Micro Focus Credit Presentation Deck

11

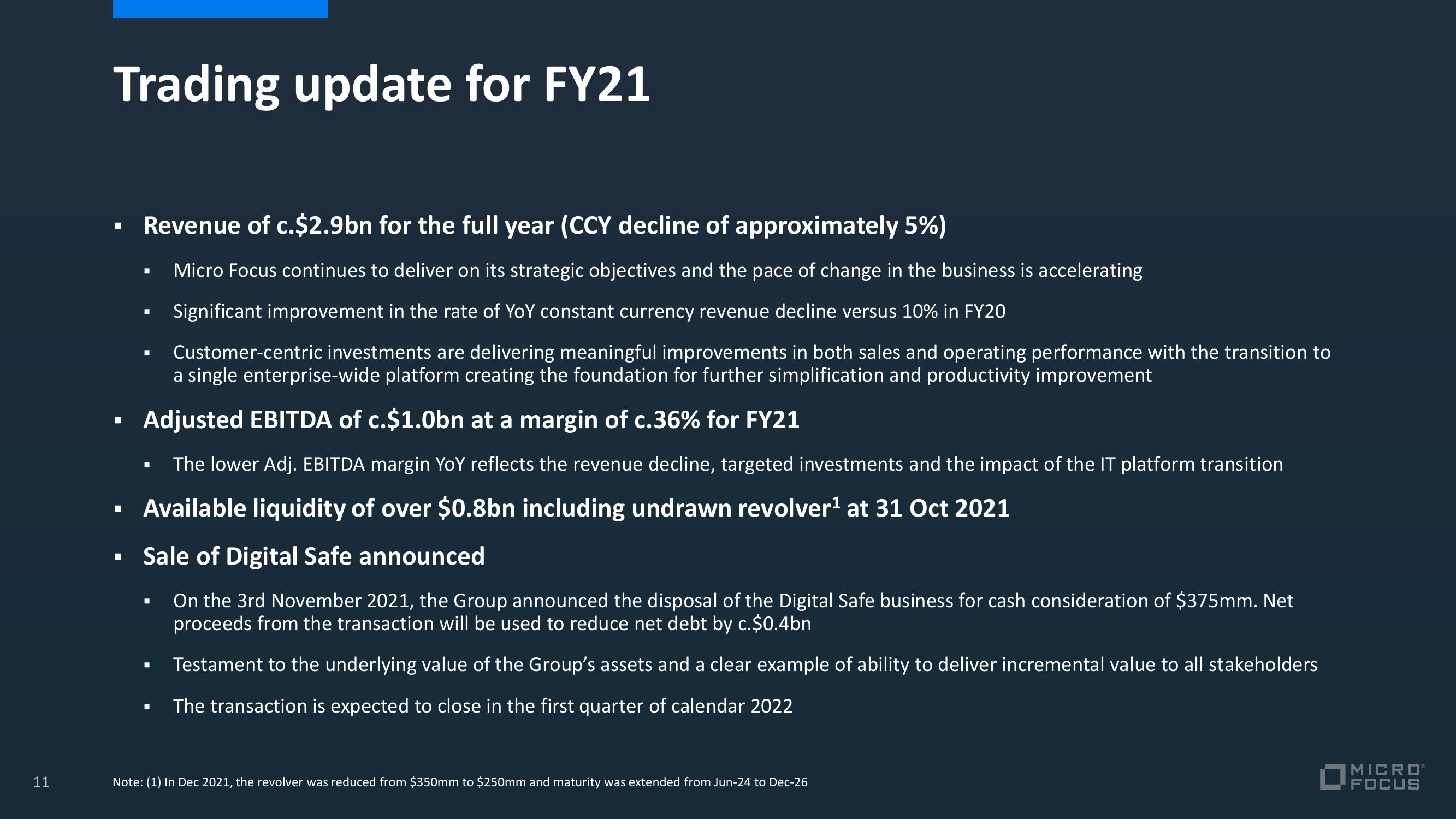

Trading update for FY21

■

Revenue of c.$2.9bn for the full year (CCY decline of approximately 5%)

Micro Focus continues to deliver on its strategic objectives and the pace of change in the business is accelerating

Significant improvement in the rate of YoY constant currency revenue decline versus 10% in FY20

Customer-centric investments are delivering meaningful improvements in both sales and operating performance with the transition to

a single enterprise-wide platform creating the foundation for further simplification and productivity improvement

Adjusted EBITDA of c.$1.0bn at a margin of c.36% for FY21

The lower Adj. EBITDA margin YoY reflects the revenue decline, targeted investments and the impact of the IT platform transition

Available liquidity of over $0.8bn including undrawn revolver¹ at 31 Oct 2021

I

■

I

▪ Sale of Digital Safe announced

■

■

On the 3rd November 2021, the Group announced the disposal of the Digital Safe business for cash consideration of $375mm. Net

proceeds from the transaction will be used to reduce net debt by c.$0.4bn

Testament to the underlying value of the Group's assets and a clear example of ability to deliver incremental value to all stakeholders

The transaction is expected to close in the first quarter of calendar 2022

Note: (1) In Dec 2021, the revolver was reduced from $350mm to $250mm and maturity was extended from Jun-24 to Dec-26

MICROⓇ

FOCUSView entire presentation