XP Inc Results Presentation Deck

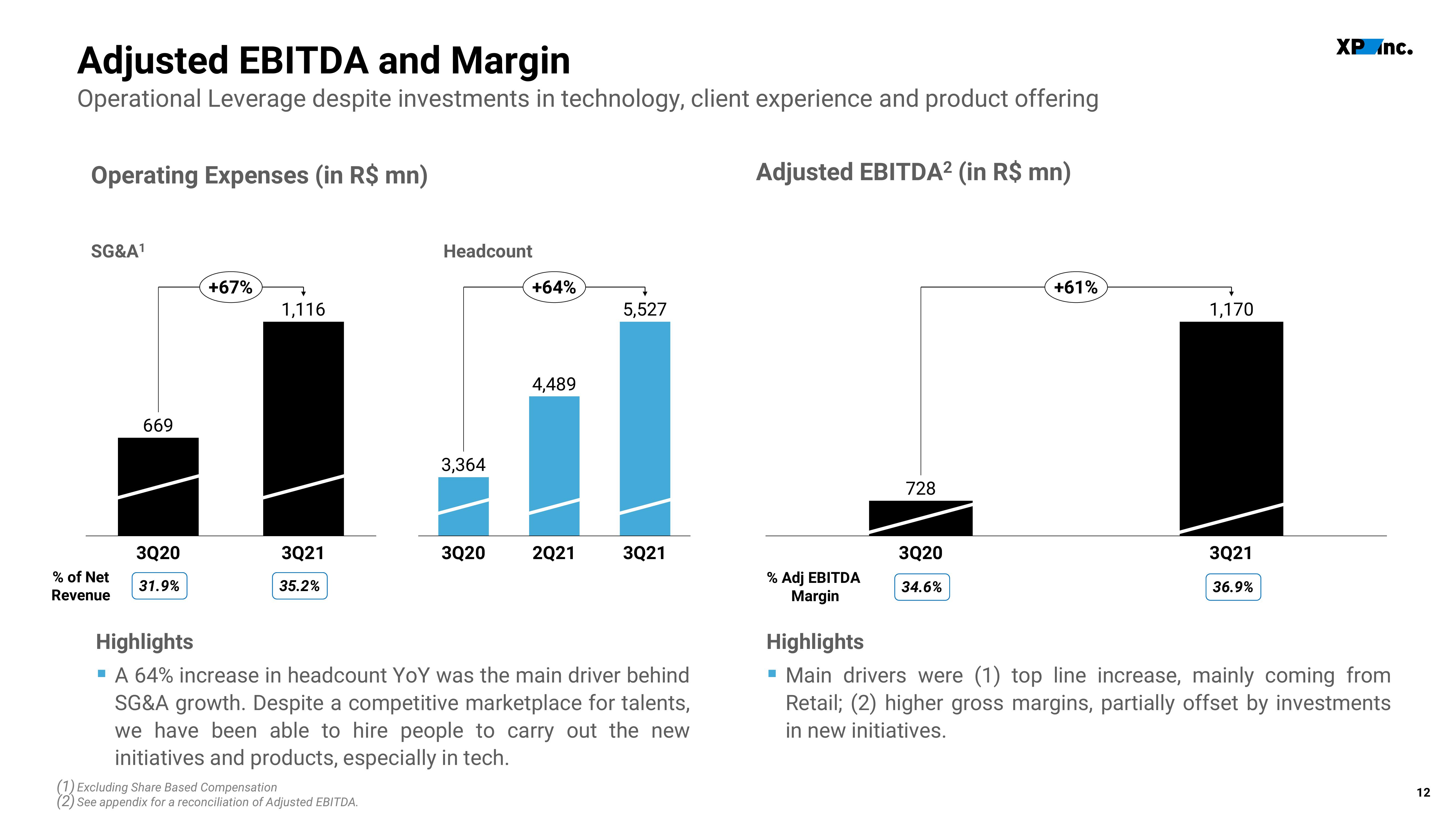

Adjusted EBITDA and Margin

Operational Leverage despite investments in technology, client experience and product offering

Operating Expenses (in R$ mn)

SG&A¹

% of Net

Revenue

669

3Q20

31.9%

+67%

1,116

3Q21

35.2%

Headcount

(2)

See appendix for a reconciliation of Adjusted EBITDA.

3,364

3Q20

+64%

4,489

2Q21

5,527

3Q21

Highlights

▪ A 64% increase in headcount YoY was the main driver behind

SG&A growth. Despite a competitive marketplace for talents,

we have been able to hire people to carry out the new

initiatives and products, especially in tech.

Adjusted EBITDA² (in R$ mn)

% Adj EBITDA

Margin

728

3Q20

34.6%

+61%

1,170

3Q21

36.9%

XP Inc.

Highlights

▪ Main drivers were (1) top line increase, mainly coming from

Retail; (2) higher gross margins, partially offset by investments

in new initiatives.

12View entire presentation