Gorilla Technology Group SPAC Presentation Deck

.

-

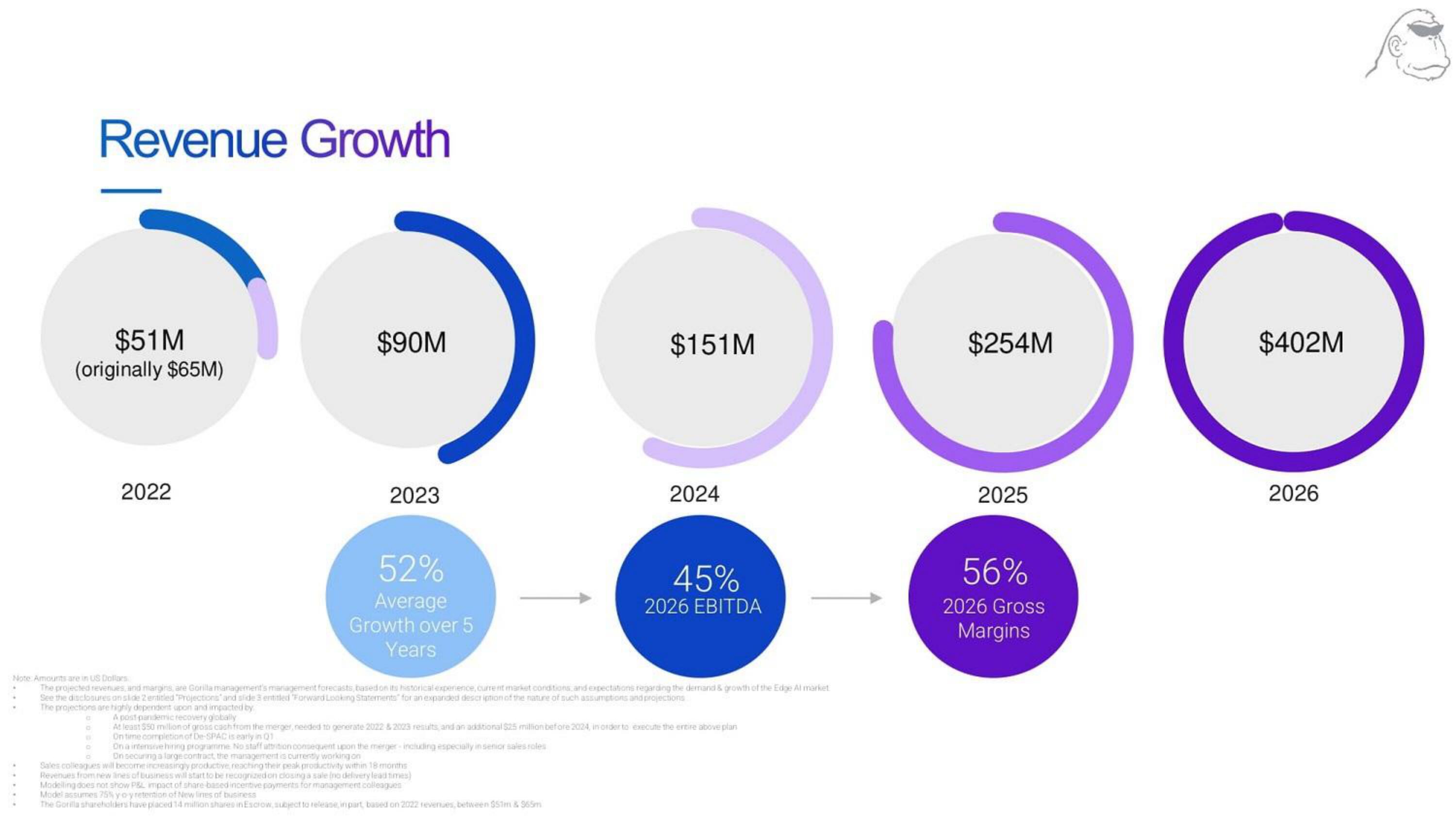

$51M

(originally $65M)

Revenue Growth

a

D

2022

$90M

2023

52%

Average

Growth over 5

Years

Note: Amounts are in US Dollars

The projected revenues, and marging, are Gorilla management's management forecasts, based on its historical experience, current market conditions, and expectations regarding the demand & growth of the Edge Al market

See the disclosures anside 2 entitled "Projections and side 3 entitled "Forward Looking Statements for an expanded description of the nature of such assumptions and projections

The projections are highly dependent upon and impacted by

$151M

Ona intensive hiring programme No staff attrition consequent upon the merger-including especially in senior sales soles

On securing a large contract, the management is currently working on

2024

Sales colleagues will become increasingly productive, reaching their peak productivity within 18 months

Revenues from new lines of business will start to be recognized on closing a sale ino delivery lead times)

Modelling does not show P&L impact of share based incentive payments for management colleagues

Model assumes 75% yo-yretention of New lines of business

The Gorilla shareholders have placed 14 million shares in Escrow, subject to release, in part, based on 2022 revenues, between $51m & 965m

45%

2026 EBITDA

A post pandemic recovery globally

At least $50 million of gross cash from the merger, needed to generate 2022 & 2023 results and an additional $25 million before 2024, in order to execute the entire above plan

On time completion of De-SPAC is early in 01

$254M

2025

56%

2026 Gross

Margins

$402M

2026View entire presentation