SmileDirectClub Investor Presentation Deck

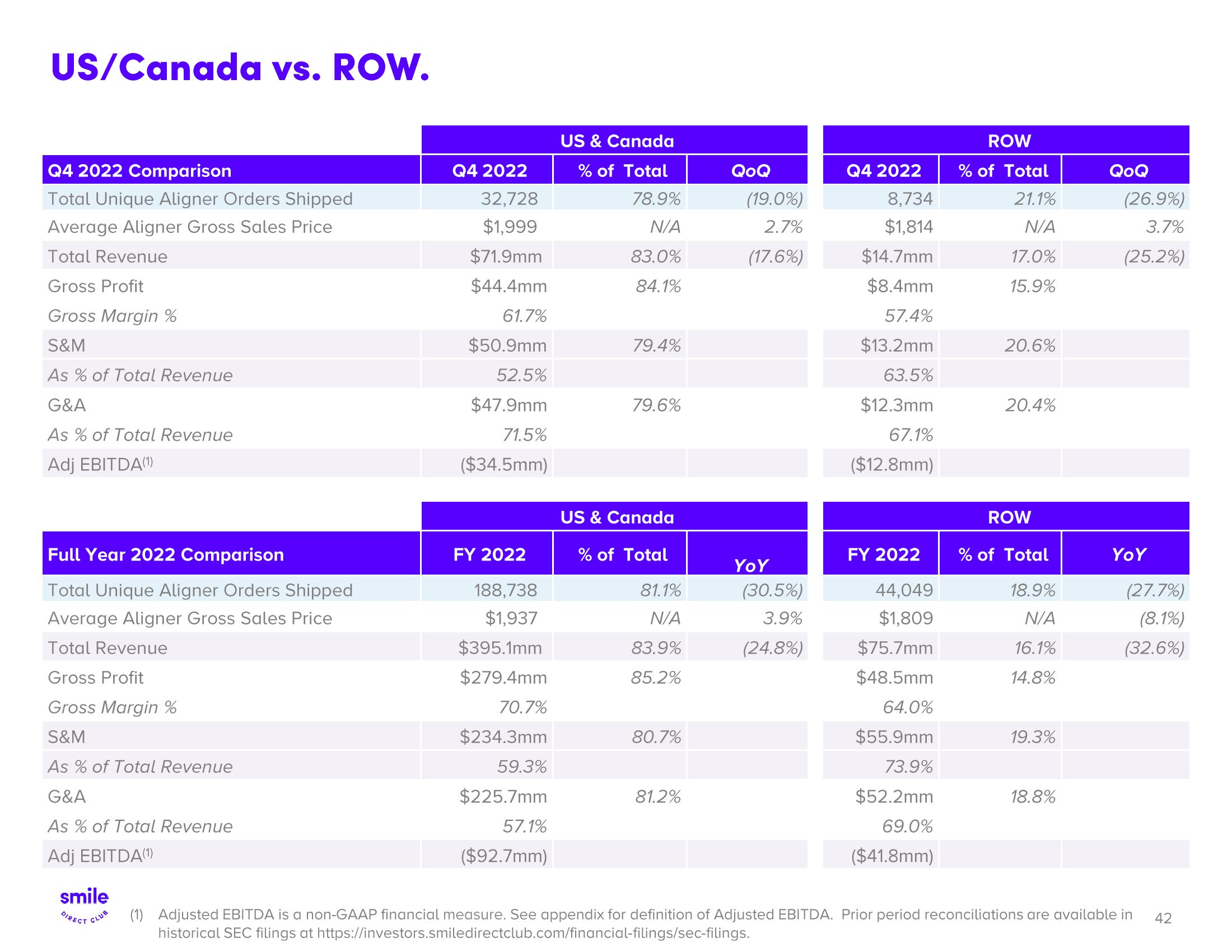

US/Canada vs. ROW.

Q4 2022 Comparison

Total Unique Aligner Orders Shipped

Average Aligner Gross Sales Price

Total Revenue

Gross Profit

Gross Margin %

S&M

As % of Total Revenue

G&A

As % of Total Revenue

Adj EBITDA(1)

Full Year 2022 Comparison

Total Unique Aligner Orders Shipped

Average Aligner Gross Sales Price

Total Revenue

Gross Profit

Gross Margin %

S&M

As % of Total Revenue

G&A

As % of Total Revenue

Adj EBITDA(1)

smile

DIRECT CLUB

Q4 2022

32,728

$1,999

$71.9mm

$44.4mm

61.7%

$50.9mm

52.5%

$47.9mm

71.5%

($34.5mm)

FY 2022

188,738

$1,937

$395.1mm

$279.4mm

70.7%

$234.3mm

59.3%

$225.7mm

57.1%

($92.7mm)

US & Canada

% of Total

78.9%

N/A

83.0%

84.1%

79.4%

79.6%

US & Canada

% of Total

81.1%

N/A

83.9%

85.2%

80.7%

81.2%

QoQ

(19.0%)

2.7%

(17.6%)

YOY

(30.5%)

3.9%

(24.8%)

Q4 2022

8,734

$1,814

$14.7mm

$8.4mm

57.4%

$13.2mm

63.5%

$12.3mm

67.1%

($12.8mm)

FY 2022

44,049

$1,809

$75.7mm

$48.5mm

64.0%

$55.9mm

73.9%

$52.2mm

69.0%

($41.8mm)

ROW

% of Total

21.1%

N/A

17.0%

15.9%

20.6%

20.4%

ROW

% of Total

18.9%

N/A

16.1%

14.8%

19.3%

18.8%

QoQ

(26.9%)

3.7%

(25.2%)

YOY

(27.7%)

(8.1%)

(32.6%)

(1) Adjusted EBITDA is a non-GAAP financial measure. See appendix for definition of Adjusted EBITDA. Prior period reconciliations are available in

historical SEC filings at https://investors.smiledirectclub.com/financial-filings/sec-filings.

42View entire presentation