TradeStation SPAC Presentation Deck

Transaction Summary

Transaction

Structure

Valuation

Uses

▪ TradeStation Newco Sub to merge with Quantum (NYSE:QFTA); Quantum

to become a wholly-owned subsidiary of TradeStation, and TradeStation

to become a publicly-traded company

▪ Pre-money enterprise value ascribed to TradeStation of approximately

$1.34bn (1)

(4)

(5)

11 (6)

Marketing & Headcount: $80-100mm(²)

▪ Liquidity & Working Capital: $160-200mm

■

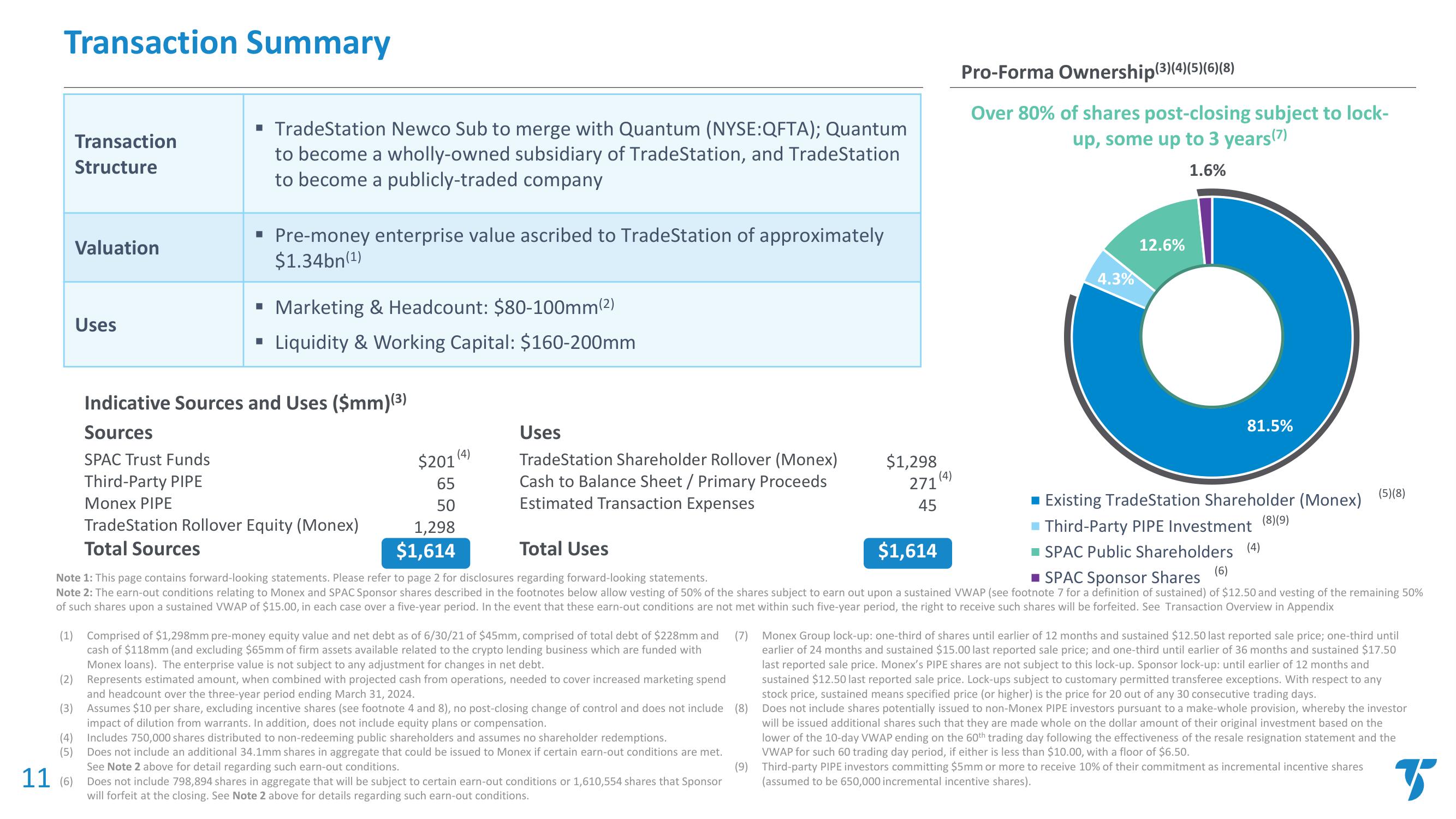

Indicative Sources and Uses ($mm)(³)

