Bakkt SPAC Presentation Deck

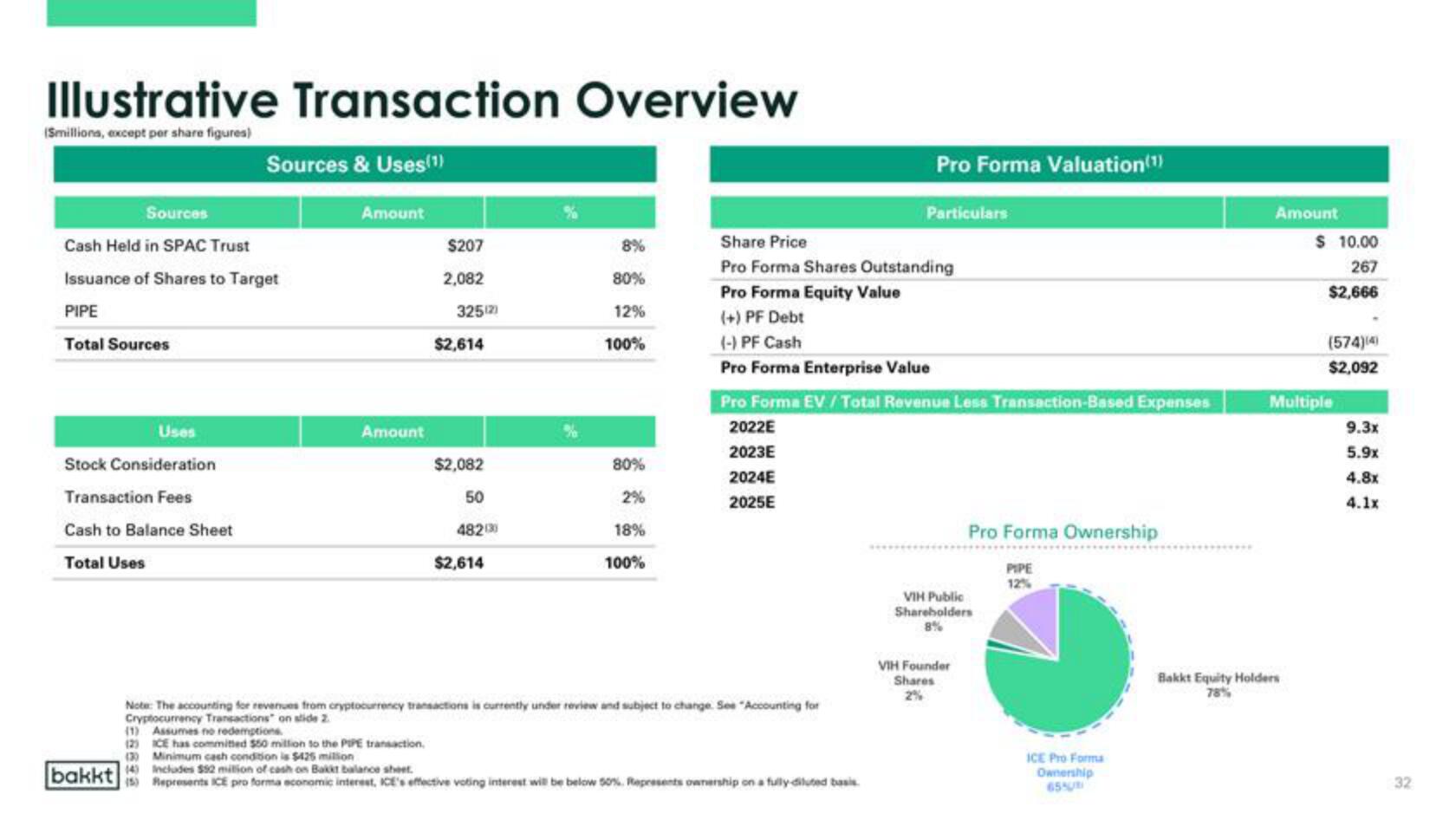

Illustrative Transaction Overview

(Smillions, except per share figures)

Sources & Uses(1)

Amount

Sources

Cash Held in SPAC Trust

Issuance of Shares to Target

PIPE

Total Sources

Uses

Stock Consideration

Transaction Fees

Cash to Balance Sheet

Total Uses

Amount

$207

2,082

(1) Assumes no redemptions

(2) ICE has committed $50 million to the PIPE transaction.

(3) Minimum cash condition is $425 million

(4)

325(2)

$2,614

$2,082

50

48230

$2,614

8%

80%

12%

100%

80%

2%

18%

100%

Note: The accounting for revenues from cryptocurrency transactions is currently under review and subject to change. See "Accounting for

Cryptocurrency Transactions" on slide 2.

Pro Forma Valuation(¹)

Share Price

Pro Forma Shares Outstanding

Pro Forma Equity Value

(+) PF Debt

(-) PF Cash

Pro Forma Enterprise Value

Particulars

Pro Forma EV / Total Revenue Less Transaction-Based Expenses

2022E

2023E

2024E

2025E

Includes

milion of cash on Bakit balance sheet.

bakkt Represents ICE pro forma economic interest, ICE's effective voting interest will be below 50%. Represents ownership on a fully-diluted basis.

Pro Forma Ownership

PIPE

12%

VIH Public

Shareholders

8%

VIH Founder

Shares

ICE Pro Forma

Ownership

65%

Amount

$ 10.00

267

$2,666

Bakkt Equity Holders

78%

(574)(4)

$2,092

Multiple

9.3x

5.9x

4.8x

4.1x

32View entire presentation