OSP Value Fund IV LP Q4 2022

OSP

●

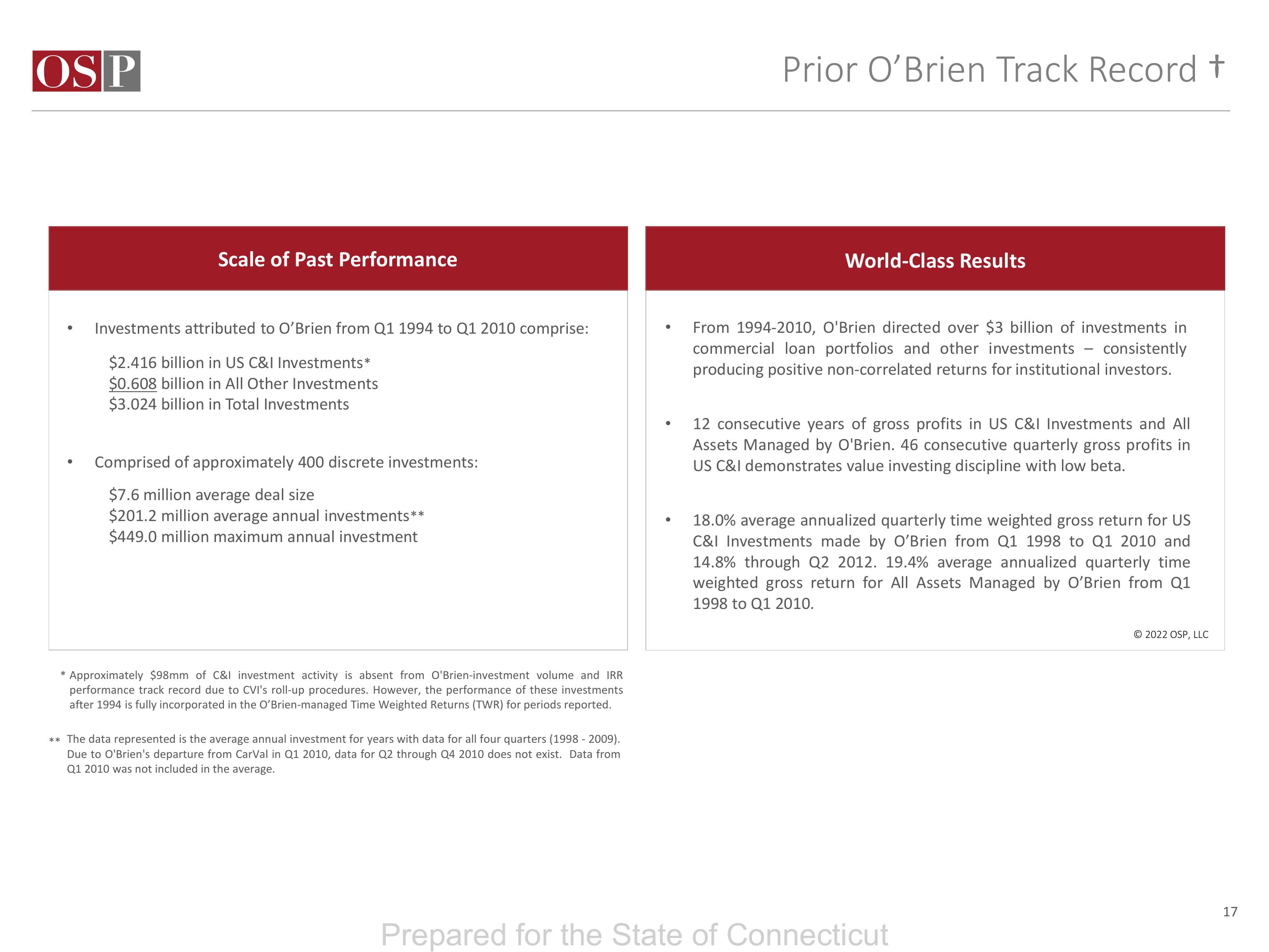

Scale of Past Performance

Investments attributed to O'Brien from Q1 1994 to Q1 2010 comprise:

$2.416 billion in US C&I Investments*

$0.608 billion in All Other Investments

$3.024 billion in Total Investments

Comprised of approximately 400 discrete investments:

$7.6 million average deal size

$201.2 million average annual investments**

$449.0 million maximum annual investment

* Approximately $98mm of C&I investment activity is absent from O'Brien-investment volume and IRR

performance track record due to CVI's roll-up procedures. However, the performance of these investments

after 1994 is fully incorporated in the O'Brien-managed Time Weighted Returns (TWR) for periods reported.

** The data represented is the average annual investment for years with data for all four quarters (1998 - 2009).

Due to O'Brien's departure from CarVal in Q1 2010, data for Q2 through Q4 2010 does not exist. Data from

Q1 2010 was not included in the average.

Prior O'Brien Track Record +

World-Class Results

From 1994-2010, O'Brien directed over $3 billion of investments in

commercial loan portfolios and other investments - consistently

producing positive non-correlated returns for institutional investors.

12 consecutive years of gross profits in US C&I Investments and All

Assets Managed by O'Brien. 46 consecutive quarterly gross profits in

US C&I demonstrates value investing discipline with low beta.

18.0% average annualized quarterly time weighted gross return for US

C&I Investments made by O'Brien from Q1 1998 to Q1 2010 and

14.8% through Q2 2012. 19.4% average annualized quarterly time

weighted gross return for All Assets Managed by O'Brien from Q1

1998 to Q1 2010.

Prepared for the State of Connecticut

Ⓒ2022 OSP, LLC

17View entire presentation