Evercore Investment Banking Pitch Book

Financial Analysis

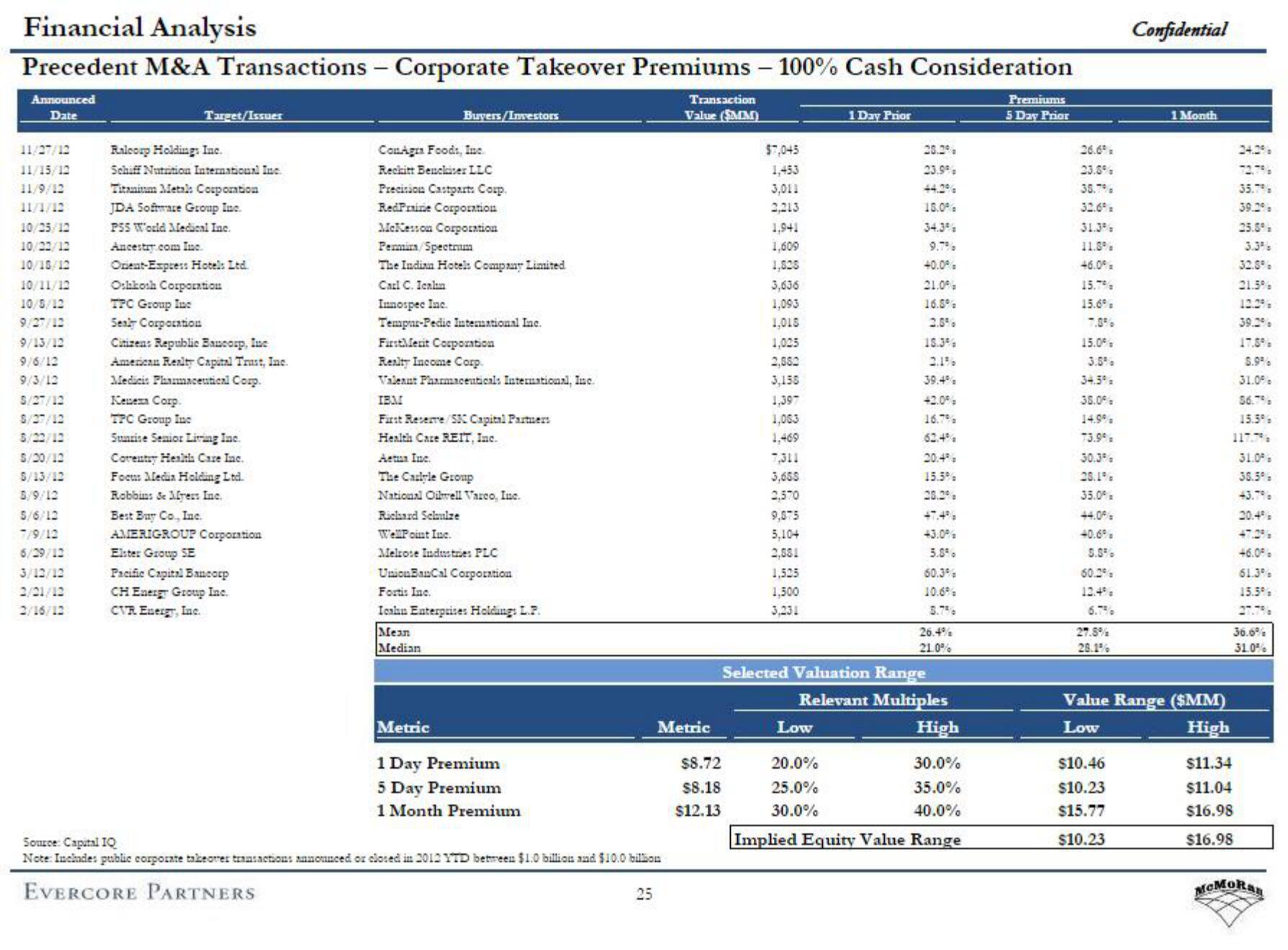

Precedent M&A Transactions - Corporate Takeover Premiums - 100% Cash Consideration

Announced

Date

11/27/12 Ralcorp Holdings Inc.

