BenevolentAI SPAC Presentation Deck

Pro Forma Capitalisation and Ownership

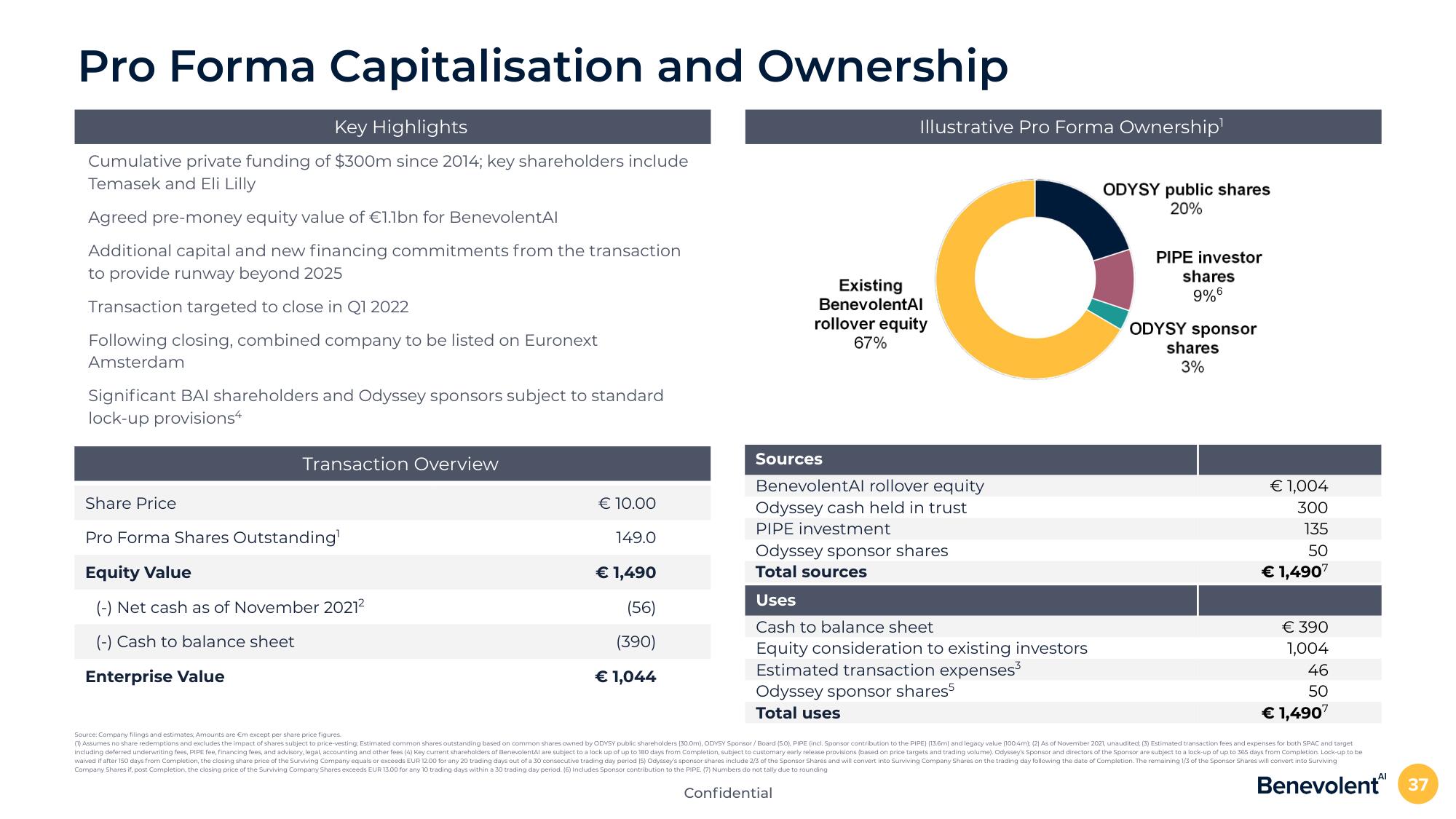

Key Highlights

Cumulative private funding of $300m since 2014; key shareholders include

Temasek and Eli Lilly

Agreed pre-money equity value of €1.1bn for BenevolentAl

Additional capital and new financing commitments from the transaction

to provide runway beyond 2025

Transaction targeted to close in Q1 2022

Following closing, combined company to be listed on Euronext

Amsterdam

Significant BAI shareholders and Odyssey sponsors subject to standard

lock-up provisions

Transaction Overview

Share Price

Pro Forma Shares Outstanding¹

Equity Value

(-) Net cash as of November 2021²

(-) Cash to balance sheet

Enterprise Value

€ 10.00

149.0

€ 1,490

(56)

(390)

€ 1,044

Illustrative Pro Forma Ownership¹

Existing

BenevolentAl

rollover equity

67%

Sources

BenevolentAl rollover equity

Odyssey cash held in trust

PIPE investment

Odyssey sponsor shares

Total sources

ODYSY public shares

20%

S

Uses

O Cash to balance sheet

Equity consideration to existing investors

Estimated transaction expenses³

Odyssey sponsor shares5

Total uses

PIPE investor

shares

9%6

ODYSY sponsor

shares

3%

€ 1,004

300

135

50

€ 1,4907

€ 390

1,004

46

50

€ 1,4907

Source: Company filings and estimates; Amounts are Em except per share price figures.

(1) Assumes no share redemptions and excludes the impact of shares subject to price-vesting. Estimated common shares outstanding based on common shares owned by ODYSY public shareholders (30.0m), ODYSY Sponsor / Board (5.0), PIPE (incl. Sponsor contribution to the PIPE) (13.6m) and legacy value (100.4m); (2) As of November 2021, unaudited; (3) Estimated transaction fees and expenses for both SPAC and target

including deferred underwriting fees, PIPE fee, financing fees, and advisory, legal, accounting and other fees (4) Key current shareholders of BenevolentAl are subject to a lock up of up to 180 days from Completion, subject to customary early release provisions (based on price targets and trading volume). Odyssey's Sponsor and directors of the Sponsor are subject to a lock-up of up to 365 days from Completion Lock-up to be

waived if after 150 days from Completion, the closing share price of the Surviving Company equals or exceeds EUR 12.00 for any 20 trading days out of a 30 consecutive trading day period (S) Odyssey's sponsor shares include 2/3 of the Sponsor Shares and will convert into Surviving Company Shares on the trading day following the date of Completion. The remaining 1/3 of the Sponsor Shares will convert into Surviving

Company Shares if, post Completion, the closing price of the Surviving Company Shares exceeds EUR 13.00 for any 10 trading days within a 30 trading day period. (6) Includes Sponsor contribution to the PIPE. (7) Numbers do not tally due to rounding

Benevolent 37

ConfidentialView entire presentation