Uber Results Presentation Deck

us

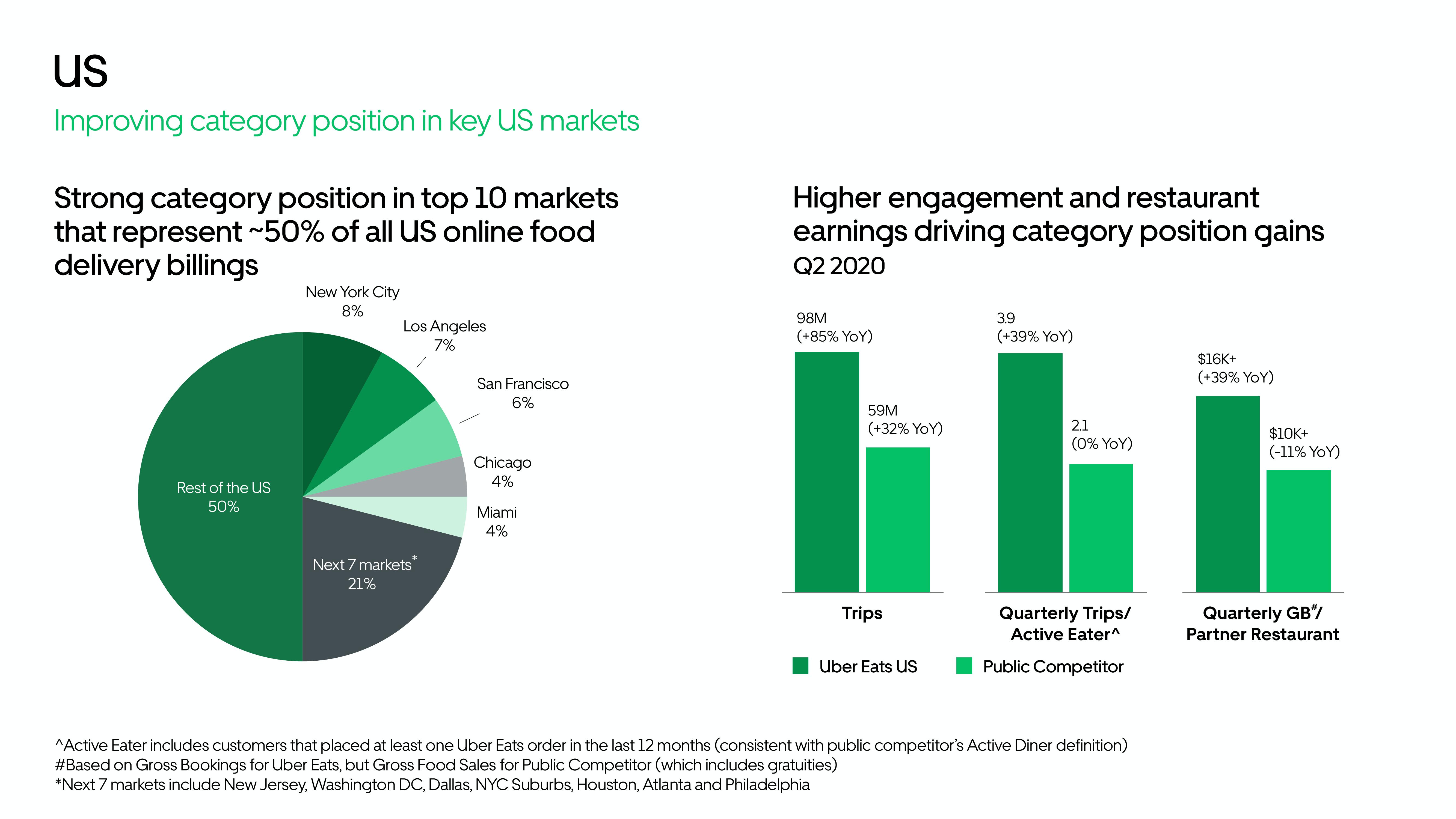

Improving category position in key US markets

Strong category position in top 10 markets

that represent ~50% of all US online food

delivery billings

Rest of the US

50%

New York City

8%

Los Angeles

7%

Next 7 markets

21%

San Francisco

6%

Chicago

4%

Miami

4%

Higher engagement and restaurant

earnings driving category position gains

Q2 2020

98M

(+85% YOY

59M

(+32% YoY)

Trips

Uber Eats Us

3.9

(+39% YoY)

2.1

(0% YoY)

Quarterly Trips/

Active Eater^

Public Competitor

^Active Eater includes customers that placed at least one Uber Eats order in the last 12 months (consistent with public competitor's Active Diner definition)

#Based on Gross Bookings for Uber Eats, but Gross Food Sales for Public Competitor (which includes gratuities)

*Next 7 markets include New Jersey, Washington DC, Dallas, NYC Suburbs, Houston, Atlanta and Philadelphia

$16K+

(+39% YoY)

$10K+

(-11% YoY)

Quarterly GB*/

Partner RestaurantView entire presentation