Trian Partners Activist Presentation Deck

Significantly Improved Performance and TSR

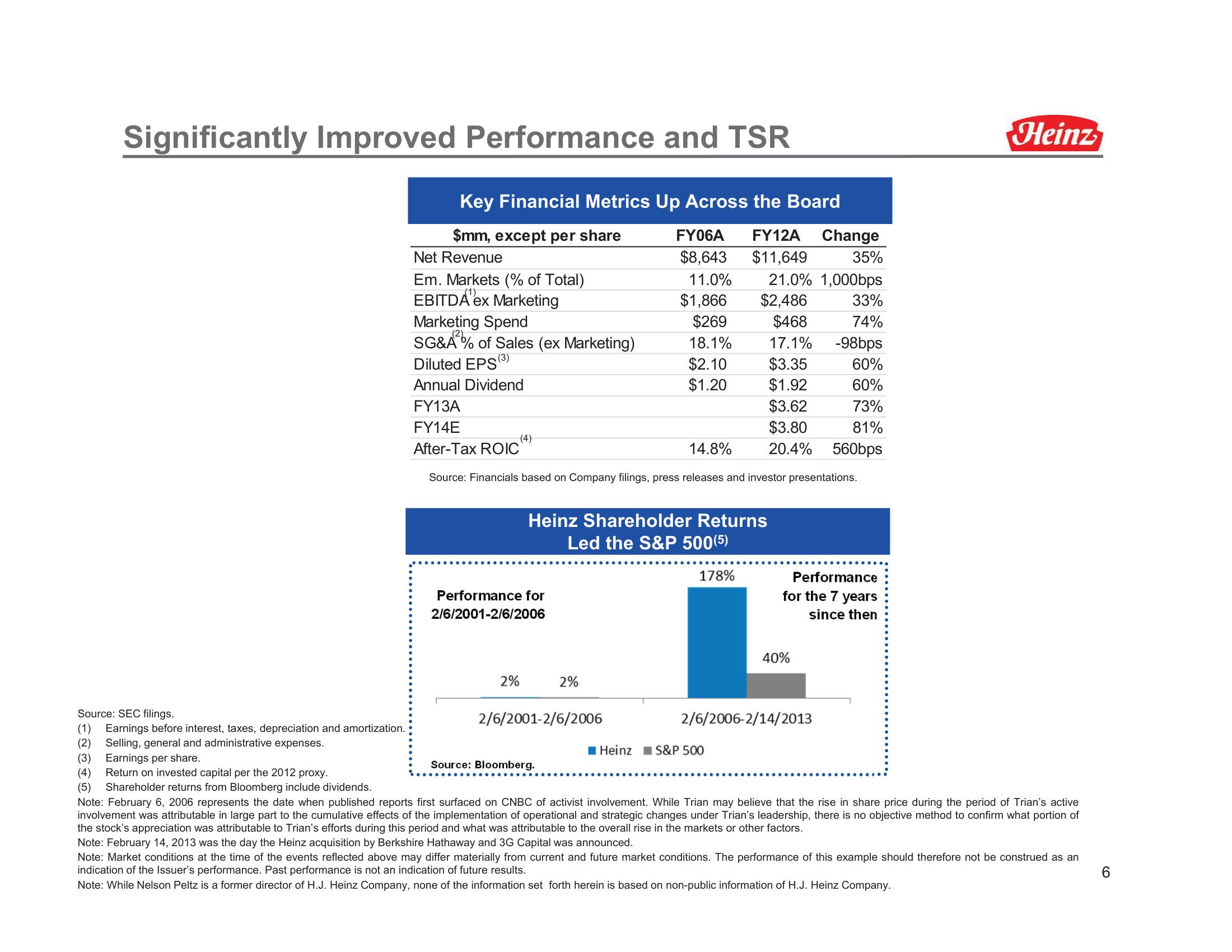

Key Financial Metrics Up Across the Board

$mm, except per share

Net Revenue

Em. Markets (% of Total)

EBITDA ex Marketing

Marketing Spend

SG&A% of Sales (ex Marketing)

Diluted EPS (3)

Annual Dividend

FY13A

FY14E

After-Tax ROIC

14.8%

Source: Financials based on Company filings, press releases and investor presentations.

Performance for

2/6/2001-2/6/2006

2%

Heinz Shareholder Returns

Led the S&P 500 (5)

FY06A FY12A Change

$8,643

$11,649

35%

11.0%

21.0% 1,000bps

$1,866

$2,486

$269

$468

18.1%

17.1%

$2.10

$3.35

$1.20

$1.92

$3.62

$3.80

20.4%

2%

2/6/2001-2/6/2006

Source: Bloomberg.

178%

33%

74%

40%

Heinz S&P 500

Performance

for the 7 years

since then

Source: SEC filings.

(1) Earnings before interest, taxes, depreciation and amortization.

(2) Selling, general and administrative expenses.

(3)

Earnings per share.

(4) Return on invested capital per the 2012 proxy.

(5) Shareholder returns from Bloomberg include dividends.

Note: February 6, 2006 represents the date when published reports first surfaced on CNBC of activist involvement. While Trian may believe that the rise in share price during the period of Trian's active

involvement was attributable in large part to the cumulative effects of the implementation of operational and strategic changes under Trian's leadership, there is no objective method to confirm what portion of

the stock's appreciation was attributable to Trian's efforts during this period and what was attributable to the overall rise in the markets or other factors.

Note: February 14, 2013 was the day the Heinz acquisition by Berkshire Hathaway and 3G Capital was announced.

Note: Market conditions at the time of the events reflected above may differ materially from current and future market conditions. The performance of this example should therefore not be construed as an

indication of the Issuer's performance. Past performance is not an indication of future results.

Note: While Nelson Peltz is a former director of H.J. Heinz Company, none of the information set forth herein is based on non-public information of H.J. Heinz Company.

2/6/2006-2/14/2013

-98bps

60%

60%

73%

81%

560bps

Heinz

CO

6View entire presentation