Brivo SPAC Presentation Deck

Transaction overview

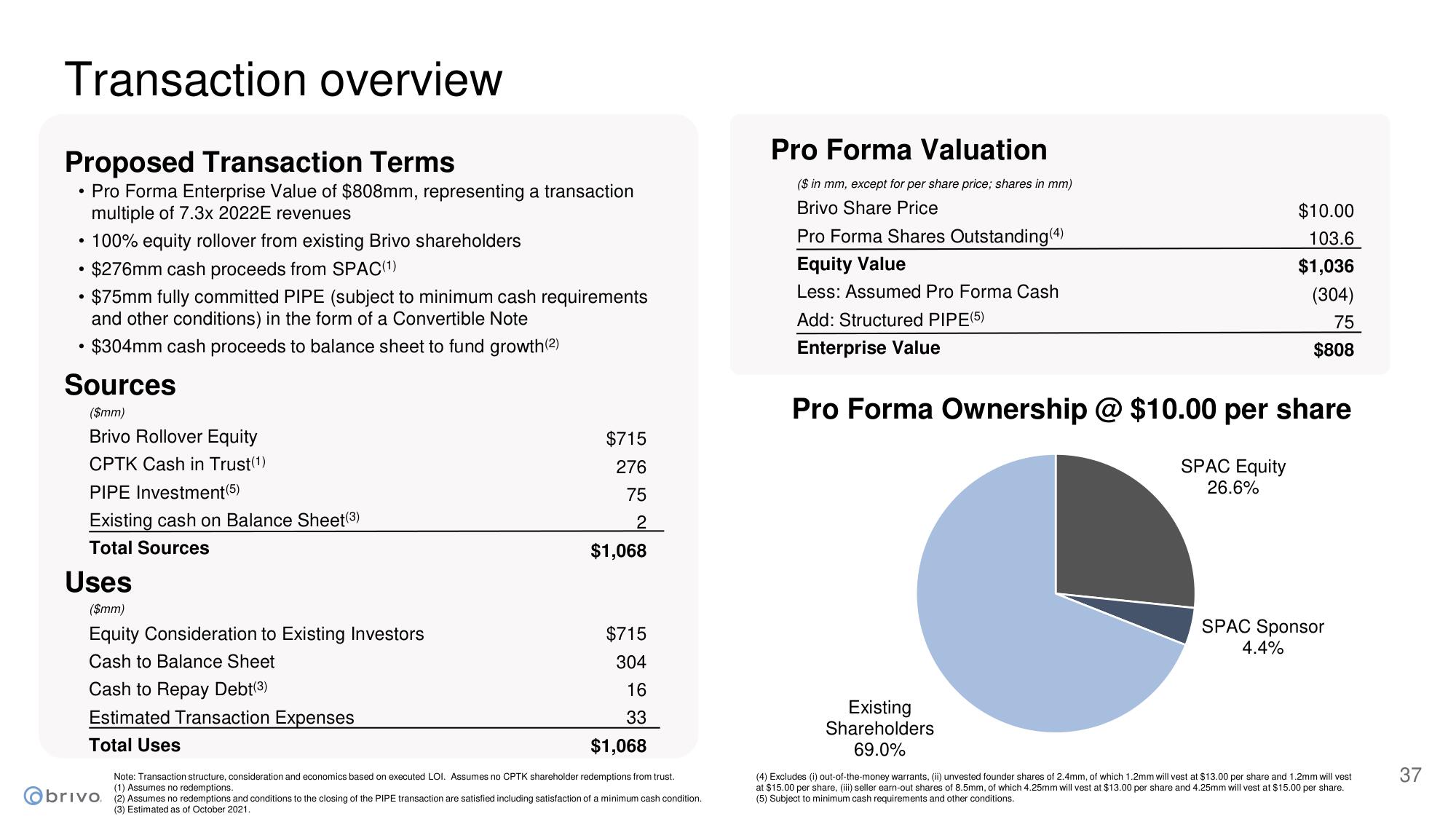

Proposed Transaction Terms

Pro Forma Enterprise Value of $808mm, representing a transaction

multiple of 7.3x 2022E revenues

• 100% equity rollover from existing Brivo shareholders

●

$276mm cash proceeds from SPAC(1)

$75mm fully committed PIPE (subject to minimum cash requirements

and other conditions) in the form of a Convertible Note

$304mm cash proceeds to balance sheet to fund growth (2)

Sources

($mm)

Brivo Rollover Equity

CPTK Cash in Trust(1)

PIPE Investment (5)

Existing cash on Balance Sheet(3)

Total Sources

Uses

($mm)

Equity Consideration to Existing Investors

Cash to Balance Sheet

Cash to Repay Debt(3)

Estimated Transaction Expenses

Total Uses

$715

276

75

2

$1,068

$715

304

16

33

$1,068

Note: Transaction structure, consideration and economics based on executed LOI. Assumes no CPTK shareholder redemptions from trust.

Assumes no redemptions.

Obrivo (2) Assumes no redemptions and conditions to the closing of the PIPE transaction are satisfied including satisfaction of a minimum cash condition.

(3) Estimated as of October 2021.

Pro Forma Valuation

($ in mm, except for per share price; shares in mm)

Brivo Share Price

Pro Forma Shares Outstanding (4)

Equity Value

Less: Assumed Pro Forma Cash

Add: Structured PIPE (5)

Enterprise Value

$10.00

103.6

$1,036

(304)

75

$808

Pro Forma Ownership @ $10.00 per share

SPAC Equity

26.6%

Existing

Shareholders

69.0%

SPAC Sponsor

4.4%

(4) Excludes (i) out-of-the-money warrants, (ii) unvested founder shares of 2.4mm, of which 1.2mm will vest at $13.00 per share and 1.2mm will vest

at $15.00 per share, (iii) seller earn-out shares of 8.5mm, of which 4.25mm will vest at $13.00 per share and 4.25mm will vest at $15.00 per share.

(5) Subject to minimum cash requirements and other conditions.

37View entire presentation