Bigbear AI SPAC Presentation Deck

Transaction Overview

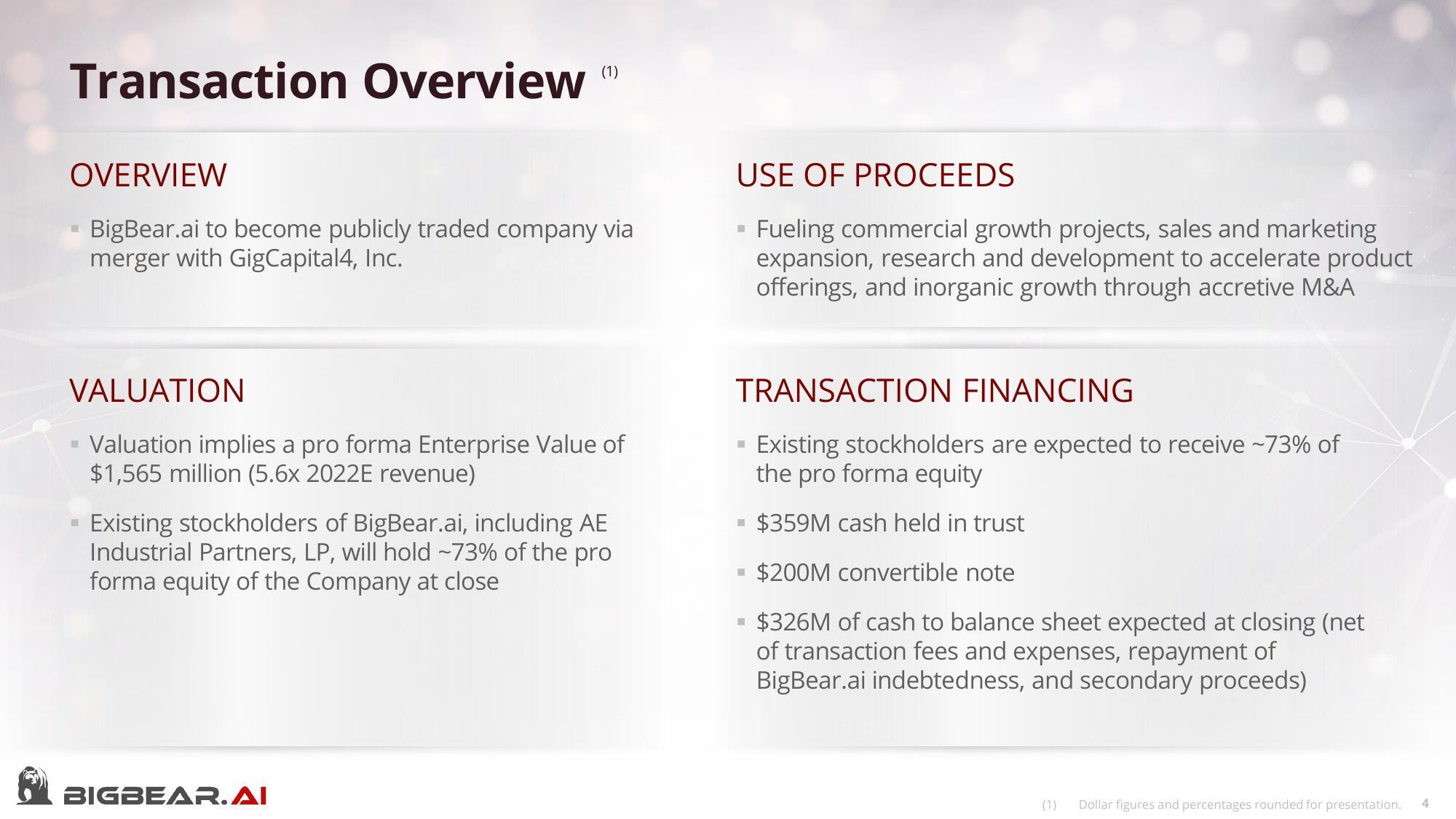

OVERVIEW

BigBear.ai to become publicly traded company via

merger with GigCapital4, Inc.

(1)

VALUATION

Valuation implies a pro forma Enterprise Value of

$1,565 million (5.6x 2022E revenue)

H

Existing stockholders of BigBear.ai, including AE

Industrial Partners, LP, will hold ~73% of the pro

forma equity of the Company at close

BIGBEAR. AI

USE OF PROCEEDS

Fueling commercial growth projects, sales and marketing

expansion, research and development to accelerate product

offerings, and inorganic growth through accretive M&A

■

TRANSACTION FINANCING

Existing stockholders are expected to receive ~73% of

the pro forma equity

■ $359M cash held in trust

$200M convertible note

$326M of cash to balance sheet expected at closing (net

of transaction fees and expenses, repayment of

BigBear.ai indebtedness, and secondary proceeds)

M

■

(1)

Dollar figures and percentages rounded for presentation.

4View entire presentation