Vince Investor Presentation

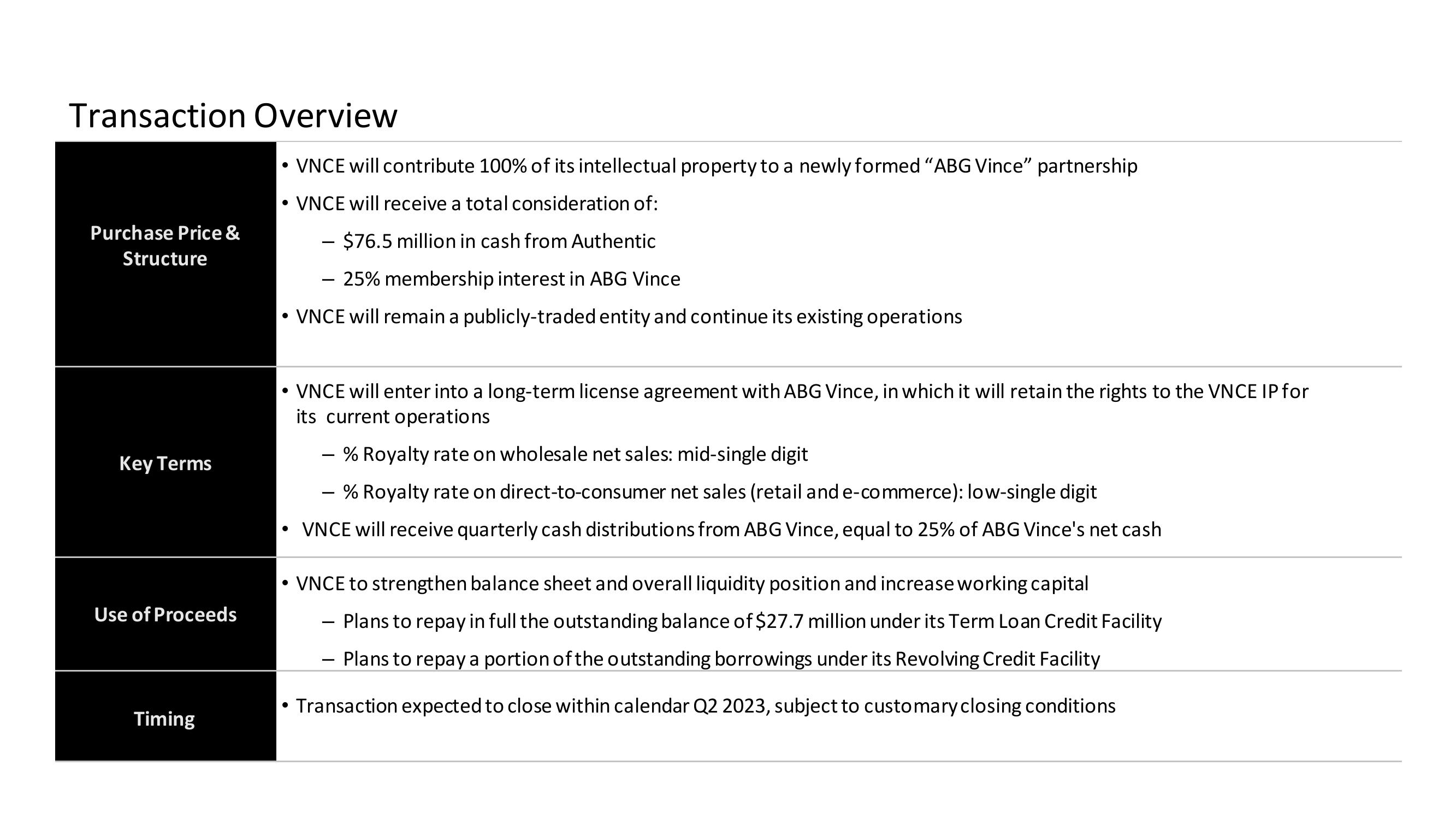

Transaction Overview

Purchase Price &

Structure

Key Terms

Use of Proceeds

Timing

• VNCE will contribute 100% of its intellectual property to a newly formed "ABG Vince" partnership

VNCE will receive a total consideration of:

- $76.5 million in cash from Authentic

- 25% membership interest in ABG Vince

VNCE will remain a publicly-traded entity and continue its existing operations

€

●

• VNCE will enter into a long-term license agreement with ABG Vince, in which it will retain the rights to the VNCE IP for

its current operations

6

●

- % Royalty rate on wholesale net sales: mid-single digit

- % Royalty rate on direct-to-consumer net sales (retail and e-commerce): low-single digit

VNCE will receive quarterly cash distributions from ABG Vince, equal to 25% of ABG Vince's net cash

VNCE to strengthen balance sheet and overall liquidity position and increase working capital

Plans to repay in full the outstanding balance of $27.7 million under its Term Loan Credit Facility

— Plans to repay a portion of the outstanding borrowings under its Revolving Credit Facility

Transaction expected to close within calendar Q2 2023, subject to customary closing conditionsView entire presentation