Maersk Investor Presentation Deck

Key statements

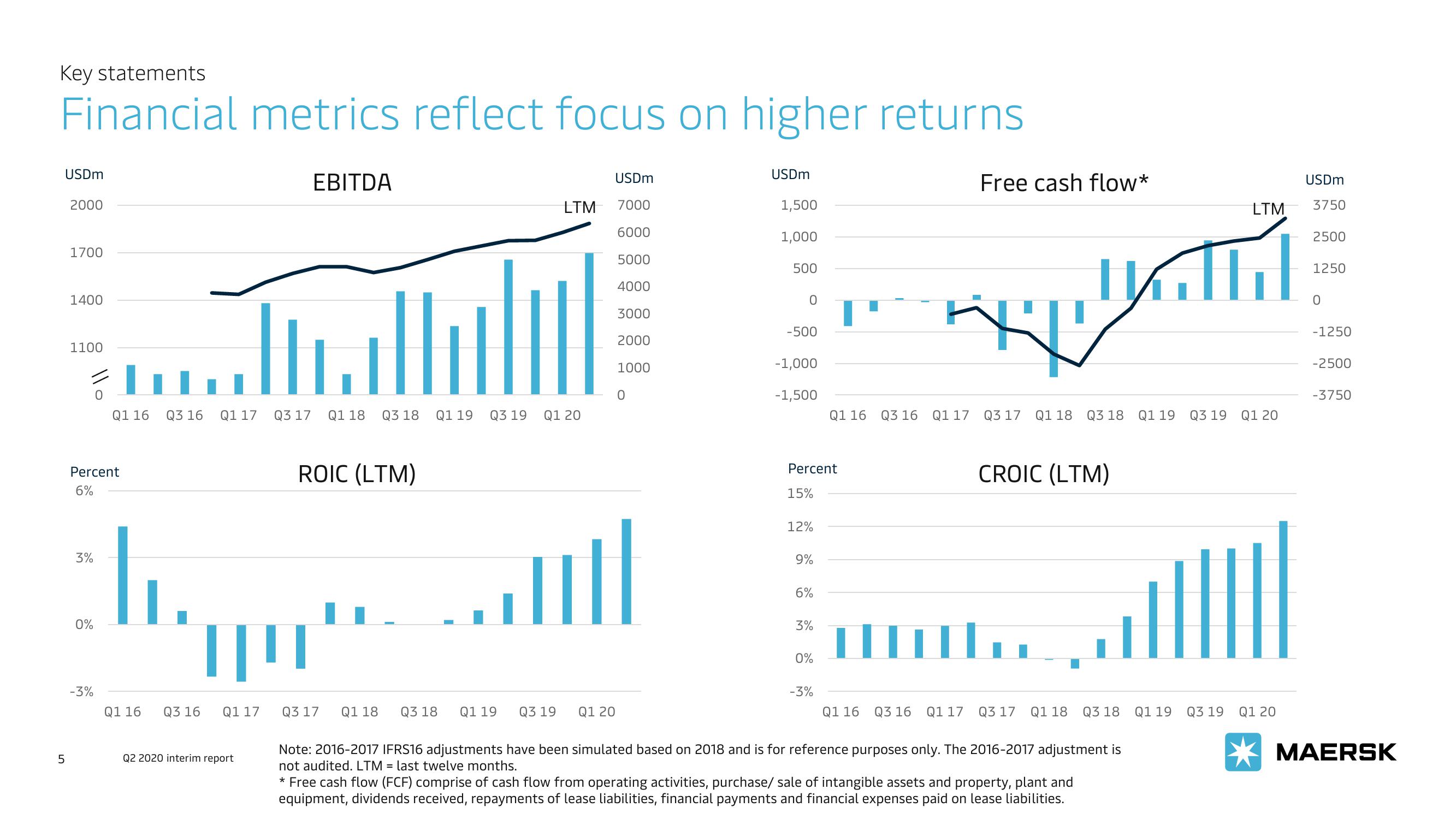

Financial metrics reflect focus on higher returns

5

USDm

2000

1700

1400

1100

3%

Percent

6%

0%

0

-3%

Q1 16 Q3 16 Q1 17 Q3 17 Q1 18 Q3 18 Q1 19

Q1 16

...........

ITU

Q3 16

EBITDA

Q1 17

Q2 2020 interim report

ROIC (LTM)

Q3 19

LTM

Q3 17 Q1 18 Q3 18 Q1 19

Q1 20

Q3 19

USDm

7000

6000

5000

4000

3000

2000

1000

....||

0

Q1 20

USDm

1,500

1,000

500

0

-500

-1,000

-1,500

Percent

15%

12%

9%

6%

3%

0%

Q1 16

-3%

Q1 16

Q3 16 Q1 17 Q3 17

Q3 16

Free cash flow*

Q1 17

Q3 17

platil

Q1 18

CROIC (LTM)

Q3 18. Q1 19

Q1 18 Q3 18

Note: 2016-2017 IFRS16 adjustments have been simulated based on 2018 and is for reference purposes only. The 2016-2017 adjustment is

not audited. LTM = last twelve months.

* Free cash flow (FCF) comprise of cash flow from operating activities, purchase/ sale of intangible assets and property, plant and

equipment, dividends received, repayments of lease liabilities, financial payments and financial expenses paid on lease liabilities.

Q3 19

LTM

Q1 19 Q3 19

Q1 20

Q1 20

USDm

3750

2500

1250

0

-1250

-2500

-3750

MAERSKView entire presentation