Sources

SPAC Trust Funds

Third-Party PIPE

Monex PIPE

TradeStation Rollover Equity (Monex)

$201 (4)

65

50

1,298

$1,614

Uses

TradeStation Shareholder Rollover (Monex)

Cash to Balance Sheet / Primary Proceeds

Estimated Transaction Expenses

Comprised of $1,298mm pre-money equity value and net debt as of 6/30/21 of $45mm, comprised of total debt of $228mm and

cash of $118mm (and excluding $65mm of firm assets available related to the crypto lending business which are funded with

Monex loans). The enterprise value is not subject to any adjustment for changes in net debt.

(2)

Represents estimated amount, when combined with projected cash from operations, needed to cover increased marketing spend

and headcount over the three-year period ending March 31, 2024.

(3) Assumes $10 per share, excluding incentive shares (see footnote 4 and 8), no post-closing change of control and does not include (8)

impact of dilution from warrants. In addition, does not include equity plans or compensation.

Includes 750,000 shares distributed to non-redeeming public shareholders and assumes no shareholder redemptions.

Does not include an additional 34.1mm shares in aggregate that could be issued to Monex if certain earn-out conditions are met.

See Note 2 above for detail regarding such earn-out conditions.

(9)

$1,298

Does not include 798,894 shares in aggregate that will be subject to certain earn-out conditions or 1,610,554 shares that Sponsor

will forfeit at the closing. See Note 2 above for details regarding such earn-out conditions.

271 (4)

45

Pro-Forma Ownership(3)(4) (5) (6) (8)

Over 80% of shares post-closing subject to lock-

up, some up to 3 years (7)

1.6%

4.3%

12.6%

81.5%

Total Sources

Total Uses

$1,614

■ SPAC Public Shareholders (4)

■ SPAC Sponsor Shares

(6)

Note 1: This page contains forward-looking statements. Please refer to page 2 for disclosures regarding forward-looking statements.

Note 2: The earn-out conditions relating to Monex and SPAC Sponsor shares described in the footnotes below allow vesting of 50% of the shares subject to earn out upon a sustained VWAP (see footnote 7 for a definition of sustained) of $12.50 and vesting of the remaining 50%

of such shares upon a sustained VWAP of $15.00, in each case over a five-year period. In the event that these earn-out conditions are not met within such five-year period, the right to receive such shares will be forfeited. See Transaction Overview in Appendix

(7)

(1)

Existing TradeStation Shareholder (Monex)

Third-Party PIPE Investment (8)(9)

(5)(8)

Monex Group lock-up: one-third of shares until earlier of 12 months and sustained $12.50 last reported sale price; one-third until

earlier of 24 months and sustained $15.00 last reported sale price; and one-third until earlier of 36 months and sustained $17.50

last reported sale price. Monex's PIPE shares are not subject to this lock-up. Sponsor lock-up: until earlier of 12 months and

sustained $12.50 last reported sale price. Lock-ups subject to customary permitted transferee exceptions. With respect to any

stock price, sustained means specified price (or higher) is the price for 20 out of any 30 consecutive trading days.

Does not include shares potentially issued to non-Monex PIPE investors pursuant to a make-whole provision, whereby the investor

will be issued additional shares such that they are made whole on the dollar amount of their original investment based on the

lower of the 10-day VWAP ending on the 60th trading day following the effectiveness of the resale resignation statement and the

VWAP for such 60 trading day period, if either is less than $10.00, with a floor of $6.50.

Third-party PIPE investors committing $5mm or more to receive 10% of their commitment as incremental incentive shares

(assumed to be 650,000 incremental incentive shares).

BView entire presentation