Ocado Results Presentation Deck

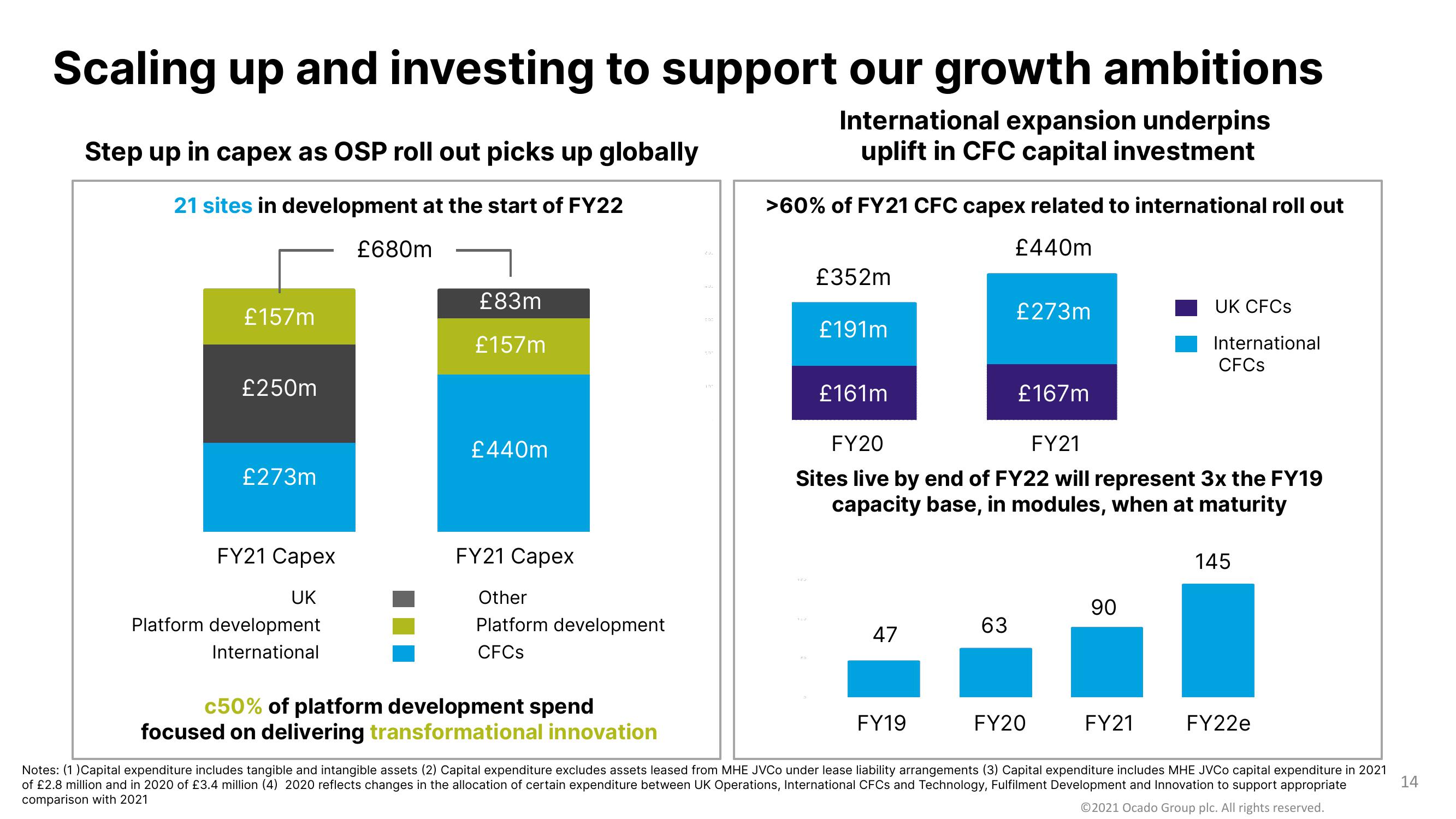

Scaling up and investing to support our growth ambitions

International expansion underpins

uplift in CFC capital investment

Step up in capex as OSP roll out picks up globally

21 sites in development at the start of FY22

£157m

£250m

£273m

FY21 Capex

UK

Platform development

International

£680m

£83m

£157m

£440m

FY21 Capex

Other

Platform development

CFCs

c50% of platform development spend

focused on delivering transformational innovation

int

>60% of FY21 CFC capex related to international roll out

£440m

£352m

£191m

£161m

47

£273m

FY20

FY21

Sites live by end of FY22 will represent 3x the FY19

capacity base, in modules, when at maturity

63

FY19

£167m

90

FY20

UK CFCS

International

CFCs

FY22e

Notes: (1) Capital expenditure includes tangible and intangible assets (2) Capital expenditure excludes assets leased from MHE JVCO under lease liability arrangements (3) Capital expenditure includes MHE JVCo capital expenditure in 2021

of £2.8 million and in 2020 of £3.4 million (4) 2020 reflects changes in the allocation of certain expenditure between UK Operations, International CFCs and Technology, Fulfilment Development and Innovation to support appropriate

comparison with 2021

Ⓒ2021 Ocado Group plc. All rights reserved.

FY21

145

14View entire presentation