Melrose Results Presentation Deck

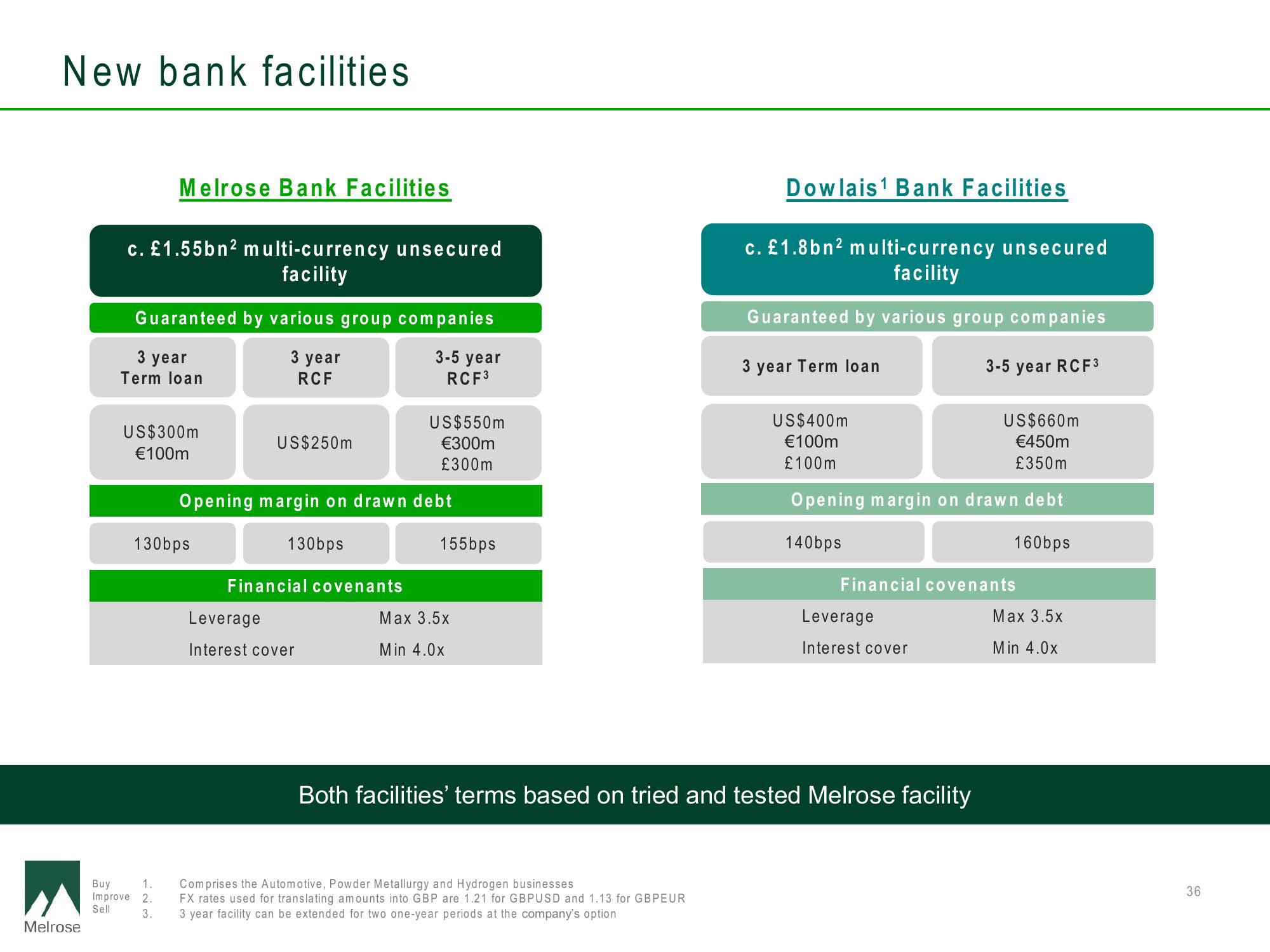

New bank facilities

Melrose

Melrose Bank Facilities

c. £1.55bn² multi-currency unsecured

facility

Guaranteed by various group companies

3-5 year

RCF³

3 year

Term loan

US$300m

€100m

Buy

1.

Improve 2.

Sell

3.

130bps

3 year

RCF

US$250m

Opening margin on drawn debt

130bps

Financial covenants

US$550m

€300m

£300m

Leverage

Interest cover

155bps

Max 3.5x

Min 4.0x

Dowlais¹ Bank Facilities

Comprises the Automotive, Powder Metallurgy and Hydrogen businesses

FX rates used for translating amounts into GBP are 1.21 for GBPUSD and 1.13 for GBPEUR

3 year facility can be extended for two one-year periods at the company's option

c. £1.8bn² multi-currency unsecured

facility

Guaranteed by various group companies

3 year Term loan

US$400m

€100m

£100m

US$660m

€450m

£350m

Opening margin on drawn debt

140bps

160bps

3-5 year RCF3

Financial covenants

Leverage

Interest cover

Both facilities' terms based on tried and tested Melrose facility

Max 3.5x

Min 4.0x

36View entire presentation