Massachusetts Water Resources Authority (“MWRA”) Employees’ Retirement System

APPENDIX

Representative Investment

Edenred (EDEN FP) Global Provider of prepaid corporate services

EDEN is the world's largest provider of prepaid benefits (~2/3 of revenues, mostly

food and child care vouchers) and expense management solutions (~1/3, mostly

fuel and fleet), which improve efficiency for its 680,000 corporate clients, increase

the purchasing power of their 42 million employees and drive business to 1.4 million

merchant affiliates. EDEN demerged from global hotel chain Accor and listed in

2011. Free float is 100%.

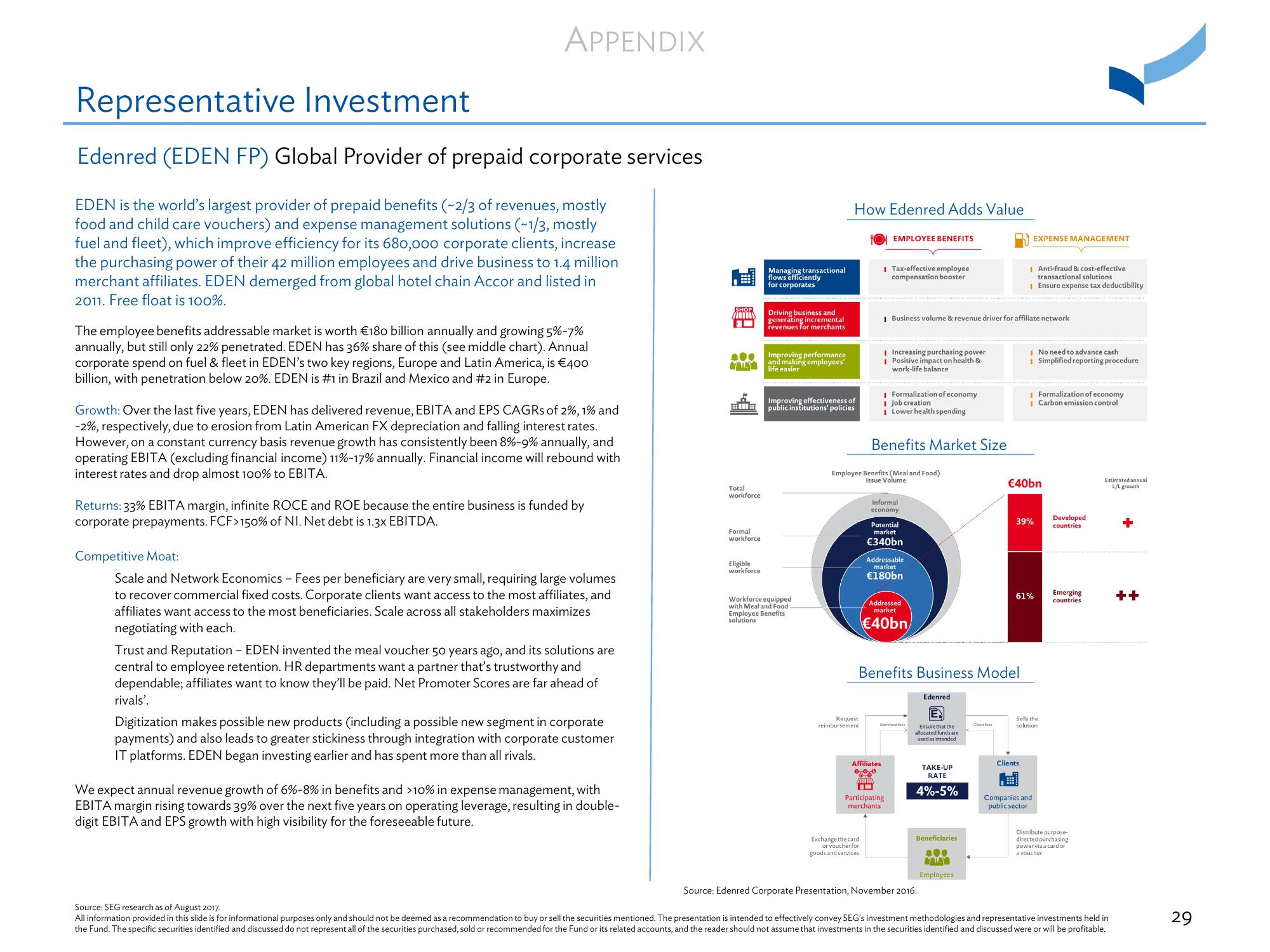

The employee benefits addressable market is worth €180 billion annually and growing 5%-7%

