Lyft Results Presentation Deck

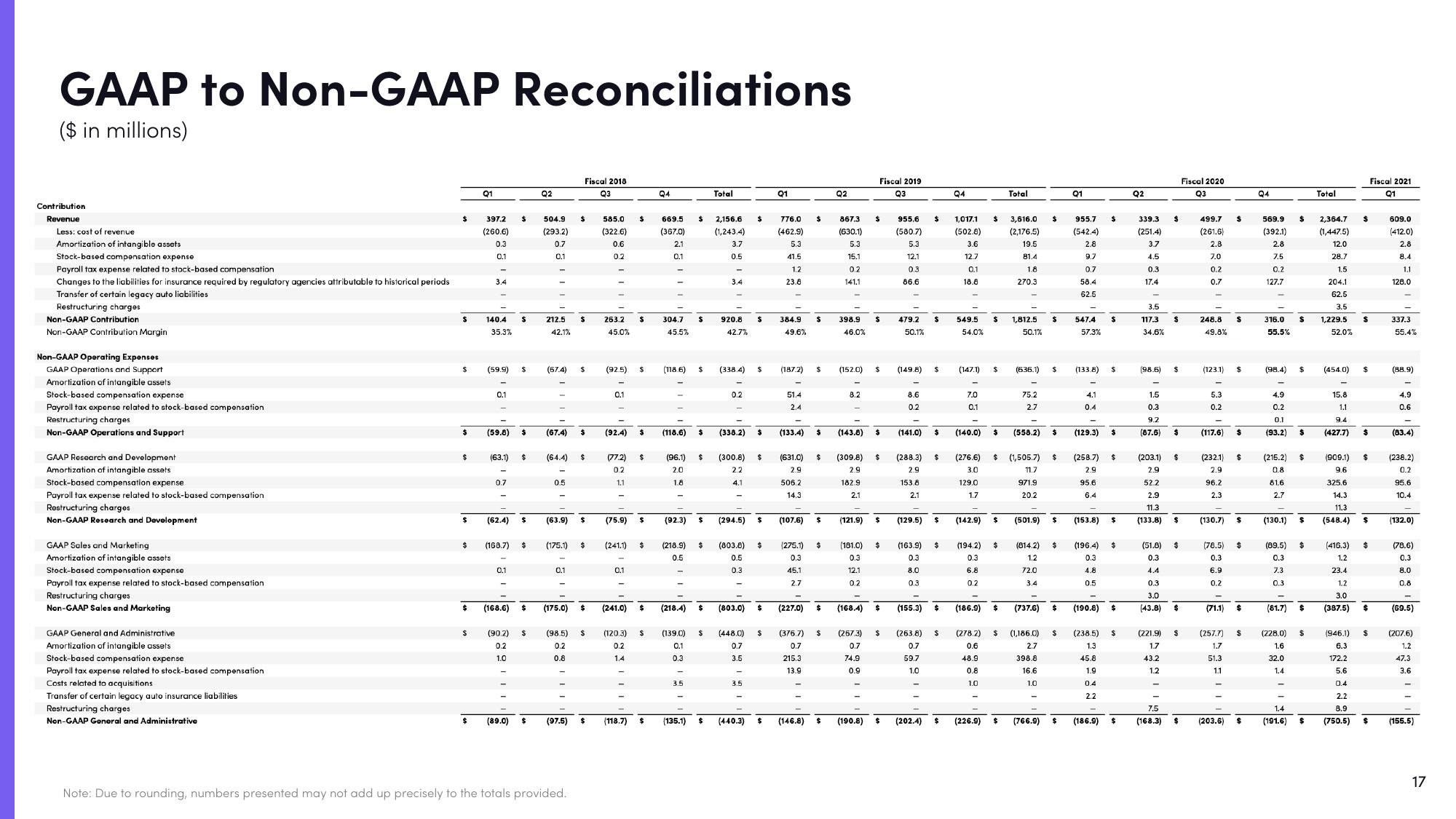

GAAP to Non-GAAP Reconciliations

($ in millions)

Contribution

Revenue

Less: cost of revenue

Amortization of intangible assets

Stock-based compensation expense

Payroll tax expense related to stock-based compensation

Changes to the liabilities for insurance required by regulatory agencies attributable to historical periods

Transfer of certain legacy auto liabilities.

Restructuring charges

Non-GAAP Contribution

Non-GAAP Contribution Margin

Non-GAAP Operating Expenses

GAAP Operations and Support

Amortization of intangible assets

Stock-based compensation expense

Payroll tax expense related to stock-based compensation

Restructuring charges

Non-GAAP Operations and Support

GAAP Research and Development

Amortization of intangible assets

Stock-based compensation expense

Payroll tax expense related to stock-based compensation

Restructuring charges

Non-GAAP Research and Development

GAAP Sales and Marketing.

Amortization of intangible assets

Stock-based compensation expense

Payroll tax expense related to stock-based compensation

Restructuring charges

Non-GAAP Sales and Marketing

GAAP General and Administrative

Amortization of intangible assets

Stock-based compensation expense

Payroll tax expense related to stock-based compensation

Costs related to acquisitions

Transfer of certain legacy auto insurance liabilities

Restructuring charges

Non-GAAP General and Administrative

$

$

$

$

$

$

$

$

$

Q1

397.2

(260.6)

0.3

0.1

3.4

140.4

35.3%

(59.9)

0.1

0.7

(59.8) $

(62.4)

(63.1) $

(168.7)

$

0.1

$

$

(89.0)

$

(168.6) $

(90.2) $

0.2

1.0

$

Q2

504.9

(293.2)

0.7

0.1

212.5

42.1%

(67.4)

(67.4)

(64.4)

0.5

(63.9)

(175.1)

0.1

(97.5)

Fiscal 2018

Q3

Note: Due to rounding, numbers presented may not add up precisely to the totals provided.

