PJT Partners Investment Banking Pitch Book

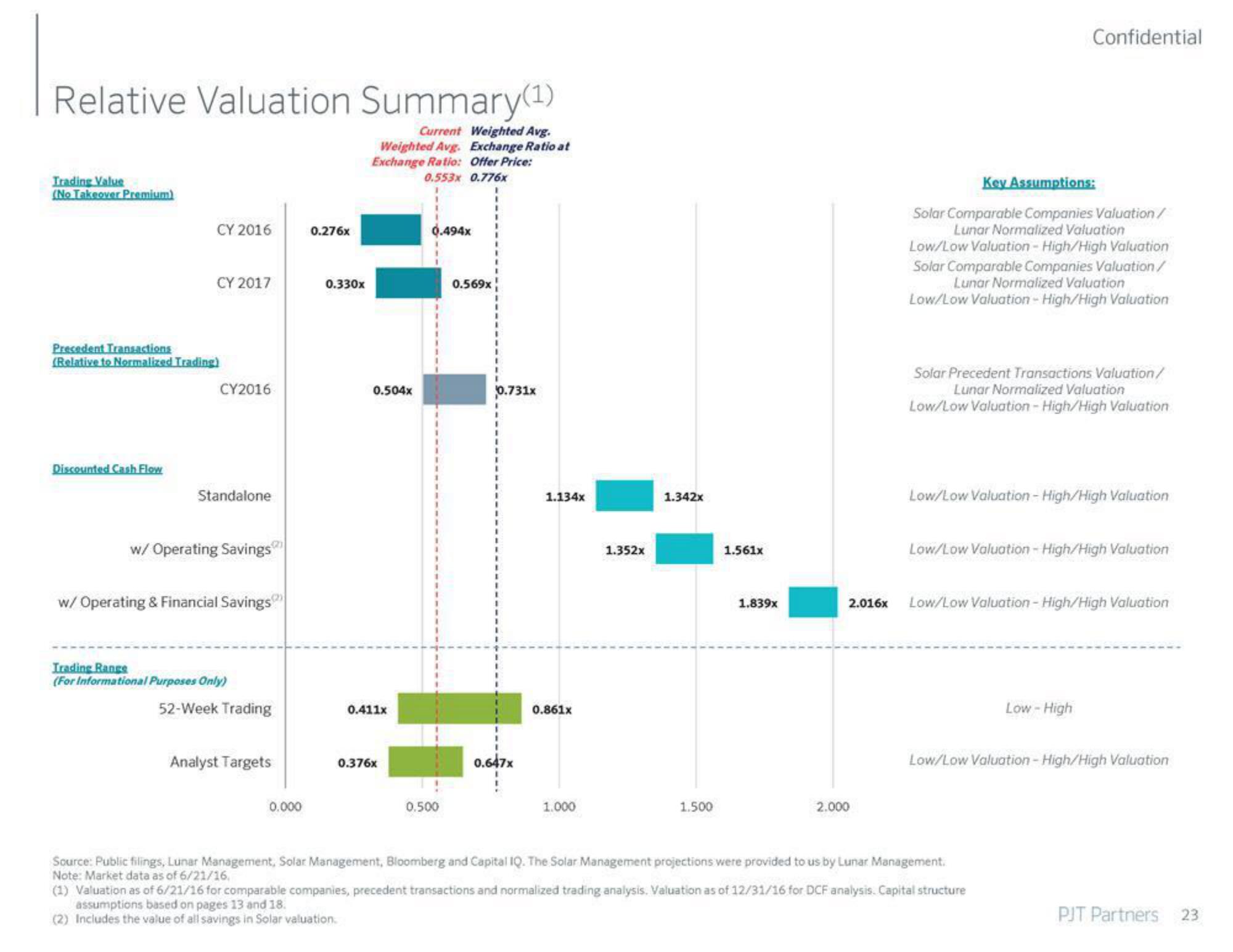

Relative Valuation Summary(¹)

Current Weighted Avg.

Weighted Avg. Exchange Ratio at

Exchange Ratio: Offer Price:

0.553x 0.776x

Trading Value

(No Takeover Premium)

CY 2016

Discounted Cash Flow

CY 2017

Precedent Transactions

(Relative to Normalized Trading)

CY2016

Standalone

w/ Operating Savings

w/ Operating & Financial Savings

Trading Range

(For Informational Purposes Only)

52-Week Trading

Analyst Targets

0.000

0.276x

0.330x

0.504x

0.411x

0.376x

0.494x

0.500

0.569x

0.731x

0.647x

1.134x

0.861x

1.000

1.352x

1.342x

1.500

1.561x

1.839x

2.000

Key Assumptions:

Solar Comparable Companies Valuation/

Lunar Normalized Valuation

Low/Low Valuation - High/High Valuation

Solar Comparable Companies Valuation/

Lunar Normalized Valuation

Low/Low Valuation - High/High Valuation

Confidential

Solar Precedent Transactions Valuation/

Lunar Normalized Valuation

Low/Low Valuation - High/High Valuation

Low/Low Valuation - High/High Valuation

Low/Low Valuation - High/High Valuation

2.016x Low/Low Valuation - High/High Valuation

Low-High

Source: Public filings, Lunar Management, Solar Management, Bloomberg and Capital IQ. The Solar Management projections were provided to us by Lunar Management.

Note: Market data as of 6/21/16.

(1) Valuation as of 6/21/16 for comparable companies, precedent transactions and normalized trading analysis. Valuation as of 12/31/16 for DCF analysis. Capital structure

assumptions based on pages 13 and 18.

(2) Includes the value of all savings in Solar valuation.

Low/Low Valuation - High/High Valuation

PJT Partners 23View entire presentation