SpringOwl Activist Presentation Deck

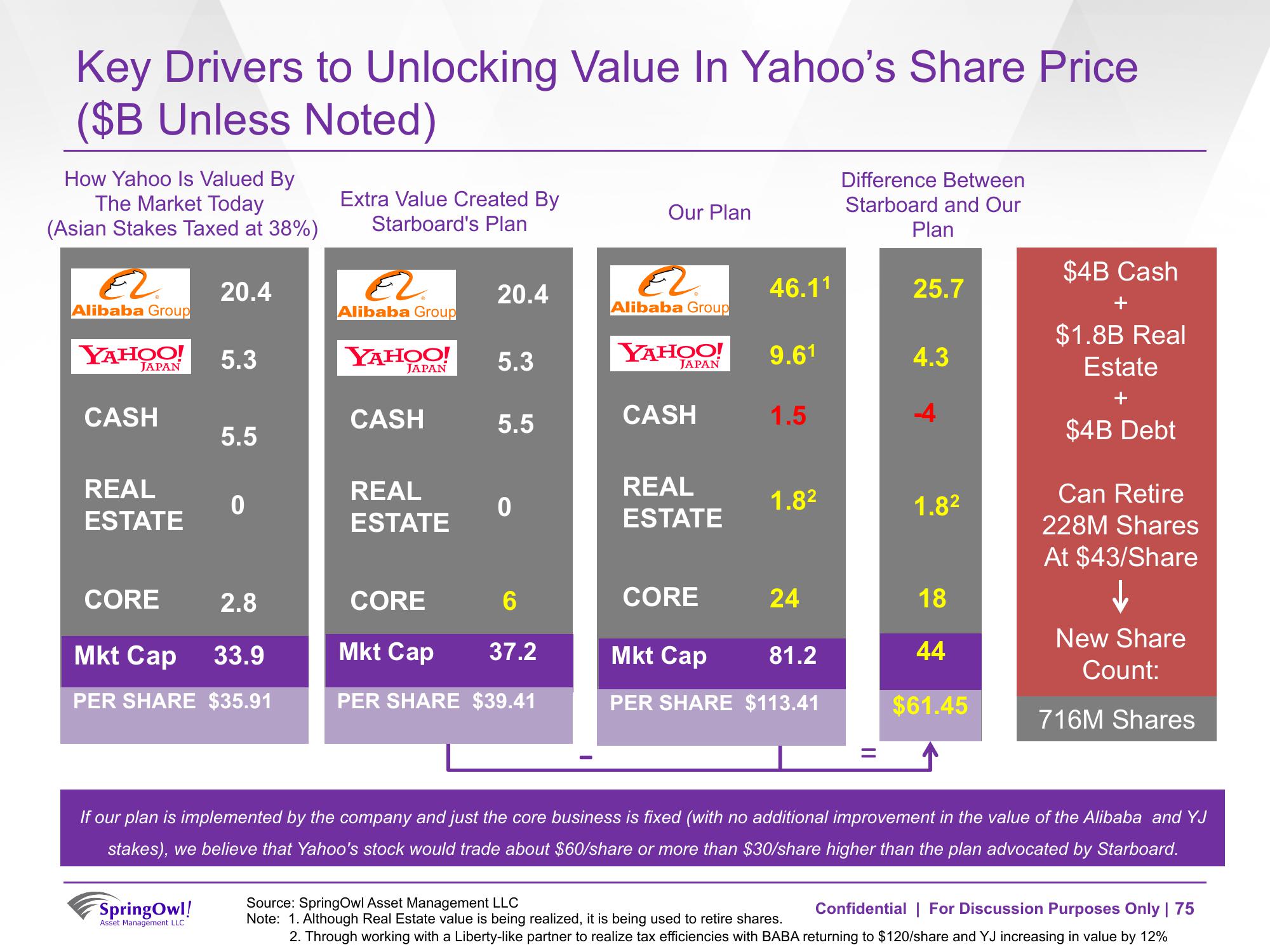

Key Drivers to Unlocking Value In Yahoo's Share Price

($B Unless Noted)

How Yahoo Is Valued By

The Market Today

(Asian Stakes Taxed at 38%)

EL.

Alibaba Group

YAHOO!

JAPAN

CASH

REAL

ESTATE

CORE

20.4

5.3

SpringOwl!

Asset Management LLC

5.5

0

2.8

Mkt Cap

33.9

PER SHARE $35.91

Extra Value Created By

Starboard's Plan

EL.

Alibaba Group

YAHOO!

JAPAN

CASH

REAL

ESTATE

20.4

5.3

5.5

0

CORE

6

Mkt Cap

37.2

PER SHARE $39.41

Our Plan

E2.

Alibaba Group

YAHOO!

JAPAN

CASH

REAL

ESTATE

CORE

46.1¹

9.61

1.5

1.8²

24

Mkt Cap

81.2

PER SHARE $113.41

Difference Between

Starboard and Our

Plan

=

25.7

4.3

1.8²

18

44

$61.45

$4B Cash

$1.8B Real

Estate

$4B Debt

Can Retire

228M Shares

At $43/Share

New Share

Count:

716M Shares

If our plan is implemented by the company and just the core busin ess is fixed (with no additional improvement in the value of the Alibaba and

stakes), we believe that Yahoo's stock would trade about $60/share or more than $30/share higher than the plan advocated by Starboard.

Source: Spring Owl Asset Management LLC

Confidential | For Discussion Purposes Only | 75

Note: 1. Although Real Estate value is being realized, it is being used to retire shares.

2. Through working with a Liberty-like partner to realize tax efficiencies with BABA returning to $120/share and YJ increasing in value by 12%View entire presentation