$

$

$

$

$

$

(175.0) $

(98.5) $

0.2

0.8

$

$

585.0

(322.6)

0.6

0.2

263.2

45.0%

(92.5)

0.1

(92.4)

(77.2)

0.2

1.1

(75.9)

(241.1)

0.1

(241.0)

(120.3)

0.2

14

(118.7)

$

$ 304.7

45.5%

$

$

$

$

Q4

$

669.5 $ 2,156.6 $

(367.0)

(1,243.4)

3.7

2.1

0.1

0.5

(118.6) $

(96.1)

2.0

1.8

(92.3) $

$ 920.8

42.7%

(218.9) $

0.5

(118.6) $ (338.2)

(218.4) $

Total

(139.0) $

0.1

0.3

3.5

(135.1)

=

3.4

(338.4)

0.2

(300.8)

2.2

4.1

(803.0)

(294.5) $

(448.0)

0.7

3.5

$

(803.8) $

0.5

0.3

3.5

$

$ (440.3)

$

$

$

$

Q1

776.0 $

(462.9)

5.3

41.5

1.2

23.8

384.9

49.6%

(1872)

51.4

2.4

(133.4)

(631.0)

2.9

506.2

14.3

$

$

(107.6) $

(275.1) $

0.3

45.1

2.7

(227.0) $

(376.7) $

0.7

215.3

13.9

02

(146.8) $

867.3

(630.1)

5.3

15.1

0.2

141.1

398.9

46.0%

(152.0)

8.2

$ (143.8) $

Fiscal 2019

Q3

$

(181.0)

0.3

12.1

0.2

$

$

(309.8) $

2.9

182.9

2.1

(190.8)

(121.9) $

$

955.6

(580.7)

5.3

12.1

0.3

86.6

479.2

50.1%

(149.8)

8.6

0.2

(141.0)

(288.3)

2.9

153.8

2.1

(163.9)

0.3

8.0

0.3

(129.5) $

(168.4) $

(267.3) $ (263.8)

0.7

0.7

74.9

59.7

0.9

1.0

(155.3)

$

$ (202.4)

$

$

$

Q4

1,017.1 $ 3,616.0 $

(502.8)

3.6

(2,176.5)

19.5

12.7

81.4

0.1

1.8

270.3

18.8

549.5

54.0%

(147.1)

7.0

0.1

(140.0)

(142.9)

(194.2)

0.3

6.8

0.2

(276.6) $

3.0

129.0

1.7

$ 1,812.5

50.1%

$

(226.9)

Total

(636.1)

75.2

2.7

$

$ (558.2) $

(1,505.7)

11.7

971.9

20.2

$ (501.9)

(814.2)

1.2

72.0

34

$

$

(186.9) $

(278.2) $ (1,186.0) $

0.6

2.7

48.9

398.8

0.8

16.6

1.0

1.0

(766.9)

$

$

(737.6) $

$

01

955.7

(542.4)

2.8

9.7

0.7

58.4

62.5

547.4

57.3%

(133.8)

4.1

0.4

(129.3)

(153.8)

(196.4)

0.3

4.8

0.5

$

$

(258.7) $

2.9

95.6

6.4

(186.9)

$

$

S

(190.8)

(238.5) $

1.3

45.8

1.9

0.4

2.2

$

$

Q2

339.3

(251.4)

3.7

4.5

0.3

17.4

3.5

117.3

34.6%

(98.6)

1.5

0.3

9.2

(87.6)

(203.1)

2.9

52.2

2.9

11.3

(133.8)

$

S

43.2

1.2

$

$

$

$

(51.8)

0.3

4.4

0.3

3.0

(43.8) $

$

(221.9) $

1.7

7.5

(168.3) $

Fiscal 2020

Q3

499.7

(261.6)

2.8

7.0

0.2

0.7

248.8

49.8%

(123.1)

5.3

0.2

(130.7)

$

(117.6) $

$

(232.1) $

2.9

96.2

2.3

(71.1)

$

(203.6)

(78.5) $

0.3

6.9

0.2

$

$

(257.7) $

1.7

51.3

1.1

$

Q4

569.9

(392.1)

2.8

7.5

0.2

127.7

316.0

55.5%

(98.4)

(215.2)

0.8

81.6

2.7

(130.1)

$ 2,364.7

(1,447.5)

12.0

28.7

1.5

204.1

62.5

3.5

4.9

0.2

0.1

(93.2) $

$ (454.0)

$ 1,229.5 $

52.0%

$

Total

(89.5) $

0.3

7.3

0.3

(81.7)

(228.0) $

1.6

32.0

1.4

1.4

(191.6) $

15.8

1.1

9.4

(427.7)

$

$

(416.3)

1.2

23.4

1.2

3.0

$ (387.5) $

$

0.4

2.2

8.9

(750.5)

(909.1) $

9.6

325.6

14.3

11.3

(548.4) $

Fiscal 2021

Q1

$

(946.1) $

6.3

172.2

5.6

$

609.0

(412.0)

2.8

8.4

1.1

128.0

337.3

55.4%

(88.9)

4.9

0.6

(83.4)

(238.2)

0.2

95.6

10.4

(132.0)

(78.6)

0.3

8.0

0.8

(69.5)

(207.6)

1.2

47.3

3.6

(155.5)

17View entire presentation