Q2 2018 Fixed Income Investor Conference Call

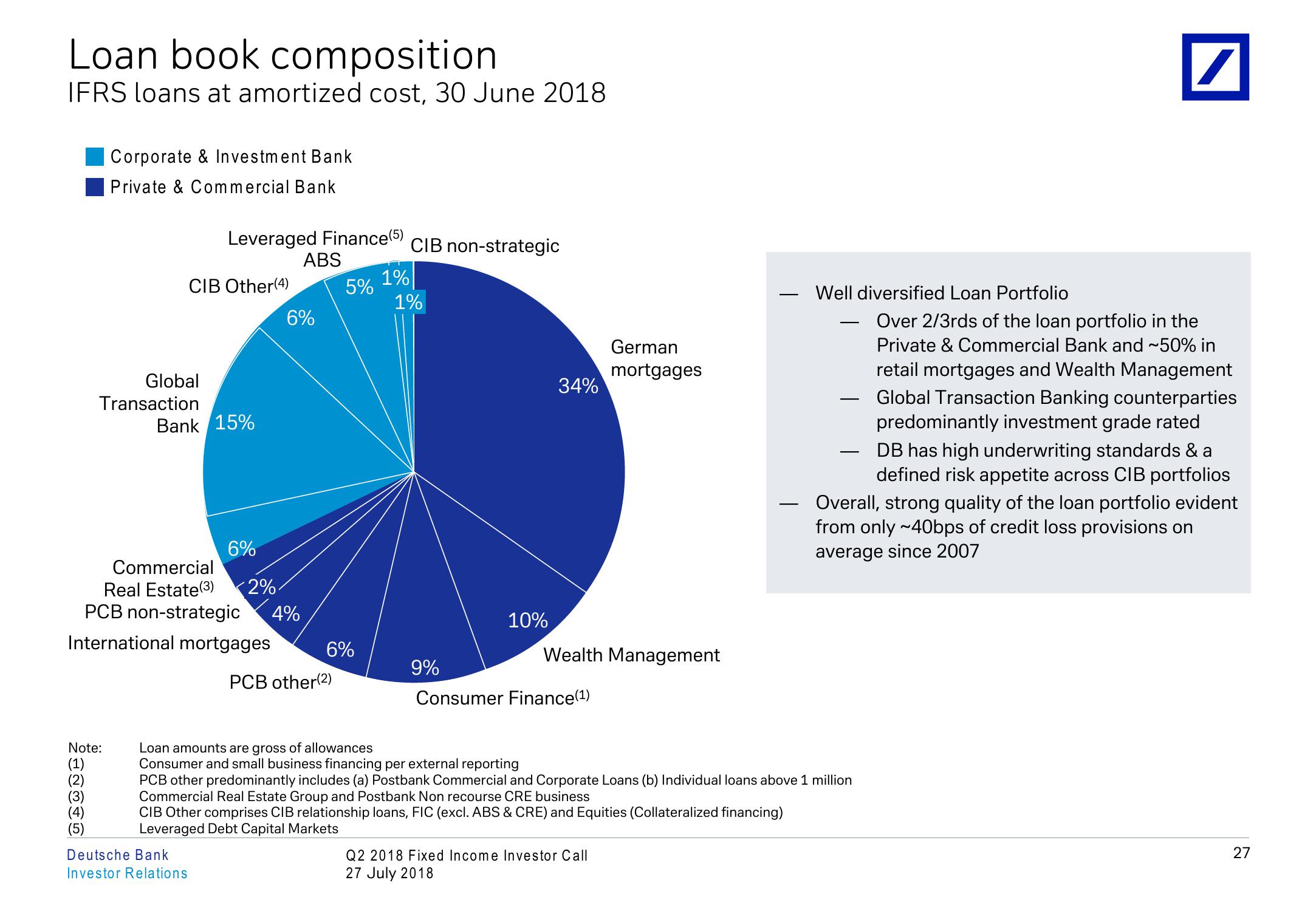

Loan book composition

IFRS loans at amortized cost, 30 June 2018

Corporate & Investment Bank

Private & Commercial Bank

Leveraged Finance (5)

ABS

CIB Other (4)

CIB non-strategic

5% 1%

1%

6%

Global

Transaction

Bank 15%

6%

Commercial

Real Estate (3) <2%

German

mortgages

34%

PCB non-strategic

4%

10%

International mortgages

6%

Wealth Management

9%

PCB other (2)

Consumer Finance (1)

-

Well diversified Loan Portfolio

-

Over 2/3rds of the loan portfolio in the

Private & Commercial Bank and ~50% in

retail mortgages and Wealth Management

Global Transaction Banking counterparties

predominantly investment grade rated

DB has high underwriting standards & a

defined risk appetite across CIB portfolios

Overall, strong quality of the loan portfolio evident

from only ~40bps of credit loss provisions on

average since 2007

Consumer and small business financing per external reporting

PCB other predominantly includes (a) Postbank Commercial and Corporate Loans (b) Individual loans above 1 million

Commercial Real Estate Group and Postbank Non recourse CRE business

Note:

Loan amounts are gross of allowances

(1)

(2)

(3)

(4)

(5)

Deutsche Bank

Investor Relations

CIB Other comprises CIB relationship loans, FIC (excl. ABS & CRE) and Equities (Collateralized financing)

Leveraged Debt Capital Markets

Q2 2018 Fixed Income Investor Call

27 July 2018

22

27View entire presentation