AMD Results Presentation Deck

APPENDICES

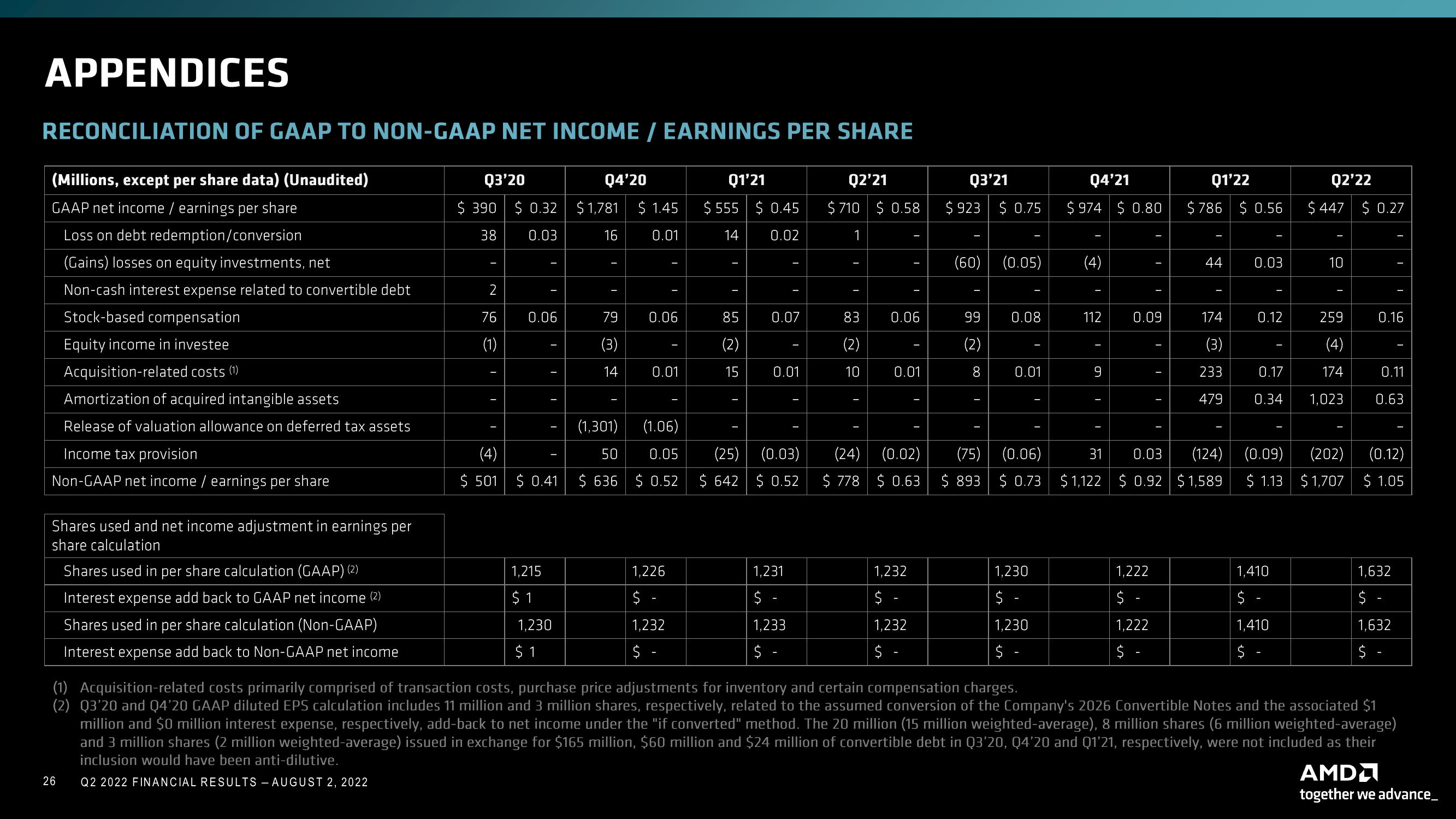

RECONCILIATION OF GAAP TO NON-GAAP NET INCOME / EARNINGS PER SHARE

(Millions, except per share data) (Unaudited)

GAAP net income / earnings per share

Loss on debt redemption/conversion

(Gains) losses on equity investments, net

Non-cash interest expense related to convertible debt

Stock-based compensation

Equity income in investee

Acquisition-related costs (1)

Amortization of acquired intangible assets

Release of valuation allowance on deferred tax assets

Income tax provision

Non-GAAP net income / earnings per share

Shares used and net income adjustment in earnings per

share calculation

Shares used in per share calculation (GAAP) (2)

Interest expense add back to GAAP net income (2)

Shares used in per share calculation (Non-GAAP)

Interest expense add back to Non-GAAP net income

26

Q3'20

Q4'20

$ 390 $ 0.32 $1,781 $ 1.45

38 0.03

16

0.01

I

2

76 0.06

(1)

I

I

1,215

$1

I

I

1,230

$1

79 0.06

(3)

14

I

I

I

0.01

1,226

$ -

1,232

$ -

I

Q1'21

Q2'21

Q3'21

Q4'21

$ 555 $ 0.45 $710 $0.58 $923 $0.75 $974 $0.80

14

0.02

1

I

85

(2)

15

I

0.07

I

I

0.01

1,231

$ -

1,233

$ -

I

I

I

83

(2)

10

I

I

I

I

0.06

0.01

1,232

$ -

1,232

$ -

I

I

T

(60) (0.05) (4)

99 0.08

(2)

8

T

I

T

0.01

1,230

$ -

I

1,230

$ -

I

I

I

112

9

I

I

31

I

0.09

(1,301) (1.06)

(4)

50

0.05 (25)

(0.03)

(24) (0.02)

(75)

(0.06)

0.03

(124) (0.09) (202) (0.12)

$ 501 $ 0.41 $636 $0.52 $ 642 $0.52 $778 $0.63 $ 893 $ 0.73 $1,122 $0.92 $1,589 $ 1.13 $1,707

$ 1.05

1,222

$ -

1,222

$ -

Q1'22

Q2'22

$786 $0.56 $447 $ 0.27

I

I

44

I

0.03

0.12

1,410

$ -

1,410

$ -

I

I

10

I

I

174

(3)

233

0.17

0.11

479 0.34 1,023 0.63

259

(4)

174

I

I

I

I

0.16

1,632

$ -

1,632

$

I

I

(1) Acquisition-related costs primarily comprised of transaction costs, purchase price adjustments for inventory and certain compensation charges.

(2) Q3'20 and Q4'20 GAAP diluted EPS calculation includes 11 million and 3 million shares, respectively, related to the assumed conversion of the Company's 2026 Convertible Notes and the associated $1

million and $0 million interest expense, respectively, add-back to net income under the "if converted" method. The 20 million (15 million weighted-average), 8 million shares (6 million weighted-average)

and 3 million shares (2 million weighted-average) issued in exchange for $165 million, $60 million and $24 million of convertible debt in Q3'20, Q4'20 and Q1'21, respectively, were not included as their

inclusion would have been anti-dilutive.

Q2 2022 FINANCIAL RESULTS - AUGUST 2, 2022

AMD

together we advance_View entire presentation