Q2 2018 Fixed Income Investor Conference Call

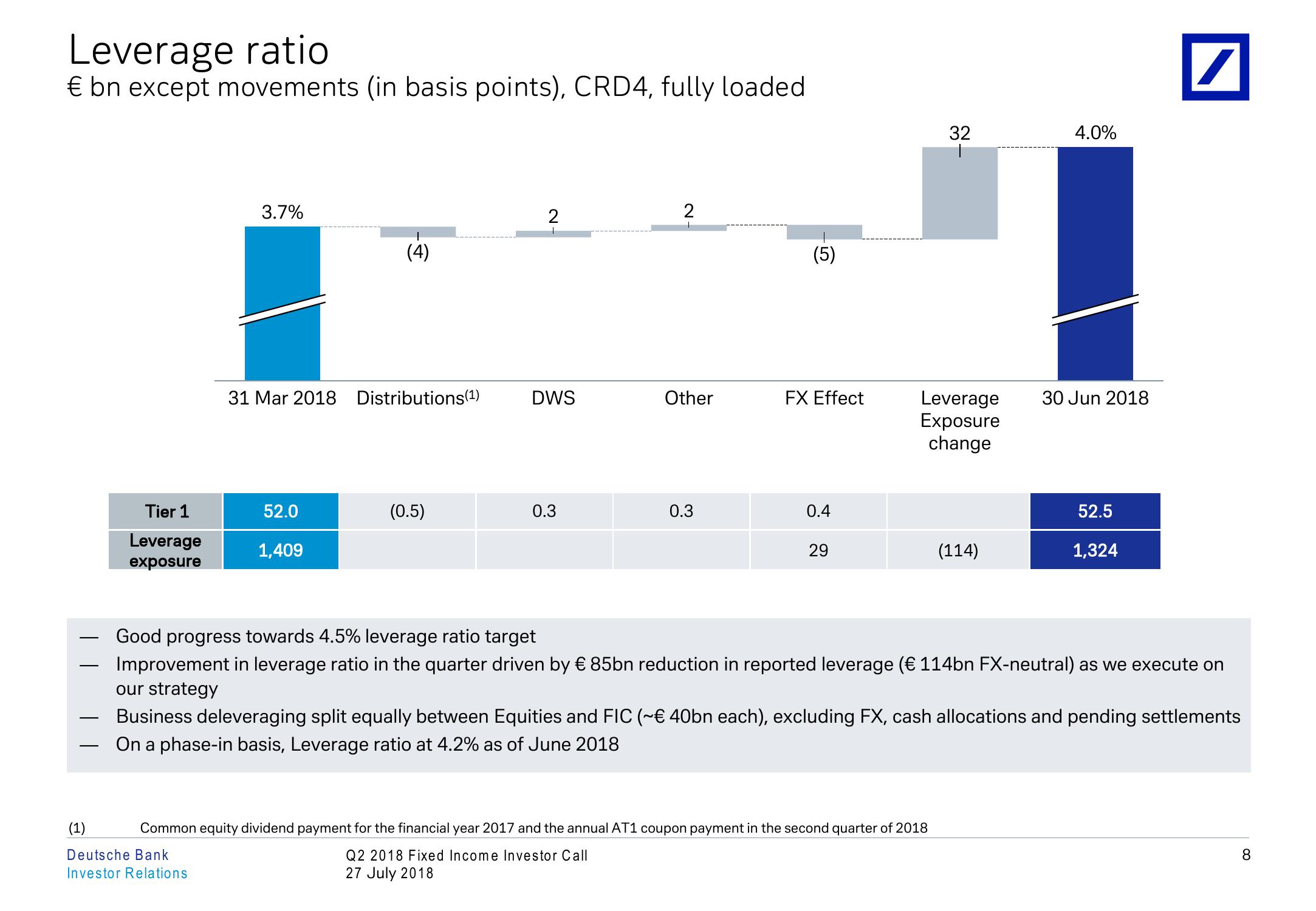

Leverage ratio

€ bn except movements (in basis points), CRD4, fully loaded

-

3.7%

-

(4)

31 Mar 2018 Distributions(1)

2

2

(5)

32

4.0%

DWS

Other

FX Effect

Leverage

Exposure

change

30 Jun 2018

52.5

29

(114)

1,324

Tier 1

52.0

(0.5)

0.3

0.3

Leverage

exposure

1,409

229

0.4

Good progress towards 4.5% leverage ratio target

Improvement in leverage ratio in the quarter driven by € 85bn reduction in reported leverage (€ 114bn FX-neutral) as we execute on

our strategy

Business deleveraging split equally between Equities and FIC (~€ 40bn each), excluding FX, cash allocations and pending settlements

On a phase-in basis, Leverage ratio at 4.2% as of June 2018

(1)

Common equity dividend payment for the financial year 2017 and the annual AT1 coupon payment in the second quarter of 2018

Deutsche Bank

Investor Relations

Q2 2018 Fixed Income Investor Call

27 July 2018

8View entire presentation