Credit Suisse Results Presentation Deck

Investment Bank

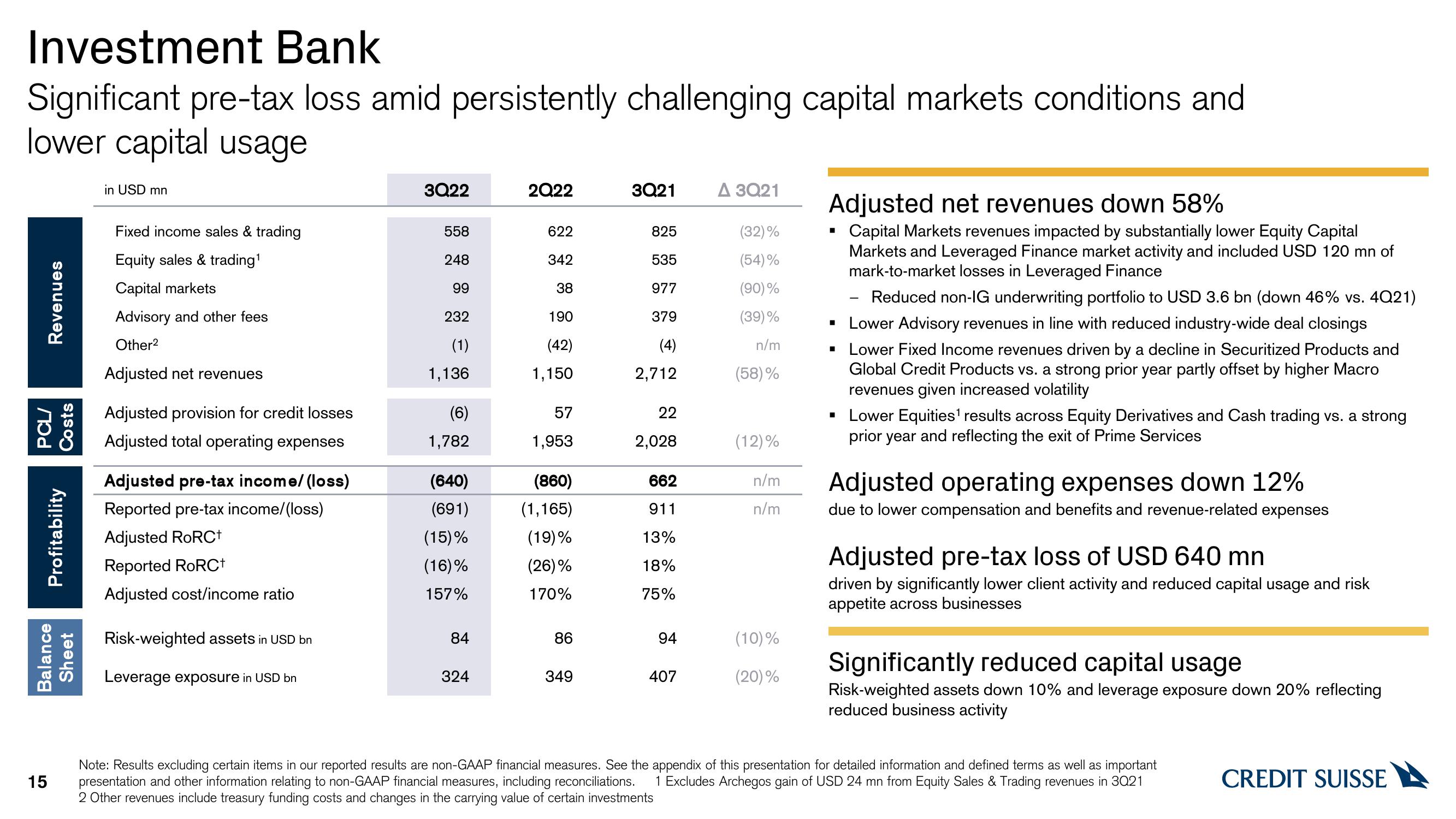

Significant pre-tax loss amid persistently challenging capital markets conditions and

lower capital usage

Revenues

PCL/

Costs

Profitability

Balance

Sheet

15

in USD mn

Fixed income sales & trading

Equity sales & trading¹

Capital markets

Advisory and other fees

Other²

Adjusted net revenues

Adjusted provision for credit losses

Adjusted total operating expenses

Adjusted pre-tax income/ (loss)

Reported pre-tax income/(loss)

Adjusted RoRC+

Reported RoRC+

Adjusted cost/income ratio

Risk-weighted assets in USD bn

Leverage exposure in USD bn

3Q22

558

248

99

232

(1)

1,136

(6)

1,782

(640)

(691)

(15)%

(16)%

157%

84

324

2Q22

622

342

38

190

(42)

1,150

57

1,953

(860)

(1,165)

(19)%

(26)%

170%

86

349

3Q21

825

535

977

379

(4)

2,712

22

2,028

662

911

13%

18%

75%

94

407

A 3Q21

(32)%

(54)%

(90)%

(39)%

n/m

(58)%

(12)%

n/m

n/m

(10)%

(20)%

Adjusted net revenues down 58%

Capital Markets revenues impacted by substantially lower Equity Capital

Markets and Leveraged Finance market activity and included USD 120 mn of

mark-to-market losses in Leveraged Finance

Reduced non-IG underwriting portfolio to USD 3.6 bn (down 46% vs. 4Q21)

▪ Lower Advisory revenues in line with reduced industry-wide deal closings

Lower Fixed Income revenues driven by a decline in Securitized Products and

Global Credit Products vs. a strong prior year partly offset by higher Macro

revenues given increased volatility

■

▪ Lower Equities¹ results across Equity Derivatives and Cash trading vs. a strong

prior year and reflecting the exit of Prime Services

Adjusted operating expenses down 12%

due to lower compensation and benefits and revenue-related expenses

Adjusted pre-tax loss of USD 640 mn

driven by significantly lower client activity and reduced capital usage and risk

appetite across businesses

Significantly reduced capital usage

Risk-weighted assets down 10% and leverage exposure down 20% reflecting

reduced business activity

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important

presentation and other information relating to non-GAAP financial measures, including reconciliations. 1 Excludes Archegos gain of USD 24 mn from Equity Sales & Trading revenues in 3021

2 Other revenues include treasury funding costs and changes in the carrying value of certain investments

CREDIT SUISSEView entire presentation