Bank of America Investment Banking Pitch Book

Appendix

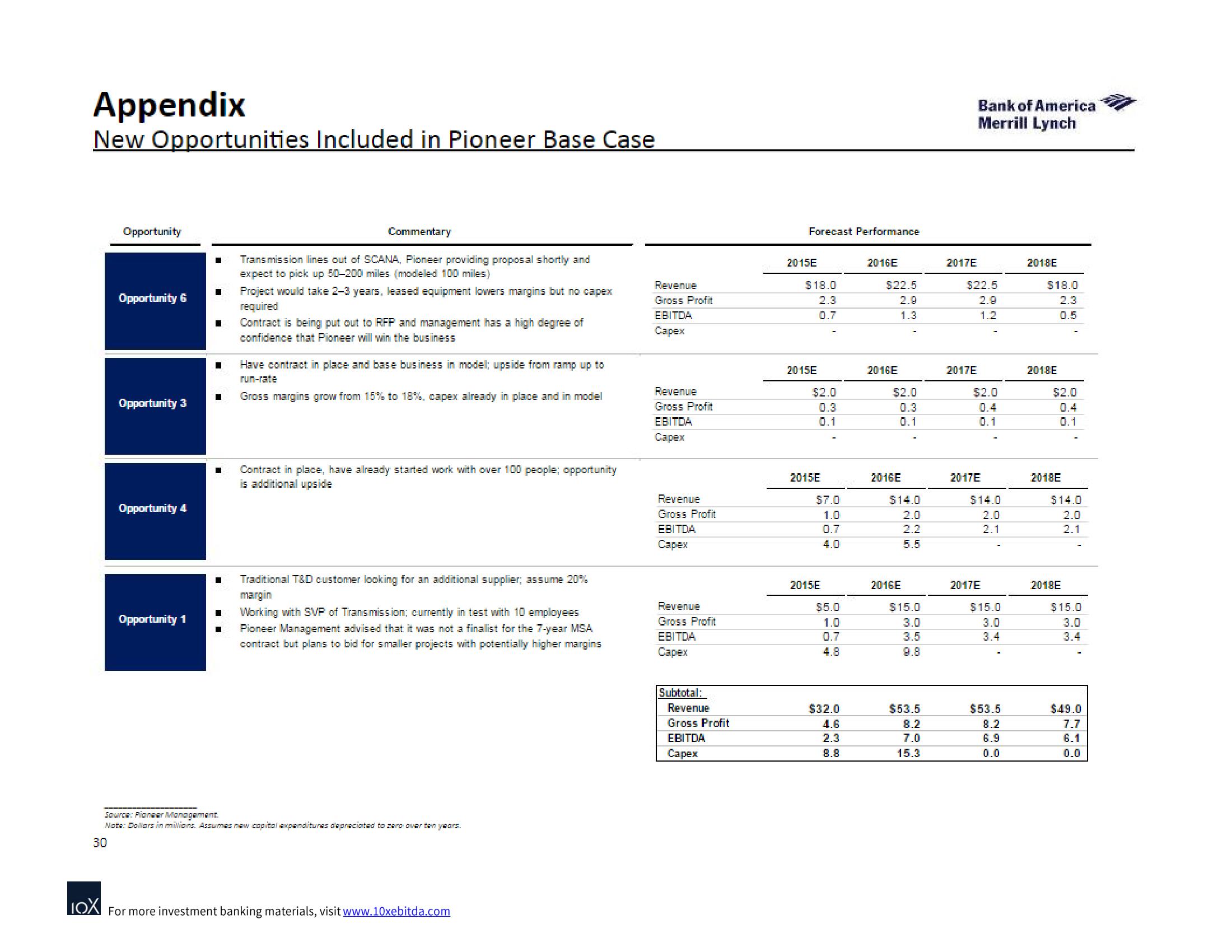

New Opportunities Included in Pioneer Base Case

Opportunity

Opportunity 6

Opportunity 3

Opportunity 4

Opportunity 1

■

1

E

■

■

■

Commentary

Transmission lines out of SCANA, Pioneer providing proposal shortly and

expect to pick up 50-200 miles (modeled 100 miles)

Project would take 2-3 years, leased equipment lowers margins but no capex

required

Contract is being put out to RFP and management has a high degree of

confidence that Pioneer will win the business

Have contract in place and base business in model; upside from ramp up to

run-rate

Gross margins grow from 15% to 18%, capex already in place and in model

Contract in place, have already started work with over 100 people; opportunity

is additional upside

Traditional T&D customer looking for an additional supplier; assume 20%

margin

Working with SVP of Transmission; currently in test with 10 employees

Pioneer Management advised that it was not a finalist for the 7-year MSA

contract but plans to bid for smaller projects with potentially higher margins

Source: Pioneer Management.

Note: Dollars in milions. Assumes new capital expenditures depreciated to pero over ten years.

30

IOX For more investment banking materials, visit www.10xebitda.com

Revenue

Gross Profit

EBITDA

Capex

Revenue

Gross Profit

EBITDA

Capex

Revenue

Gross Profit

EBITDA

Capex

Revenue

Gross Profit

EBITDA

Capex

Subtotal:

Revenue

Gross Profit

EBITDA

Capex

Forecast Performance

2015E

$18.0

2015E

0.7

$2.0

0.3

0.1

2015E

0371

$7.0

1.0

0.7

4.0

2015E

6104

$5.0

8070

1.0

0.7

4.8

$32.0

4.6

2.3

2016E

$22.5

2.9

1.3

2016E

$2.0

0.3

0.1

2016E

$14.0

2.0

2.2

5.5

2016E

$15.0

3.0

3.5

9.8

$53.5

8.2

7.0

15.3

2017E

Bank of America

Merrill Lynch

$22.5

2017E

1.2

$2.0

2017E

0.1

$14.0

2.0

2.1

2017E

$15.0

3.0

3.4

$53.5

8.2

6.9

0.0

2018E

$18.0

2.3

0.5

2018E

$2.0

'

0.1

2018E

$14.0

2.0

2.1

2018E

$15.0

3.0

3.4

$49.0

7.7

6.1View entire presentation