First Merchants Results Presentation Deck

Non-GAAP

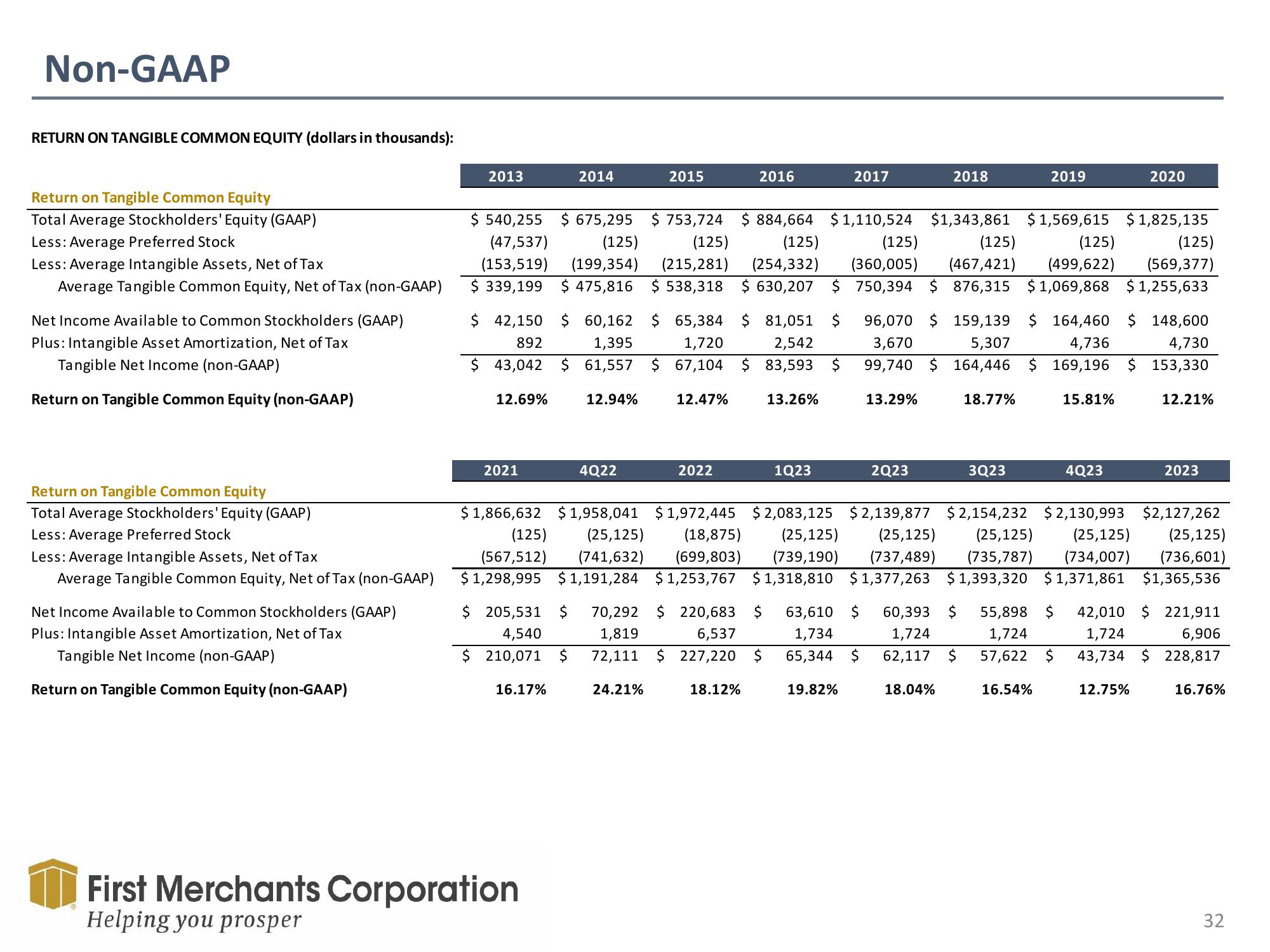

RETURN ON TANGIBLE COMMON EQUITY (dollars in thousands):

Return on Tangible Common Equity

Total Average Stockholders' Equity (GAAP)

Less: Average Preferred Stock

Less: Average Intangible Assets, Net of Tax

Average Tangible Common Equity, Net of Tax (non-GAAP)

Net Income Available to Common Stockholders (GAAP)

Plus: Intangible Asset Amortization, Net of Tax

Tangible Net Income (non-GAAP)

Return on Tangible Common Equity (non-GAAP)

Return on Tangible Common Equity

Total Average Stockholders' Equity (GAAP)

Less: Average Preferred Stock

Less: Average Intangible Assets, Net of Tax

Average Tangible Common Equity, Net of Tax (non-GAAP)

Net Income Available to Common Stockholders (GAAP)

Plus: Intangible Asset Amortization, Net of Tax

Tangible Net Income (non-GAAP)

Return on Tangible Common Equity (non-GAAP)

2013

12.69%

$ 42,150 $ 60,162 $ 65,384

892

1,395

1,720

$ 43,042 $ 61,557 $ 67,104

12.47%

2021

(567,512)

$1,298,995

2014

$ 205,531 $

4,540

$ 210,071 $

$ 675,295 $ 753,724 $ 884,664 $1,110,524 $1,343,861 $1,569,615 $1,825,135

(125)

(125)

(125)

(125)

(125)

(125)

$ 540,255

(47,537)

(153,519) (199,354)

$ 339,199 $ 475,816

(125)

(215,281) (254,332) (360,005) (467,421) (499,622) (569,377)

$ 538,318

$630,207 $ 750,394 $ 876,315 $1,069,868 $1,255,633

96,070 $ 159,139 $164,460 $ 148,600

3,670

5,307

4,736

4,730

99,740 $ 164,446 $ 169,196 $ 153,330

16.17%

First Merchants Corporation

Helping you prosper

12.94%

2015

4Q22

24.21%

2022

2016

18.12%

$ 81,051 $

2,542

$ 83,593 $

13.26%

1Q23

2017

19.82%

13.29%

2Q23

2018

18.04%

18.77%

$1,866,632 $1,958,041 $1,972,445 $2,083,125 $2,139,877 $2,154,232 $2,130,993 $2,127,262

(125) (25,125) (18,875) (25,125) (25,125) (25,125) (25,125) (25,125)

(741,632) (699,803) (739,190) (737,489) (735,787) (734,007) (736,601)

$1,191,284 $1,253,767 $1,318,810 $1,377,263 $1,393,320 $1,371,861 $1,365,536

70,292 $ 220,683 $ 63,610 $ 60,393 $ 55,898 $ 42,010 $ 221,911

1,819

6,537

1,734

1,724

1,724

1,724

6,906

72,111 $ 227,220

65,344 $ 62,117 $ 57,622 $ 43,734 $ 228,817

3Q23

2019

16.54%

15.81%

4Q23

2020

12.75%

12.21%

2023

16.76%

32View entire presentation