LSE Mergers and Acquisitions Presentation Deck

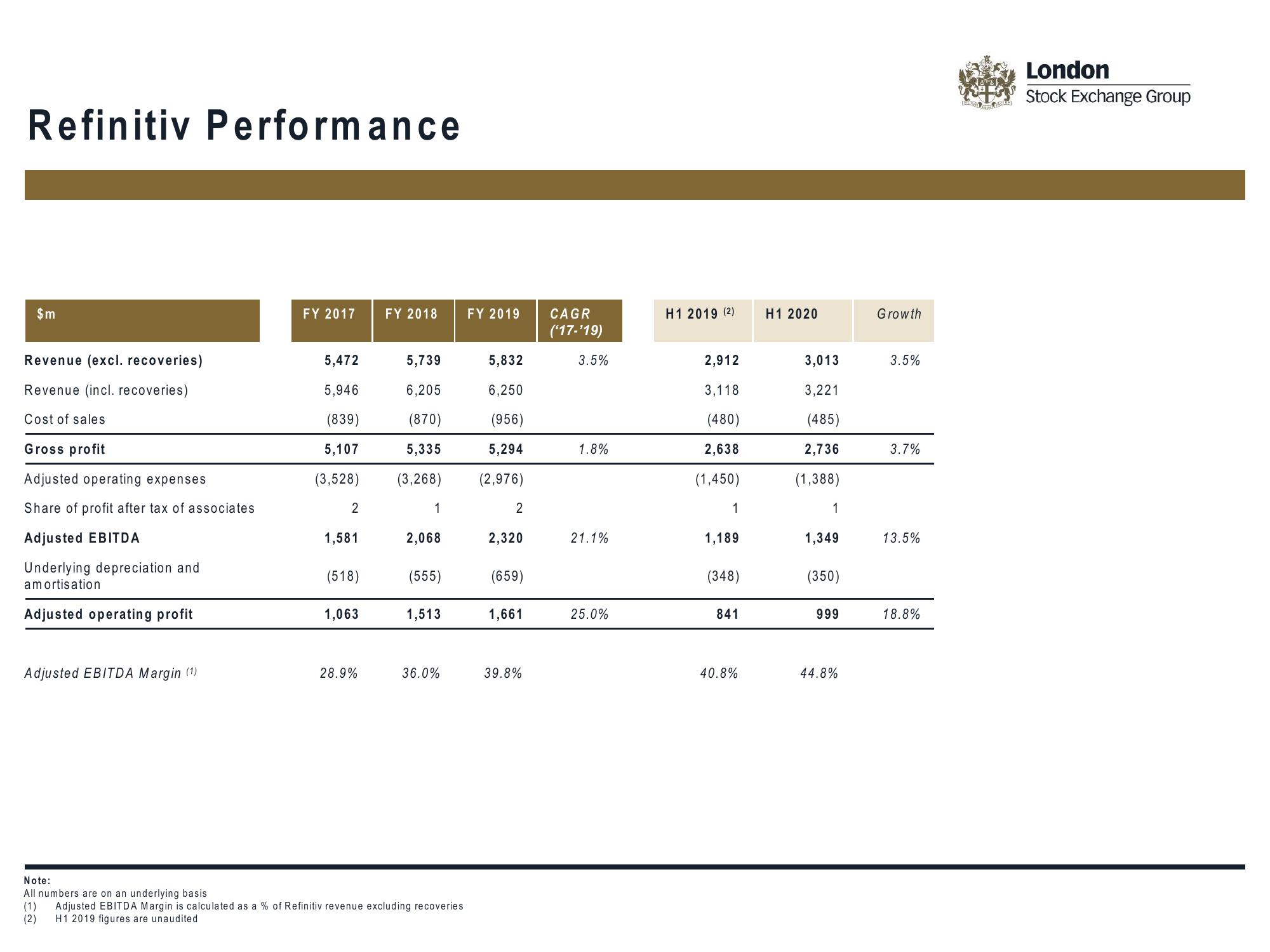

Refinitiv Performance

$m

Revenue (excl. recoveries)

Revenue (incl. recoveries)

Cost of sales

Gross profit

Adjusted operating expenses

Share of profit after tax of associates

Adjusted EBITDA

Underlying depreciation and

amortisation

Adjusted operating profit

Adjusted EBITDA Margin (1)

FY 2017

5,472

5,946

(839)

5,107

(3,528)

2

1,581

(518)

1,063

28.9%

FY 2018

5,739

5,832

6,205

6,250

(870)

(956)

5,335

5,294

(3,268) (2,976)

1

2,068

(555)

1,513

36.0%

FY 2019

Note:

All numbers are on an underlying basis

(1) Adjusted EBITDA Margin is calculated as a % of Refinitiv revenue excluding recoveries

(2) H1 2019 figures are unaudited

2

2,320

(659)

1,661

39.8%

CAGR

('17-'19)

3.5%

1.8%

21.1%

25.0%

H1 2019 (2)

2,912

3,118

(480)

2,638

(1,450)

1

1,189

(348)

841

40.8%

H1 2020

3,013

3,221

(485)

2,736

(1,388)

1

1,349

(350)

999

44.8%

Growth

3.5%

3.7%

13.5%

18.8%

London

Stock Exchange GroupView entire presentation