ProSomnus SPAC Presentation Deck

Transaction Summary(¹)(2)

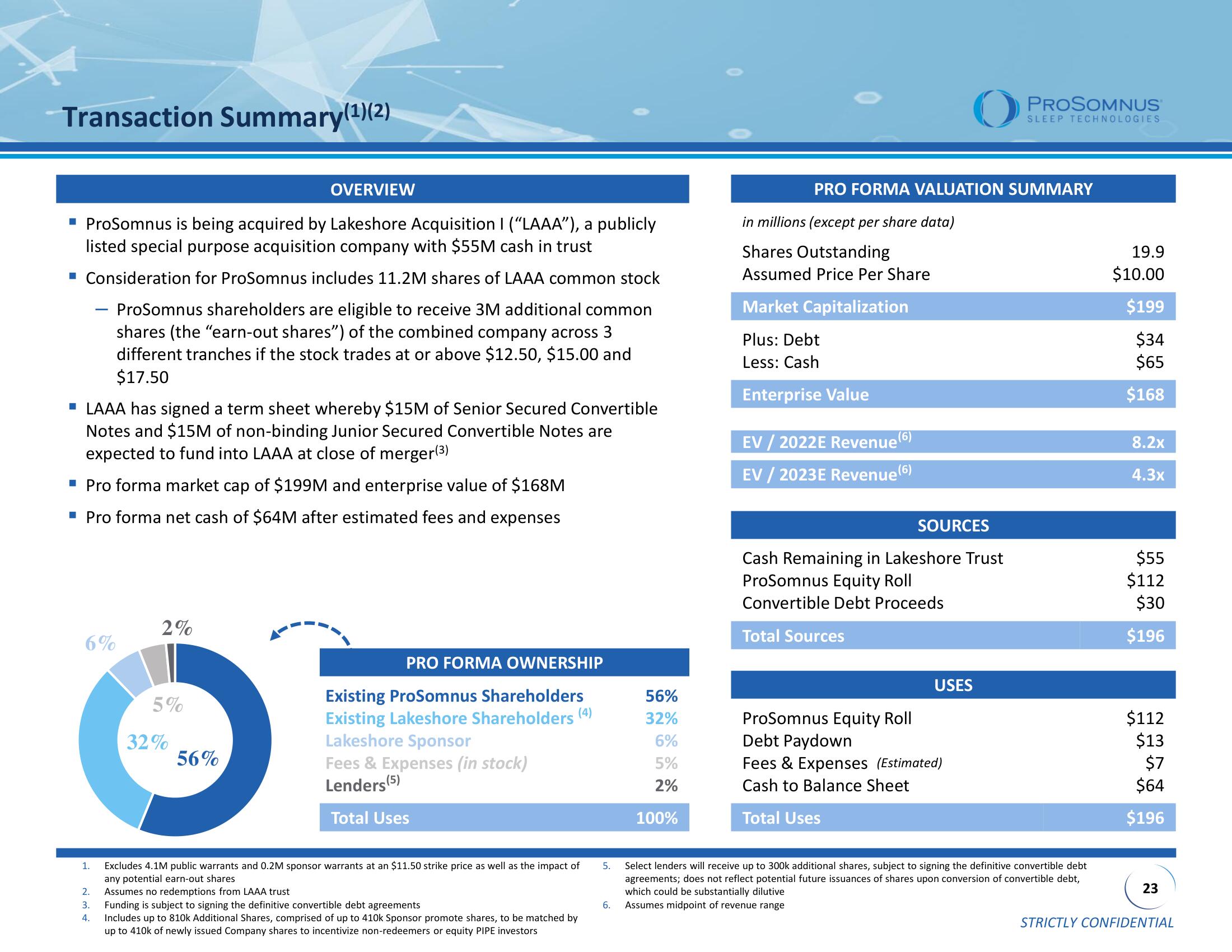

OVERVIEW

▪ ProSomnus is being acquired by Lakeshore Acquisition I (“LAAA"), a publicly

listed special purpose acquisition company with $55M cash in trust

■ Consideration for ProSomnus includes 11.2M shares of LAAA common stock

- ProSomnus shareholders are eligible to receive 3M additional common

shares (the "earn-out shares") of the combined company across 3

different tranches if the stock trades at or above $12.50, $15.00 and

$17.50

▪ LAAA has signed a term sheet whereby $15M of Senior Secured Convertible

Notes and $15M of non-binding Junior Secured Convertible Notes are

expected to fund into LAAA at close of merger(³)

▪ Pro forma market cap of $199M and enterprise value of $168M

▪ Pro forma net cash of $64M after estimated fees and expenses

6%

1.

2%

5%

32%

56%

PRO FORMA OWNERSHIP

Existing ProSomnus Shareholders

Existing Lakeshore Shareholders (4)

Lakeshore Sponsor

Fees & Expenses (in stock)

Lenders (5)

Total Uses

Excludes 4.1M public warrants and 0.2M sponsor warrants at an $11.50 strike price as well as the impact of

any potential earn-out shares

2. Assumes no redemptions from LAAA trust

3.

Funding is subject to signing the definitive convertible debt agreements

4.

Includes up to 810k Additional Shares, comprised of up to 410k Sponsor promote shares, to be matched by

up to 410k of newly issued Company shares to incentivize non-redeemers or equity PIPE investors

5.

6.

56%

32%

6%

5%

2%

100%

PRO FORMA VALUATION SUMMARY

in millions (except per share data)

Shares Outstanding

Assumed Price Per Share

Market Capitalization

Plus: Debt

Less: Cash

Enterprise Value

EV / 2022E Revenue (6)

EV / 2023E Revenue (6)

SOURCES

Cash Remaining in Lakeshore Trust

ProSomnus Equity Roll

Convertible Debt Proceeds

Total Sources

USES

PROSOMNUS

SLEEP TECHNOLOGIES

ProSomnus Equity Roll

Debt Paydown

Fees & Expenses (Estimated)

Cash to Balance Sheet

Total Uses

Select lenders will receive up to 300k additional shares, subject to signing the definitive convertible debt

agreements; does not reflect potential future issuances of shares upon conversion of convertible debt,

which could be substantially dilutive

Assumes midpoint of revenue range

19.9

$10.00

$199

$34

$65

$168

8.2x

4.3x

$55

$112

$30

$196

$112

$13

$7

$64

$196

23

STRICTLY CONFIDENTIALView entire presentation