11/15/12

11/9/12

11/1/12

10/25/12

10/22/12

10/18/12

10/11/12

10/8/12

9/27/12

9/13/12

9/6/12

9/3/12

5/27/12

S/27/12

3/22/12

5/20/12

S/13/12

5/9/12

5/6/12

7/9/12

6/29/12

3/12/12

2/21/12

2/16/12

Target/Issuer

Schiff Nutrition International Inc.

Titanium Metals Corporation

JDA Software Group Inc.

PSS World Medical Inc.

Ancestry.com Inc.

Onent Express Hotels Ltd.

Oshkosh Corporation

TPC Group Inc

Sealy Corporation

Citizen: Republic Bancorp, Inc

American Realty Capital Trust, Inc.

Medicis Pharmaceutical Corp.

Kenema Corp.

TPC Group Inc

Sunrise Senior Living Inc.

Coventry Health Care Inc.

Focus Media Holding Ltd.

Robbins & Myers Inc.

Best Buy Co., Inc.

AMERIGROUP Corporation

Elster Group SE

Pacific Capital Bancorp

CH Energy Group Inc.

CVR Energy, Inc.

Buyers/Investors

ConAgra Foods, Inc.

Reckitt Benckiser LLC

Precision Castpart: Corp.

RedPrairie Corporation

McKesson Corporation

Permis/Spectrum

The Indian Hotels Company Limited.

Carl C. Icalin

Innospec Inc.

Tempur-Pedic International Inc.

FirstMerit Corporation

Realty Income Corp.

Valeant Pharmaceuticals International, Inc.

IBM

First Reserve SKC Capital Partners

Health Care REIT, Inc.

Actus Inc.

The Carlyle Group

National Oilwell Varco, Inc.

Richard Schulze

WellPoint Inc.

Melrose Industries PLC

UnionBanCal Corporation

Fortis Inc.

Icahn Enterprises Holdings L.P.

Mean

Median

Metric

1 Day Premium

5 Day Premium

1 Month Premium

Source: Capital IQ

Note: Includes public corporate takeover transactions announced or closed in 2012 YTD between $1.0 billion and $10.0 bilion

EVERCORE PARTNERS

25

Transaction

Value (MM)

Metric

$8.72

$8.18

$12.13

$7,045

1,453

3,011

2,213

1,941

1,609

1,825

3,636

1,093

1,015

1,025

2,882

3,155

1,397

1,063

1,469

7,311

3,655

2,570

9,875

5.104

2,881

1.525

1,500

3,231

1 Day Prior

26.2%,

23.9%

44.2%

15.0%

34.3%

9.7%

40.0%

21.0%

16.5%

2.8%

15.3%

Low

39.4%

42.0%

16.7%

62.4%

20.0%

25.0%

30.0%

20.4%

15.5%

47.4%

43.0%

5.8%

60.3%

10.6%

5.7%

Selected Valuation Range

26.4%

21.0%

Relevant Multiples

High

30.0%

35.0%

40.0%

Implied Equity Value Range

Premiums

5 Day Prior

26.69

23.8%

35.7%

32.6% =

31.3%

11.8%

46.0%=

15.7%

15.6%

7.8%

15.0%

3.5%

34.5%

35.0%

14.9%

73.9% =

30.3%

28.1%

35.0⁰ a

44.0%

40.6%

5.8%

60.2%

12.4%

6.7%

27.8%

28.1%

Confidential

$10.46

$10.23

$15.77

$10.23

1 Month

Value Range ($MM)

Low

High

24.2%

72.7%

35.7%

39.2%

25.8%

3.3%

32.8%

21.5%

12.29

39.2%

$11.34

$11.04

$16.98

$16.98

17.5%

8.9%

31.0%

56.7%

15.5%

117.7%

31.09

38.5%

43.7%

20.49

47.2%

+6.0%

61.3%

15.5%

36.6%

31.0%

MCMORanView entire presentation