BlackRock Global Long/Short Credit Absolute Return Credit

Derivative Usage, Instruments and Risks

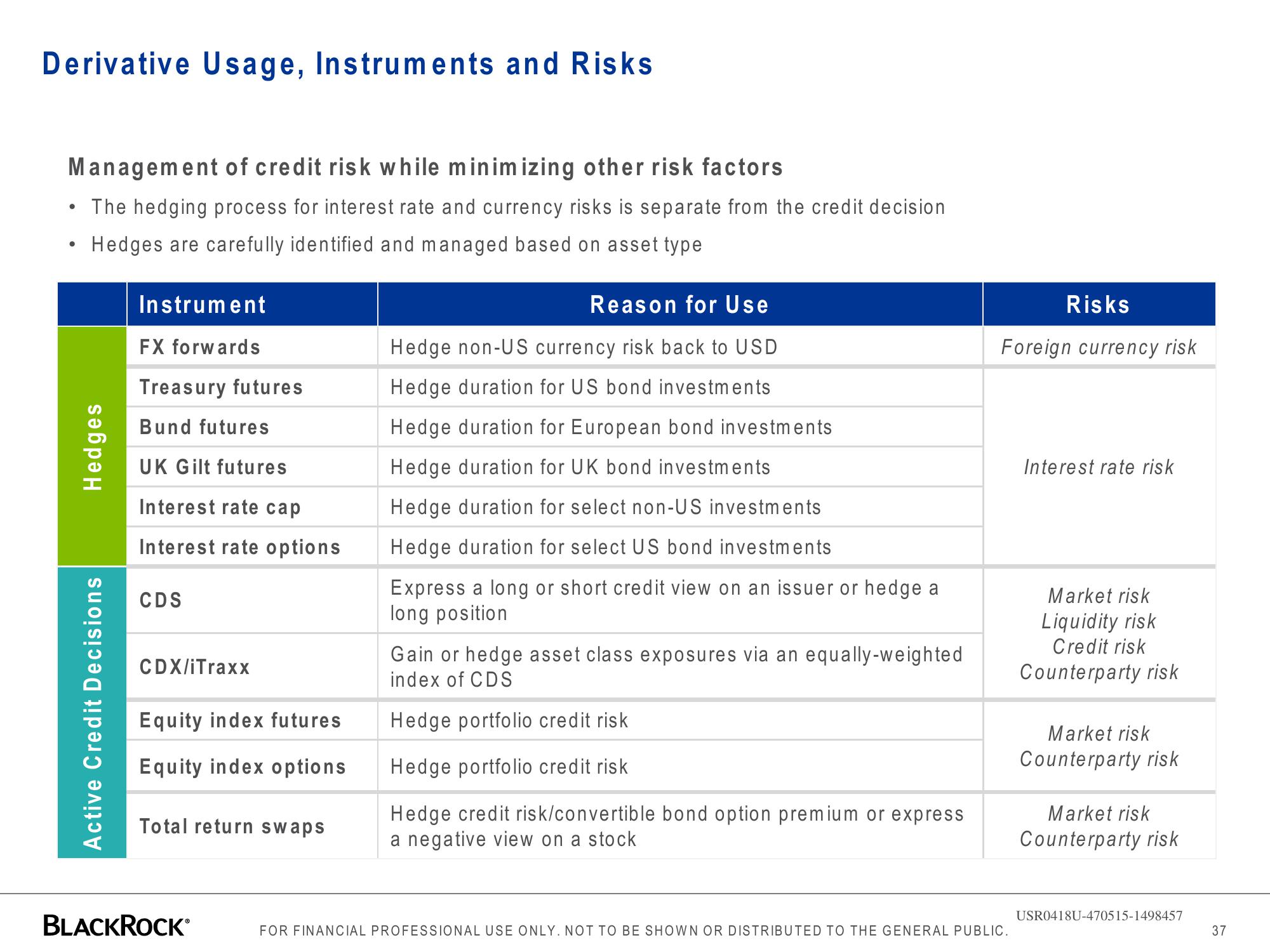

Management of credit risk while minimizing other risk factors

The hedging process for interest rate and currency risks is separate from the credit decision

• Hedges are carefully identified and managed based on asset type

Hedges

Active Credit Decisions

Instrument

FX forwards

Treasury futures

Bund futures

UK Gilt futures

Interest rate cap

Interest rate options

CDS

CDX/iTraxx

Equity index futures

Equity index options

Total return swaps

BLACKROCK*

Reason for Use

Hedge non-US currency risk back to USD

Hedge duration for US bond investments

Hedge duration for European bond investments

Hedge duration for UK bond investments

Hedge duration for select non-US investments

Hedge duration for select US bond investments

Express a long or short credit view on an issuer or hedge a

long position

Gain or hedge asset class exposures via an equally-weighted

index of CDS

Hedge portfolio credit risk

Hedge portfolio credit risk

Hedge credit risk/convertible bond option premium or express

a negative view on a stock

Risks

Foreign currency risk

FOR FINANCIAL PROFESSIONAL USE ONLY. NOT TO BE SHOWN OR DISTRIBUTED TO THE GENERAL PUBLIC.

Interest rate risk

Market risk

Liquidity risk

Credit risk

Counterparty risk

Market risk

Counterparty risk

Market risk

Counterparty risk

USR0418U-470515-1498457

37View entire presentation