Fort Capital Investment Banking Pitch Book

Overview of Mother Lode

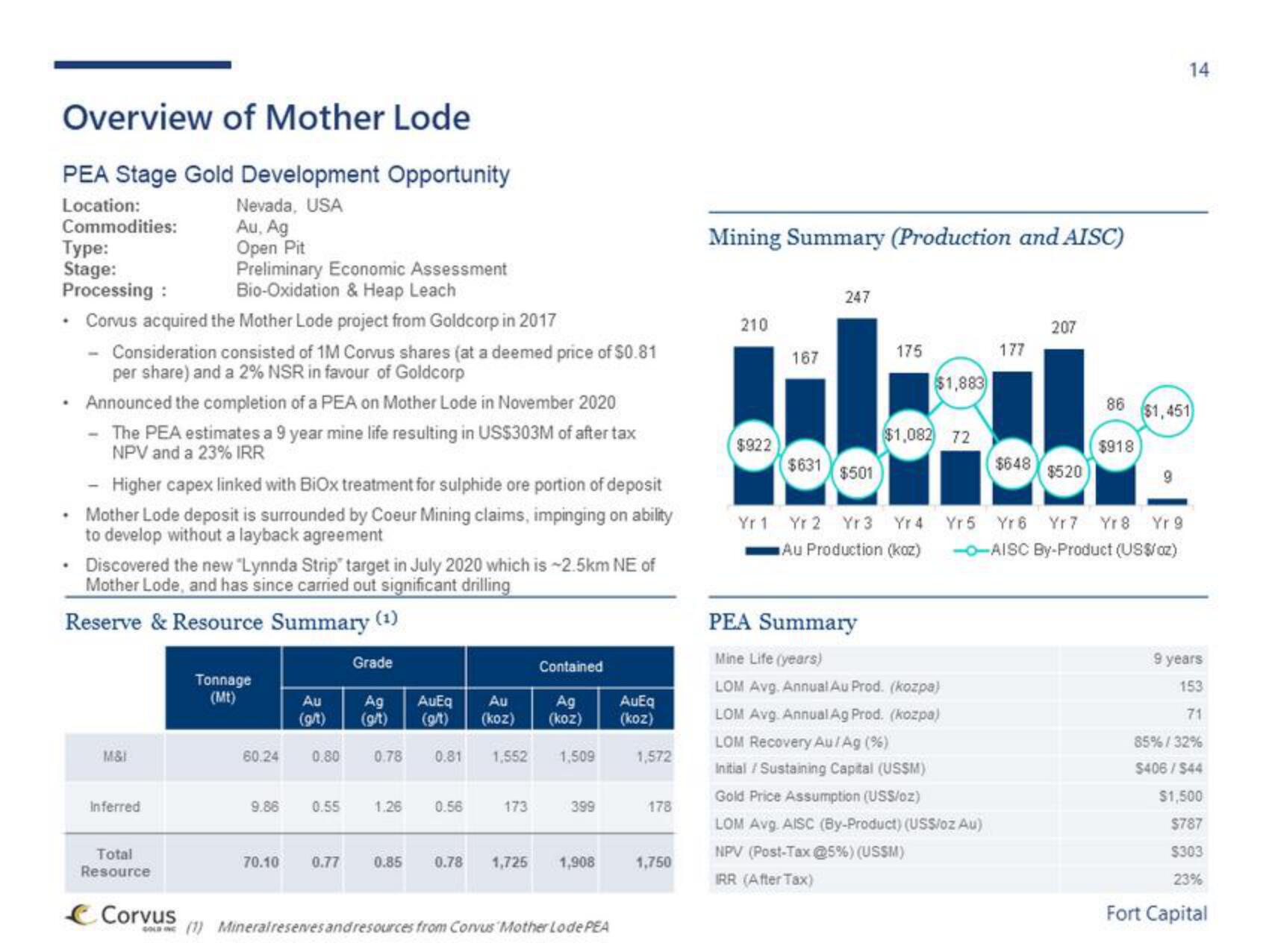

PEA Stage Gold Development Opportunity

Nevada, USA

Location:

Commodities:

Au, Ag

Open Pit

Type:

Stage:

Processing :

.

Corvus acquired the Mother Lode project from Goldcorp in 2017

Consideration consisted of 1M Corvus shares (at a deemed price of $0.81

per share) and a 2% NSR in favour of Goldcorp

Announced the completion of a PEA on Mother Lode in November 2020

The PEA estimates a 9 year mine life resulting in US$303M of after tax

NPV and a 23% IRR

- Higher capex linked with BiOx treatment for sulphide ore portion of deposit

Mother Lode deposit is surrounded by Coeur Mining claims, impinging on ability

to develop without a layback agreement

Preliminary Economic Assessment

Bio-Oxidation & Heap Leach

• Discovered the new "Lynnda Strip" target in July 2020 which is -2.5km NE of

Mother Lode, and has since carried out significant drilling

Reserve & Resource Summary (¹)

M&I

Inferred

Total

Resource

Tonnage

(Mt)

60.24

9.86

70.10

Au

(g/t)

0.55

Grade

0.80 0.78 0.81

0.77

Contained

Ag AuEq Au

Ag

(g/t) (g/t) (koz) (koz)

1.26

0.85

0.56

1,552 1,509

173

399

0.78 1,725 1,908

Corvus

COLN (1) Mineralreserves and resources from Corvus Mother Lode PEA

AuEq

(koz)

1,572

178

1,750

Mining Summary (Production and AISC)

210

$922

167

247

$631 $501

175

$1,883

$1,082 72

Yr 1 Yr 2 Yr3 Yr 4

Au Production (koz)

177

PEA Summary

Mine Life (years)

LOM Avg. Annual Au Prod. (kozpa)

LOM Avg. Annual Ag Prod. (kozpa)

LOM Recovery Au/Ag (%)

Initial / Sustaining Capital (USSM)

Gold Price Assumption (USS/oz)

LOM Avg. AISC (By-Product) (US$/oz Au)

NPV (Post-Tax @5%) (USSM)

IRR (After Tax)

207

14

86 $1,451

$918

$648 $520

Yr5 Yr6 Yr7 Yr8 Yr9

--AISC By-Product (US$/oz)

9 years

153

71

85%/32%

$406/$44

$1,500

$787

$303

23%

Fort CapitalView entire presentation