Sweetheart Brands Acquisition

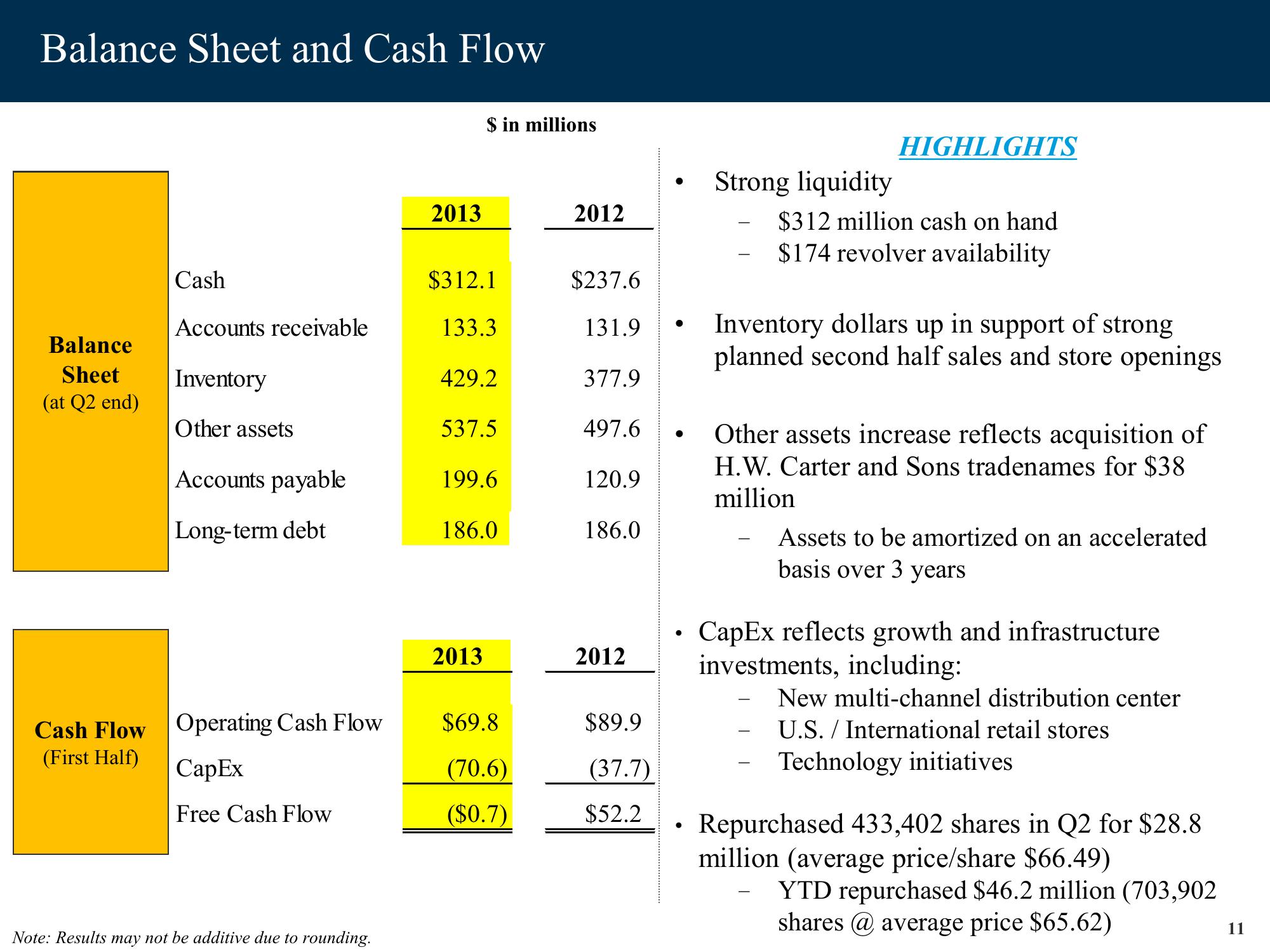

Balance Sheet and Cash Flow

Balance

Sheet

(at Q2 end)

Cash Flow

(First Half)

Cash

Accounts receivable

Inventory

Other assets

Accounts payable

Long-term debt

Operating Cash Flow

CapEx

Free Cash Flow

Note: Results may not be additive due to rounding.

2013

$ in millions

$312.1

133.3

429.2

537.5

199.6

186.0

2013

$69.8

(70.6)

($0.7)

2012

$237.6

131.9

377.9

497.6

120.9

186.0

2012

$89.9

(37.7)

$52.2

●

Strong liquidity

HIGHLIGHTS

$312 million cash on hand

$174 revolver availability

Inventory dollars up in support of strong

planned second half sales and store openings

-

Other assets increase reflects acquisition of

H.W. Carter and Sons tradenames for $38

million

Assets to be amortized on an accelerated

basis over 3 years

CapEx reflects growth and infrastructure

investments, including:

New multi-channel distribution center

U.S. / International retail stores

Technology initiatives

Repurchased 433,402 shares in Q2 for $28.8

million (average price/share $66.49)

YTD repurchased $46.2 million (703,902

shares @ average price $65.62)

11View entire presentation