Morgan Stanley Investment Banking Pitch Book

Morgan Stanley

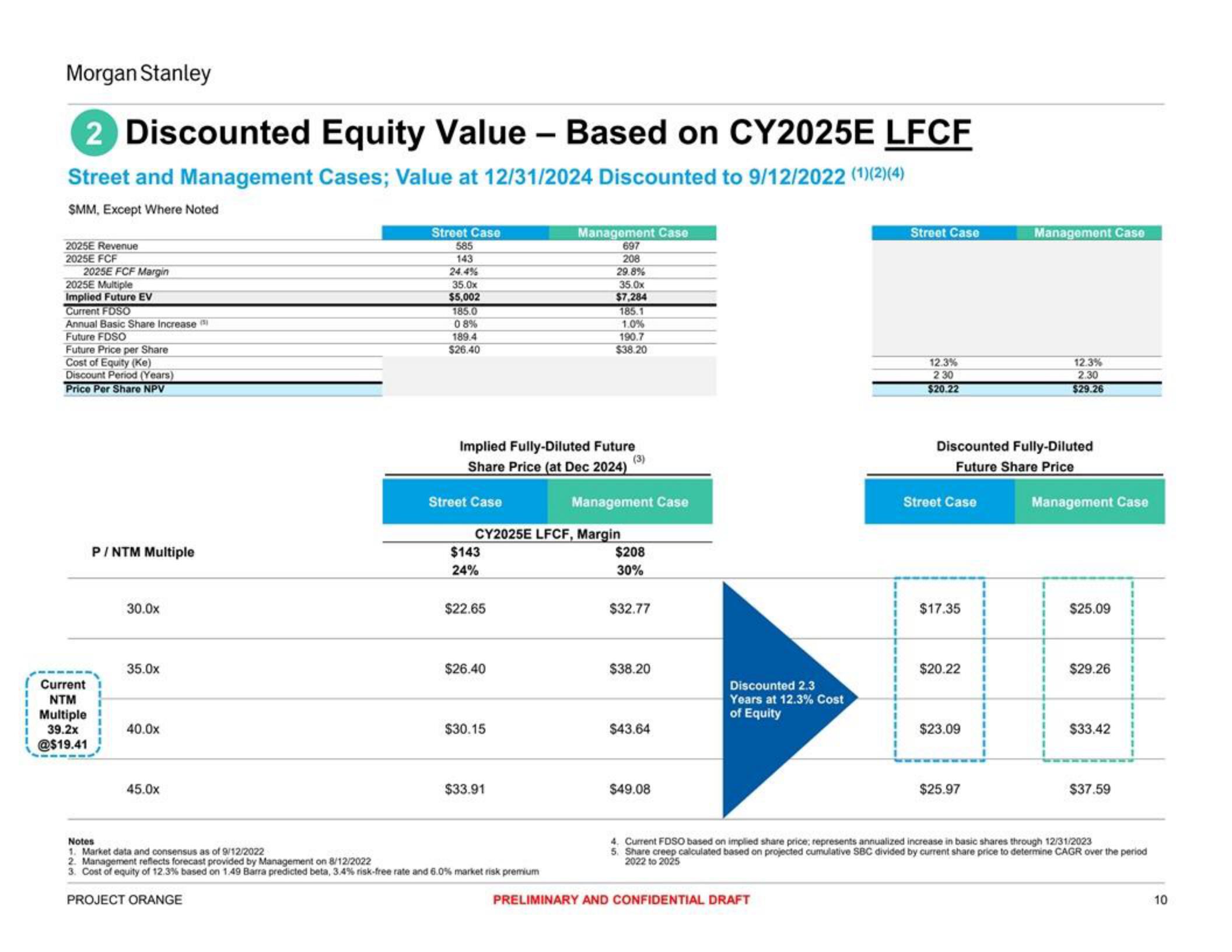

2 Discounted Equity Value - Based on CY2025E LFCF

Street and Management Cases; Value at 12/31/2024 Discounted to 9/12/2022 (1)(2)(4)

SMM, Except Where Noted

2025E Revenue

2025E FCF

2025E FCF Margin

2025E Multiple

Implied Future EV

Current FDSO

Annual Basic Share Increase

Future FDSO

Future Price per Share

Cost of Equity (Ke)

Discount Period (Years)

Price Per Share NPV

Current

NTM

Multiple

39.2x

@$19.41

P/NTM Multiple

30.0x

35.0x

40.0x

45.0x

Street Case

585

143

24.4%

35.0x

$5,002

185.0

0 8%

189.4

$26.40

Street Case

Implied Fully-Diluted Future

Share Price (at Dec 2024)

(3)

$143

24%

$22.65

$26.40

CY2025E LFCF, Margin

$30.15

Management Case

697

208

29.8%

$33.91

35.0x

$7,284

Notes

1. Market data and consensus as of 9/12/2022

2. Management reflects forecast provided by Management on 8/12/2022

3. Cost of equity of 12.3% based on 1.49 Barra predicted beta, 3.4 % risk-free rate and 6.0% market risk premium

PROJECT ORANGE

185.1

1.0%

190.7

$38.20

Management Case

$208

30%

$32.77

$38.20

$43.64

$49.08

Discounted 2.3

Years at 12.3% Cost

of Equity

Street Case

PRELIMINARY AND CONFIDENTIAL DRAFT

12.3%

230

$20.22

Street Case

Discounted Fully-Diluted

Future Share Price

$17.35

$20.22

$23.09

Management Case

$25.97

12.3%

2.30

$29.26

Management Case

$25.09

$29.26

$33.42

$37.59

4. Current FDSO based on implied share price; represents annualized increase in basic shares through 12/31/2023

5. Share creep calculated based on projected cumulative SBC divided by current share price to determine CAGR over the period

2022 to 2025

10View entire presentation