Non-cash convertible notes discount amortization

Distributable Earnings (³)

Weighted Average Shares Outstanding

Basic

Diluted

Distributable Earnings per Weighted Average Share, Basic (³)

Distributable Earnings per Weighted Average Share, Diluted (3)

September 30, 2021

31,989

39

LA

LA

2,027

(748)

1,165

91

34,524

55,637,480

56,011,243

0.62

0.62

Three Months Ended

June 30, 2021

29,264

1,994

(364)

(559)

90

30,425

55,632,322

55,907,086

0.55

0.54

September 30, 2020

31,351

1,390

(1) Includes $0.3 million, ($0.2) million, and ($0.3) million non-cash redemption value adjustment of our SNVPS during 3Q'21, 2Q'21 and 3Q'20, respectively.

(2) Includes ($1.0) million, ($0.1) million, and $0.1 million of unrealized loss (gain) on RECOP I, an equity method investment, during 3Q'21, 2Q'21,and 3Q'20, respectively.

(3) The Company has a $40.3 million, or $0.72 per share, allowance for credit losses against one 5-rated retail loan with an outstanding principal balance of $109.6 million as of September 30, 2021. Such unrealized loss has not been

reflected in distributable earnings.

(178)

(126)

91

32,528

55,491,405

55,632,170

0.59

0.58

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation