Baird Investment Banking Pitch Book

CASE STUDY: TALLGRASS SIMPLIFICATION

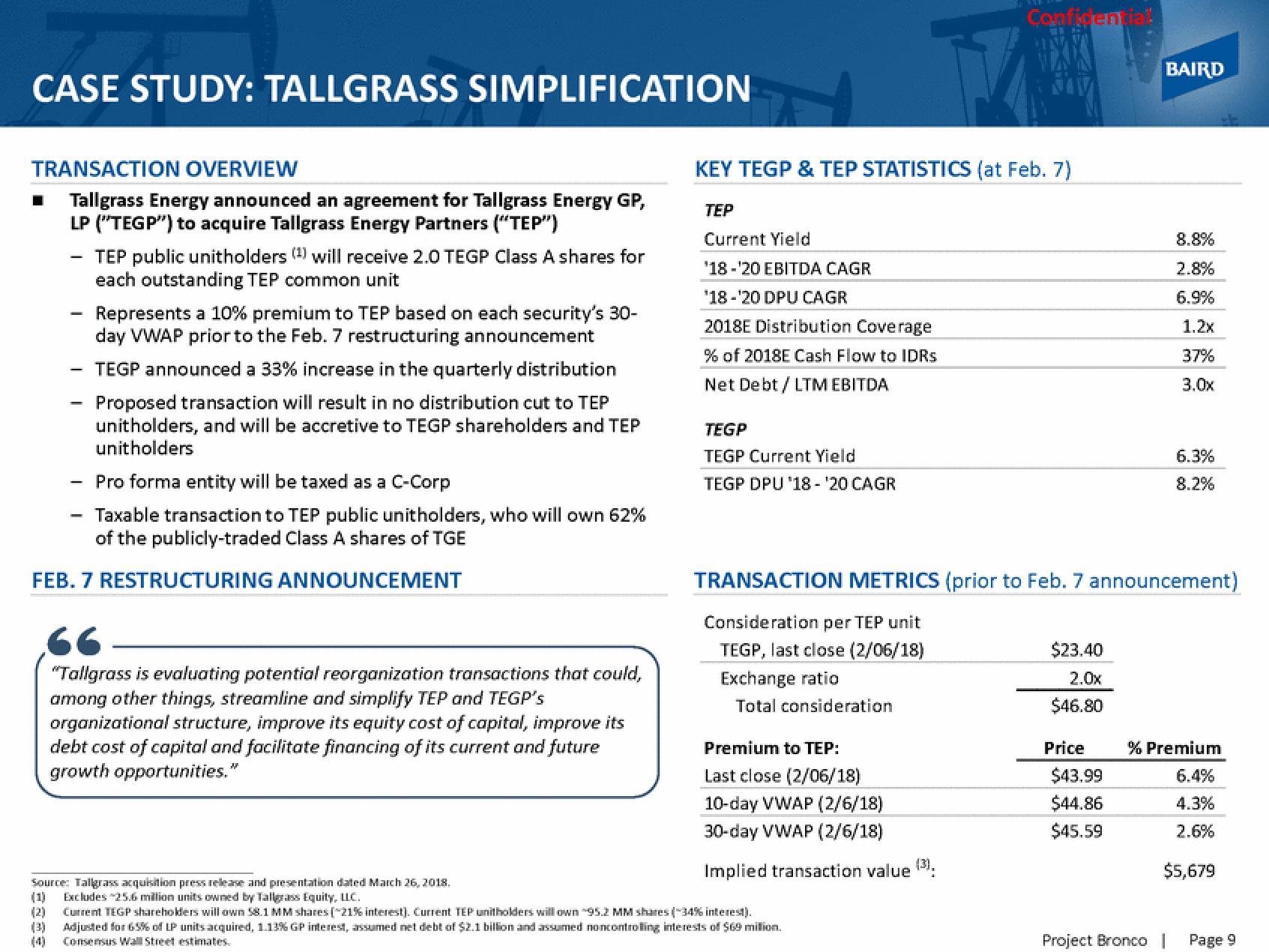

TRANSACTION OVERVIEW

■ Tallgrass Energy announced an agreement for Tallgrass Energy GP,

LP ("TEGP") to acquire Tallgrass Energy Partners ("TEP")

-

-

TEP public unitholders (¹) will receive 2.0 TEGP Class A shares for

each outstanding TEP common unit

Represents a 10% premium to TEP based on each security's 30-

day VWAP prior to the Feb. 7 restructuring announcement

TEGP announced a 33% increase in the quarterly distribution

Proposed transaction will result in no distribution cut to TEP

unitholders, and will be accretive to TEGP shareholders and TEP

unitholders

Pro forma entity will be taxed as a C-Corp

Taxable transaction to TEP public unitholders, who will own 62%

of the publicly-traded Class A shares of TGE

FEB. 7 RESTRUCTURING ANNOUNCEMENT

66

"Tallgrass is evaluating potential reorganization transactions that could,

among other things, streamline and simplify TEP and TEGP's

organizational structure, improve its equity cost of capital, improve its

debt cost of capital and facilitate financing of its current and future

growth opportunities."

KEY TEGP & TEP STATISTICS (at Feb. 7)

TEP

Current Yield

¹18-¹20 EBITDA CAGR

¹18-¹20 DPU CAGR

2018E Distribution Coverage

% of 2018E Cash Flow to IDRs

Net Debt / LTM EBITDA

TEGP

TEGP Current Yield

TEGP DPU '18 - ¹20 CAGR

Confidential

Premium to TEP:

Last close (2/06/18)

10-day VWAP (2/6/18)

30-day VWAP (2/6/18)

Implied transaction value (³);

Source: Tallgrass acquisition press release and presentation dated March 26, 2018.

(1) Excludes 25.6 million units owned by Tallgrass Equity, LLC.

(2) Current TEGP shareholders will own 58.1 MM shares (~21% interest). Current TEP unitholders will own 95.2 MM shares (-34% interest).

Adjusted for 65% of LP units acquired, 1.13% GP interest, assumed net debt of $2.1 billion and assumed noncontrolling interests of $69 million.

Consensus Wall Street estimates.

TRANSACTION METRICS (prior to Feb. 7 announcement)

Consideration per TEP unit

TEGP, last close (2/06/18)

Exchange ratio

Total consideration

$23.40

2.0x

$46.80

Price

$43.99

$44.86

$45.59

BAIRD

8.8%

2.8%

6.9%

1.2x

37%

3.0x

Project Bronco

6.3%

8.2%

% Premium

6.4%

4.3%

2.6%

$5,679

Page 9View entire presentation