Ready Capital Investor Presentation Deck

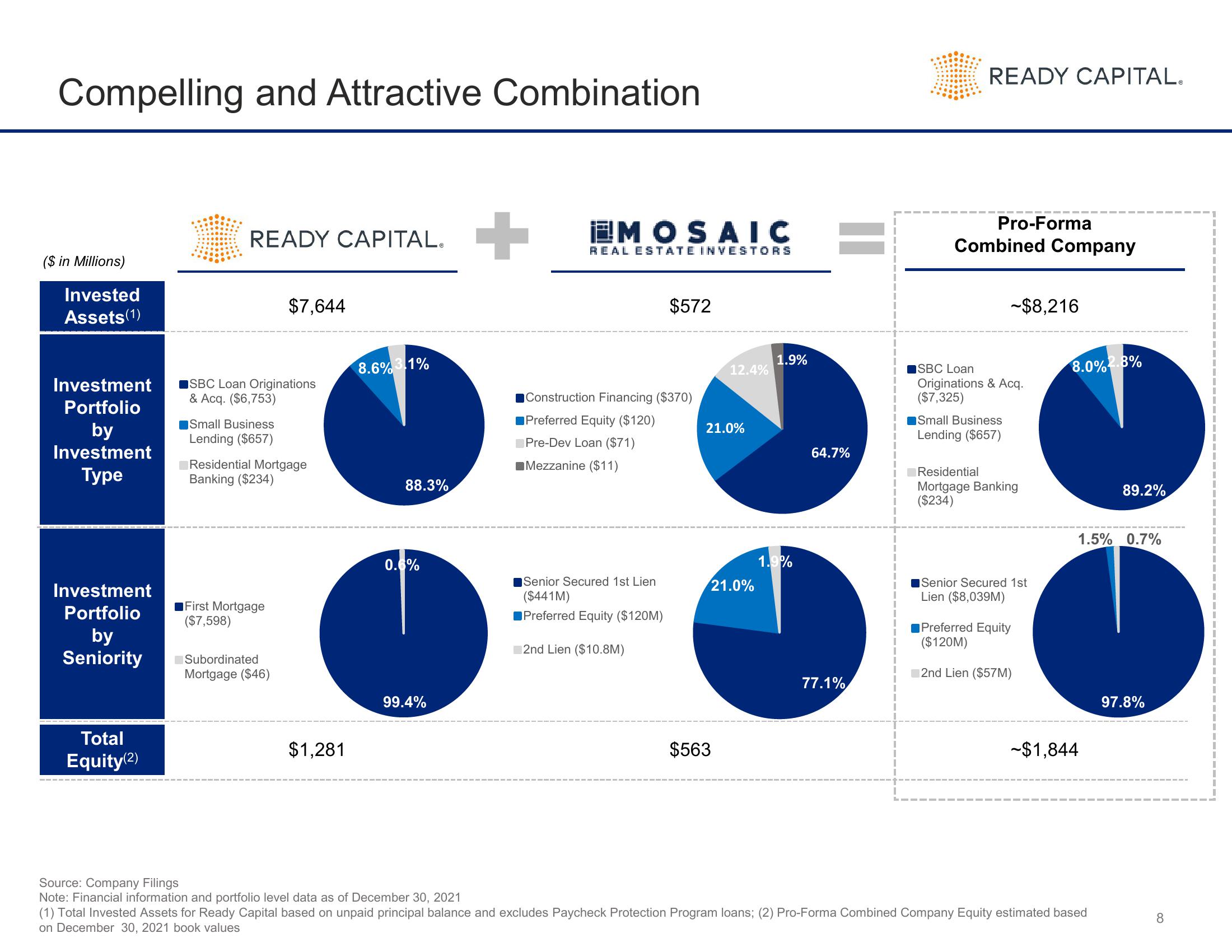

Compelling and Attractive Combination

($ in Millions)

Invested

Assets (1)

Investment

Portfolio

by

Investment

Туре

Investment

Portfolio

by

Seniority

Total

Equity (2)

READY CAPITAL.

SBC Loan Originations

& Acq. ($6,753)

Small Business

Lending ($657)

$7,644

Residential Mortgage

Banking ($234)

First Mortgage

($7,598)

Subordinated

Mortgage ($46)

$1,281

8.6% 3.1%

88.3%

0.6%

99.4%

+

EMOSAIC

REAL ESTATE INVESTORS

$572

Construction Financing ($370)

Preferred Equity ($120)

Pre-Dev Loan ($71)

Mezzanine ($11)

Senior Secured 1st Lien

($441M)

Preferred Equity ($120M)

2nd Lien ($10.8M)

12.4%

21.0%

21.0%

$563

1.9%

1.9%

64.7%

77.1%

READY CAPITAL.

Pro-Forma

Combined Company

-$8,216

SBC Loan

Originations & Acq.

($7,325)

Small Business

Lending ($657)

Residential

Mortgage Banking

($234)

Senior Secured 1st

Lien ($8,039M)

Preferred Equity

($120M)

2nd Lien ($57M)

8.0%2.8%

1.5% 0.7%

~$1,844

89.2%

Source: Company Filings

Note: Financial information and portfolio level data as of December 30, 2021

(1) Total Invested Assets for Ready Capital based on unpaid principal balance and excludes Paycheck Protection Program loans; (2) Pro-Forma Combined Company Equity estimated based

on December 30, 2021 book values

97.8%

8

1

1View entire presentation