Morgan Stanley Investment Banking Pitch Book

Project Roosevelt

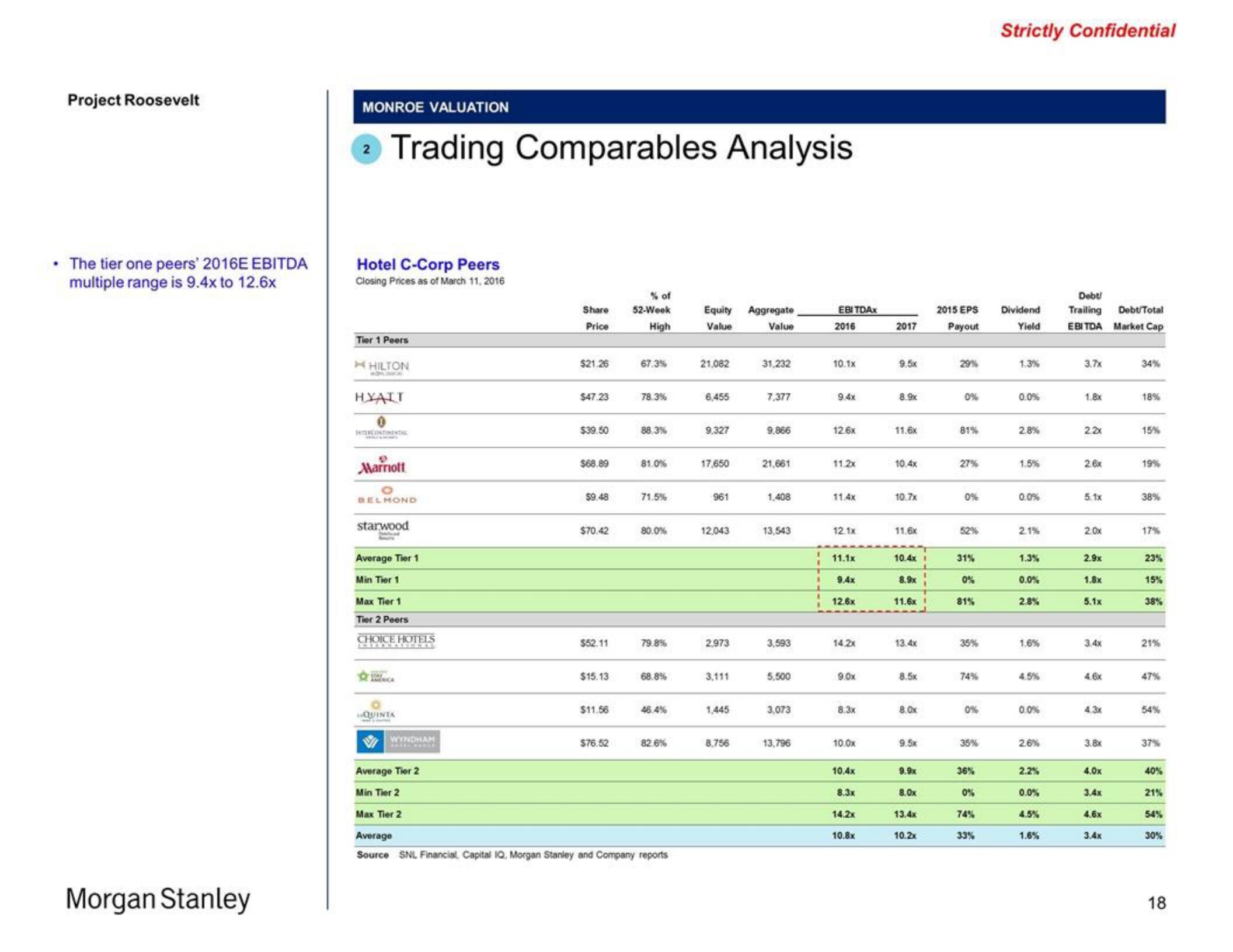

• The tier one peers' 2016E EBITDA

multiple range is 9.4x to 12.6x

Morgan Stanley

MONROE VALUATION

Trading Comparables Analysis

Hotel C-Corp Peers

Closing Prices as of March 11, 2016

Tier 1 Peers

HILTON

HYAIT

INTERCONTINENTAL

9

Marriott

O

BELMOND

starwood

Doorked

Average Tier 1

Min Tier 1

Max Tier 1

Tier 2 Peers

CHOICE HOTELS

ANTOORARIONES

DAY

QUINTA

WYNDHAM

Average Tier 2

Min Tier 2

Max Tier 2

Share

Price

$21.26

$47.23

$39.50

$68.89

$9.48

$70.42

$52.11

$15.13

$11.56

$76.52

% of

52-Week

High

67.3%

78.3%

88.3%

81.0%

71.5%

80.0%

79.8%

68.8%

46.4%

82.6%

Average

Source SNL Financial, Capital IQ, Morgan Stanley and Company reports

Equity

Value

21,082

6,455

9.327

17,650

961

12,043

2,973

3.111

1,445

8,756

Aggregate

Value

31,232

7,377

9.866

21,661

1,408

13,543

3,593

5.500

3,073

13,796

EBITDAX

2016

10.1x

9.4x

12.6x

11.2x

11.4x

12.1x

11.1x

9.4x

12.6x

14.2x

9.0x

8.3x

10.0x

10.4x

8.3x

14,2x

10.8x

2017

8.9x

11.6x

10.4x

10.7x

11.6x

10.4x 1

8.9x

11.6x1

13.4x

8.5x

8.0x

9.5x

9.9x

8.0x

13.4x

10.2x

2015 EPS

Payout

0%

81%

27%

0%

52%

31%

0%

81%

35%

74%

0%

35%

36%

0%

74%

33%

Strictly Confidential

Dividend

Yield

1.3%

0.0%

2.8%

1.5%

0.0%

2.1%

1.3%

0.0%

2.8%

1.6%

4.5%

0.0%

2.6%

2.2%

0.0%

4.5%

1.6%

Debt!

Trailing Debt Total

EBITDA Market Cap

3.7x

1.8x

22x

2.6x

5.1x

2.0x

2.9x

1.8x

5.1x

3.4x

4.6x

4.3x

3.8x

4.0x

3.4x

4.6x

3.4x

34%

18%

15%

19%

38%

17%

23%

15%

38%

21%

47%

54%

37%

40%

21%

54%

30%

18View entire presentation