annually, but still only 22% penetrated. EDEN has 36% share of this (see middle chart). Annual

corporate spend on fuel & fleet in EDEN's two key regions, Europe and Latin America, is €400

billion, with penetration below 20%. EDEN is #1 in Brazil and Mexico and #2 in Europe.

Growth: Over the last five years, EDEN has delivered revenue, EBITA and EPS CAGRs of 2%, 1% and

-2%, respectively, due to erosion from Latin American FX depreciation and falling interest rates.

However, on a constant currency basis revenue growth has consistently been 8% -9% annually, and

operating EBITA (excluding financial income) 11%-17% annually. Financial income will rebound with

interest rates and drop almost 100% to EBITA.

Returns: 33% EBITA margin, infinite ROCE and ROE because the entire business is funded by

corporate prepayments. FCF>150% of NI. Net debt is 1.3x EBITDA.

Competitive Moat:

Scale and Network Economics - Fees per beneficiary are very small, requiring large volumes

to recover commercial fixed costs. Corporate clients want access to the most affiliates, and

affiliates want access to the most beneficiaries. Scale across all stakeholders maximizes

negotiating with each.

Trust and Reputation - EDEN invented the meal voucher 50 years ago, and its solutions are

central to employee retention. HR departments want a partner that's trustworthy and

dependable; affiliates want to know they'll be paid. Net Promoter Scores are far ahead of

rivals'.

Digitization makes possible new products (including a possible new segment in corporate

payments) and also leads to greater stickiness through integration with corporate customer

IT platforms. EDEN began investing earlier and has spent more than all rivals.

We expect annual revenue growth of 6%-8% in benefits and >10% in expense management, with

EBITA margin rising towards 39% over the next five years on operating leverage, resulting in double-

digit EBITA and EPS growth with high visibility for the foreseeable future.

SHOP

200

MAY

illa

Total

workforce

Formal

workforce

Eligible

workforce

Managing transactional

flows efficiently

for corporates

Driving business and

generating incremental

revenues for merchants

Improving performance

and making employees'

life easier

How Edenred Adds Value

Improving effectiveness of

public institutions' policies

Workforce equipped

with Meal and Food

Employee Benefits

solutions

Request

reimbursement

EMPLOYEE BENEFITS

I Tax-effective employee

compensation booster

Exchange the card

or voucher for

goods and services

I Increasing purchasing power

I Positive impact on health &

work-life balance

I Business volume & revenue driver for affiliate network

I Formalization of economy

I Job creation

I Lower health spending

Employee Benefits (Meal and Food)

Issue Volume

Benefits Market Size

Informal

economy

Potential

market

€340bn

Addressable

market

€180bn

Addressed

market

€40bn

Affiliates

0.0.0

ATTEN

D

Participating

merchants

Benefits Business Model

Marchant fors

Edenred

Ensure that the

allocated funds are

used as intended

TAKE-UP

RATE

4%-5%

Beneficiaries

400

MATAY

Employees

Client fors

I Anti-fraud & cost-effective

transactional solutions

I Ensure expense tax deductibility

EXPENSE MANAGEMENT

I No need to advance cash

Simplified reporting procedure

€40bn

39%

I Formalization of economy

| Carbon emission control

Clients

61%

Sells the

solution

Companies and

public sector

Developed

countries

Emerging

countries

Distribute purpose-

directed purchasing

power via a card or

a voucher

Estimated annual

L/L growth

Source: Edenred Corporate Presentation, November 2016.

Source: SEG research as of August 2017.

All information provided in this slide is for informational purposes only and should not be deemed as a recommendation to buy or sell the securities mentioned. The presentation is intended to effectively convey SEG's investment methodologies and representative investments held in

the Fund. The specific securities identified and discussed do not represent all of the securities purchased, sold or recommended for the Fund or its related accounts, and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

++

29View entire presentation