SmileDirectClub Results Presentation Deck

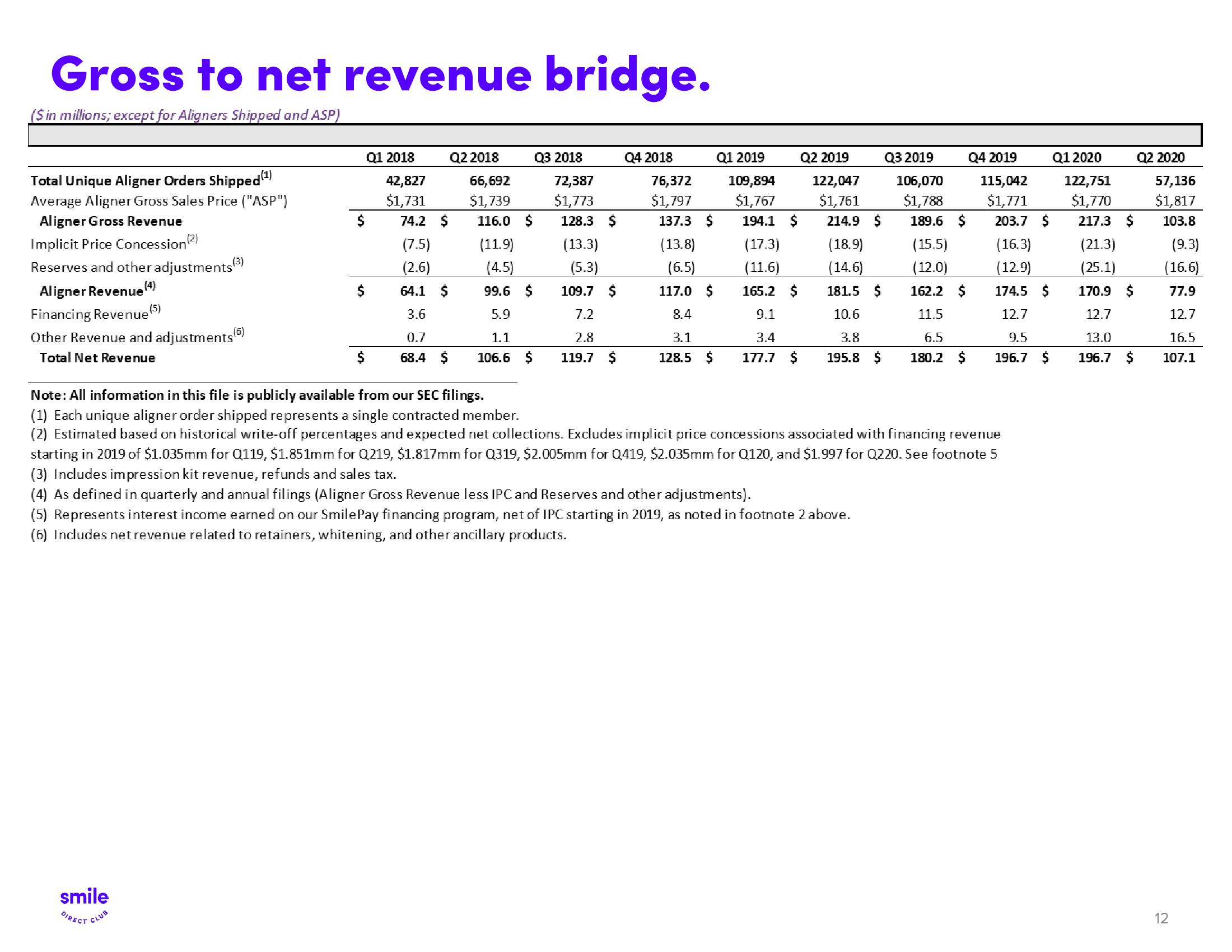

Gross to net revenue bridge.

($ in millions; except for Aligners Shipped and ASP)

Total Unique Aligner Orders Shipped (¹)

Average Aligner Gross Sales Price ("ASP")

Aligner Gross Revenue

Implicit Price Concession (²)

Reserves and other adjustments (3)

(4)

Aligner Revenue

Financing Revenue

Other Revenue and adjustments (6)

Total Net Revenue

(5)

smile

DIRECT CLUB

$

Q1 2018

42,827

$1,731

74.2 $

Q2 2018

(7.5)

(2.6)

64.1 $

3.6

0.7

68.4 $

66,692

$1,739

116.0 $

(11.9)

(4.5)

99.6 $

5.9

1.1

106.6 $

Q3 2018

72,387

$1,773

128.3 $

(13.3)

(5.3)

109.7 $

7.2

2.8

119.7 $

Q1 2019

109,894

$1,767

194.1 $

(18.9)

(14.6)

181.5 $

8.4

10.6

3.1

3.8

128.5 $ 177.7 $ 195.8 $ 180.2 $

(17.3)

(11.6)

165.2 $

9.1

3.4

6.5

Q4 2018

76,372

$1,797

137.3 $

(13.8)

(6.5)

117.0 $

Q2 2019

122,047

$1,761

214.9 $

Q3 2019

106,070

$1,788

189.6 $

(15.5)

(12.0)

162.2 $

11.5

Q4 2019

115,042

$1,771

203.7 $

(16.3)

(12.9)

174.5 $

12.7

9.5

196.7 $

Note: All information in this file is publicly available from our SEC filings.

(1) Each unique aligner order shipped represents a single contracted member.

(2) Estimated based on historical write-off percentages and expected net collections. Excludes implicit price concessions associated with financing revenue

starting in 2019 of $1.035mm for Q119, $1.851mm for Q219, $1.817mm for Q319, $2.005mm for Q419, $2.035mm for Q120, and $1.997 for Q220. See footnote 5

(3) Includes impression kit revenue, refunds and sales tax.

(4) As defined in quarterly and annual filings (Aligner Gross Revenue less IPC and Reserves and other adjustments).

(5) Represents interest income earned on our Smile Pay financing program, net of IPC starting in 2019, as noted in footnote 2 above.

(6) Includes net revenue related to retainers, whitening, and other ancillary products.

Q1 2020

122,751

$1,770

217.3 $

(21.3)

(25.1)

170.9 $

12.7

13.0

196.7 $

Q2 2020

57,136

$1,817

103.8

(9.3)

(16.6)

77.9

12.7

16.5

107.1

12View entire presentation