Pathward Financial Results Presentation Deck

COMMERCIAL FINANCE MIX¹

Total Exposure

●

●

●

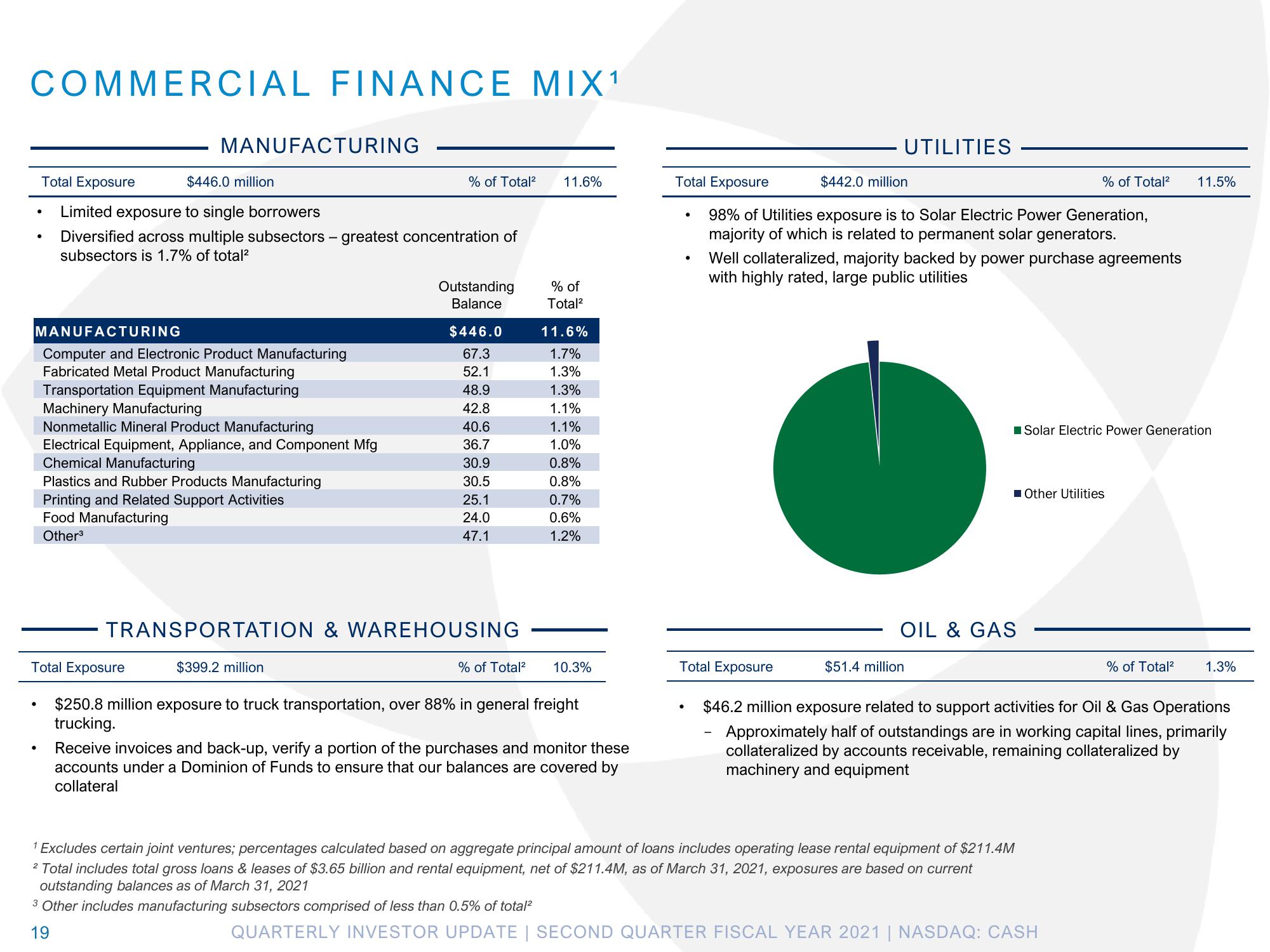

MANUFACTURING

MANUFACTURING

Computer and Electronic Product Manufacturing

Fabricated Metal Product Manufacturing

Transportation Equipment Manufacturing

$446.0 million

Limited exposure to single borrowers

Diversified across multiple subsectors - greatest concentration of

subsectors is 1.7% of total²

Total Exposure

Machinery Manufacturing

Nonmetallic Mineral Product Manufacturing

Electrical Equipment, Appliance, and Component Mfg

Chemical Manufacturing

Plastics and Rubber Products Manufacturing

Printing and Related Support Activities

Food Manufacturing

Other³

% of Total² 11.6%

$399.2 million

Outstanding

Balance

$446.0

67.3

52.1

48.9

42.8

40.6

36.7

30.9

TRANSPORTATION & WAREHOUSING

30.5

25.1

24.0

47.1

% of

Total²

11.6%

1.7%

1.3%

1.3%

1.1%

1.1%

1.0%

0.8%

0.8%

0.7%

0.6%

1.2%

% of Total² 10.3%

$250.8 million exposure to truck transportation, over 88% in general freight

trucking.

Receive invoices and back-up, verify a portion of the purchases and monitor these

accounts under a Dominion of Funds to ensure that our balances are covered by

collateral

Total Exposure

$442.0 million

98% of Utilities exposure is to Solar Electric Power Generation,

majority of which is related to permanent solar generators.

●

.

UTILITIES

Total Exposure

Well collateralized, majority backed by power purchase agreements

with highly rated, large public utilities

OIL & GAS

$51.4 million

% of Total²

Excludes certain joint ventures; percentages calculated based on aggregate principal amount of loans includes operating lease rental equipment of $211.4M

² Total includes total gross loans & leases of $3.65 billion and rental equipment, net of $211.4M, as of March 31, 2021, exposures are based on current

outstanding balances as of March 31, 2021

3 Other includes manufacturing subsectors comprised of less than 0.5% of total²

19

Solar Electric Power Generation

Other Utilities

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH

11.5%

% of Total²

$46.2 million exposure related to support activities for Oil & Gas Operations

Approximately half of outstandings are in working capital lines, primarily

collateralized by accounts receivable, remaining collateralized by

machinery and equipment

1.3%View entire presentation