NuStar Energy Investor Conference Presentation Deck

NuStar

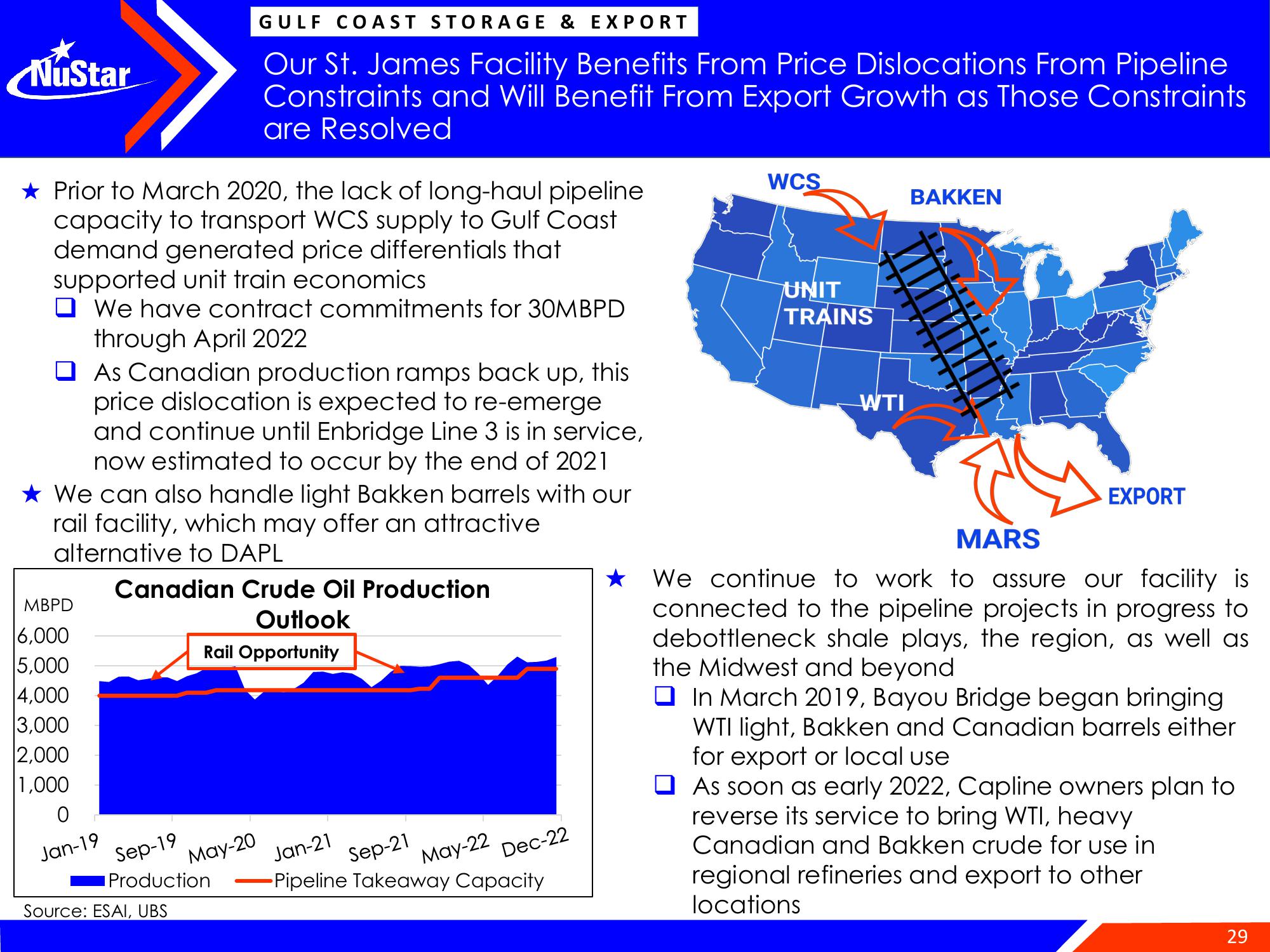

★ Prior to March 2020, the lack of long-haul pipeline

capacity to transport WCS supply to Gulf Coast

demand generated price differentials that

supported unit train economics

We have contract commitments for 30MBPD

through April 2022

As Canadian production ramps back up, this

price dislocation is expected to re-emerge

and continue until Enbridge Line 3 is in service,

now estimated to occur by the end of 2021

★ We can also handle light Bakken barrels with our

rail facility, which may offer an attractive

alternative to DAPL

MBPD

6,000

5,000

4,000

3,000

2,000

1,000

0

Jan-19

GULF COAST STORAGE & EXPORT

Our St. James Facility Benefits From Price Dislocations From Pipeline

Constraints and Will Benefit From Export Growth as Those Constraints

are Resolved

Canadian Crude Oil Production

Outlook

Rail Opportunity

Sep-19

Production

Source: ESAI, UBS

May-20

Dec-22

Jan-21

Sep-21

-Pipeline Takeaway Capacity

May-22

WCS

UNIT

TRAINS

WTI

BAKKEN

EXPORT

MARS

We continue to work to assure our facility is

connected to the pipeline projects in progress to

debottleneck shale plays, the region, as well as

the Midwest and beyond

In March 2019, Bayou Bridge began bringing

WTI light, Bakken and Canadian barrels either

for export or local use

As soon as early 2022, Capline owners plan to

reverse its service to bring WTI, heavy

Canadian and Bakken crude for use in

regional refineries and export to other

locations

29View entire presentation