Playboy SPAC Presentation Deck

PLAYBOY 2020

D $3

с

B

A

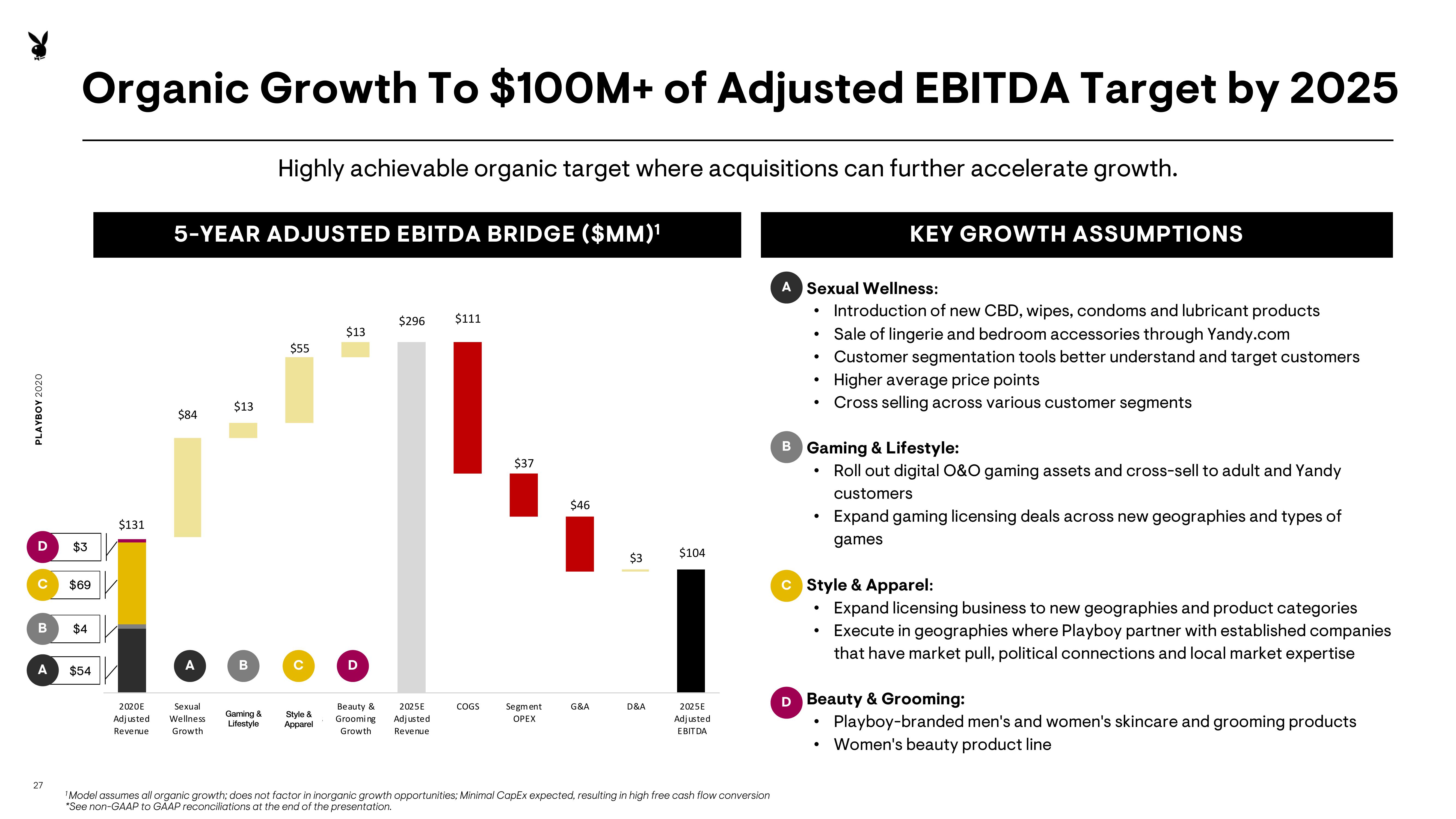

Organic Growth To $100M+ of Adjusted EBITDA Target by 2025

27

$69

$4

$54

$131

2020E

Adjusted

Revenue

5-YEAR ADJUSTED EBITDA BRIDGE ($MM)¹

$84

A

Sexual

Wellness

Growth

$13

B

Highly achievable organic target where acquisitions can further accelerate growth.

Gaming &

Lifestyle

$55

C

Style &

Apparel

$13

D

Beauty &

Grooming

Growth

$296 $111

2025E

Adjusted

Revenue

COGS

$37

Segment

OPEX

$46

G&A

$3

D&A

$104

2025E

Adjusted

EBITDA

¹Model assumes all organic growth; does not factor in inorganic growth opportunities; Minimal CapEx expected, resulting in high free cash flow conversion

*See non-GAAP to GAAP reconciliations at the end of the presentation.

A Sexual Wellness:

KEY GROWTH ASSUMPTIONS

Introduction of new CBD, wipes, condoms and lubricant products

• Sale of lingerie and bedroom accessories through Yandy.com

Customer segmentation tools better understand and target customers

Higher average price points

Cross selling across various customer segments

●

B Gaming & Lifestyle:

• Roll out digital O&O gaming assets and cross-sell to adult and Yandy

customers

Expand gaming licensing deals across new geographies and types of

games

c Style & Apparel:

Expand licensing business to new geographies and product categories

Execute in geographies where Playboy partner with established companies

that have market pull, political connections and local market expertise

.

D Beauty & Grooming:

Playboy-branded men's and women's skincare and grooming products

Women's beauty product lineView entire presentation