Babylon SPAC Presentation Deck

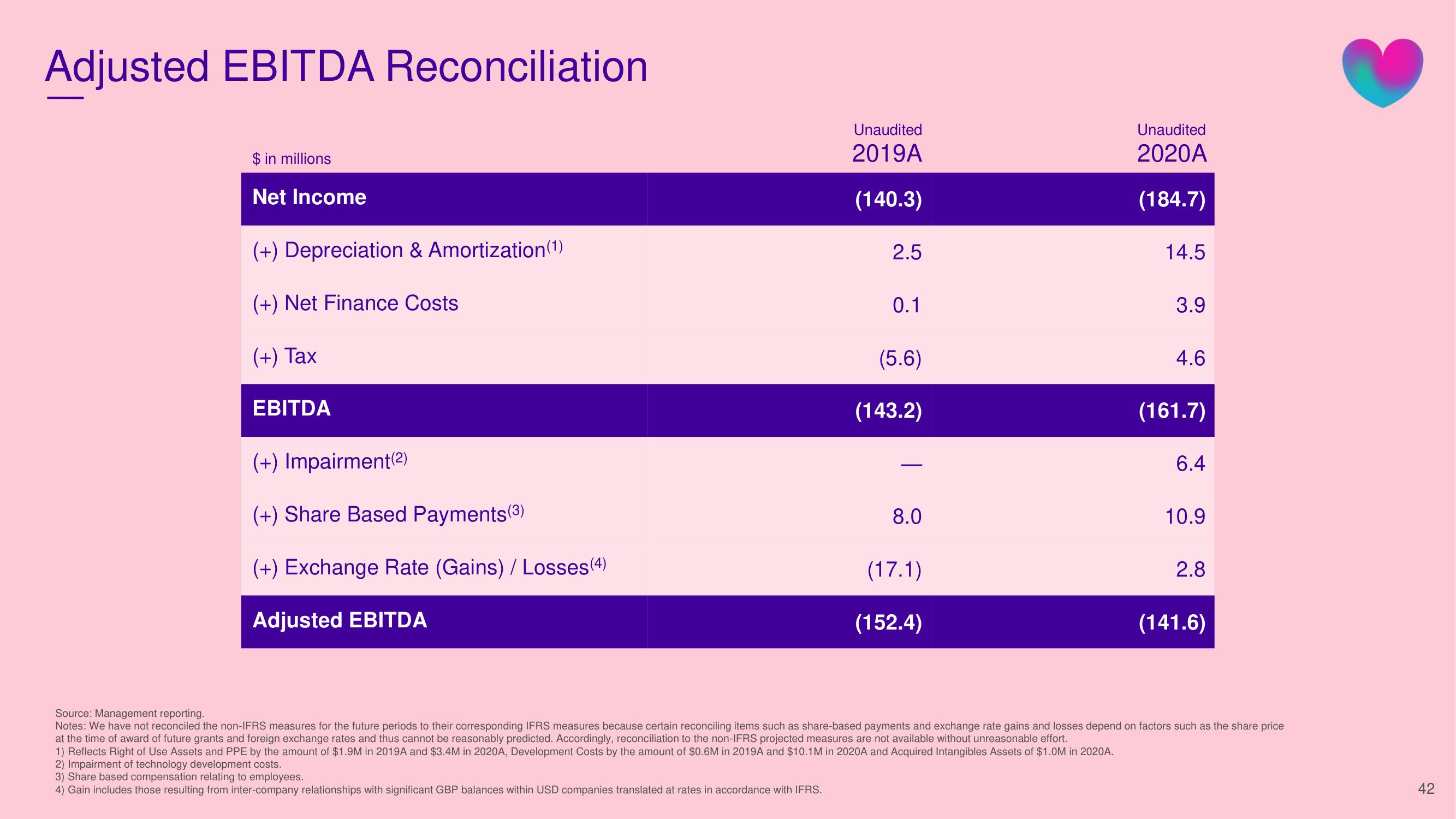

Adjusted EBITDA Reconciliation

$ in millions

Net Income

(+) Depreciation & Amortization (1)

(+) Net Finance Costs

(+) Tax

EBITDA

(+) Impairment(2)

(+) Share Based Payments (3)

(+) Exchange Rate (Gains) / Losses (4)

Adjusted EBITDA

Unaudited

2019A

(140.3)

2.5

0.1

(5.6)

(143.2)

8.0

(17.1)

(152.4)

Unaudited

2020A

(184.7)

1) Reflects Right of Use Assets and PPE by the amount of $1.9M in 2019A and $3.4M in 2020A, Development Costs by the amount of $0.6M in 2019A and $10.1M in 2020A and Acquired Intangibles Assets of $1.0M in 2020A.

2) Impairment of technology development costs.

3) Share based compensation relating to employees.

4) Gain includes those resulting from inter-company relationships with significant GBP balances within USD companies translated at rates in accordance with IFRS.

14.5

3.9

4.6

(161.7)

6.4

10.9

2.8

(141.6)

Source: Management reporting.

Notes: We have not reconciled the non-IFRS measures for the future periods to their corresponding IFRS measures because certain reconciling items such as share-based payments and exchange rate gains and losses depend on factors such as the share price

at the time of award of future grants and foreign exchange rates and thus cannot be reasonably predicted. Accordingly, reconciliation to the non-IFRS projected measures are not available without unreasonable effort.

42View entire presentation