Comera SPAC Presentation Deck

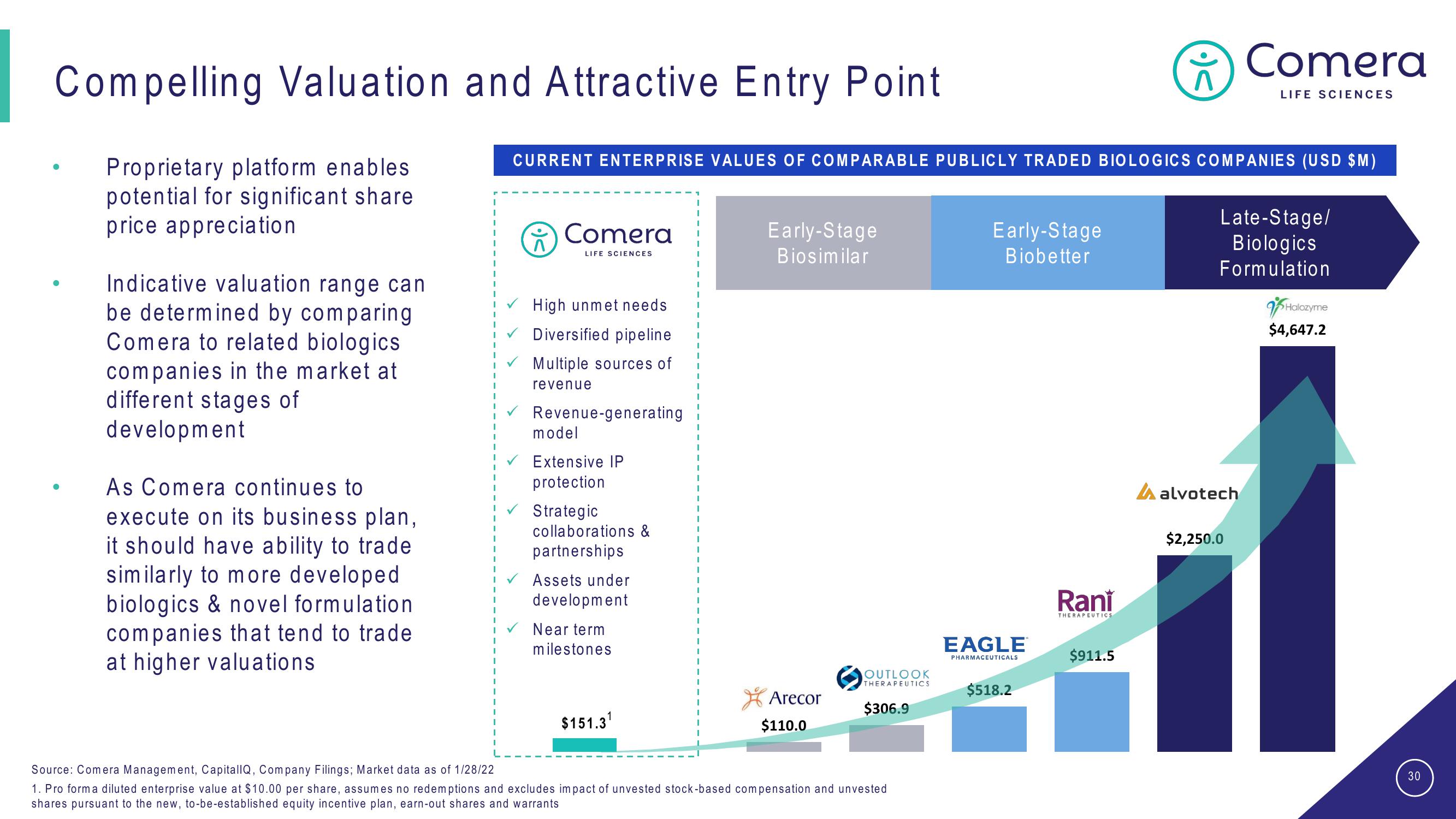

Compelling Valuation and Attractive Entry Point

Proprietary platform enables

potential for significant share.

price appreciation.

Indicative valuation range can

be determined by comparing

Comera to related biologics.

companies in the market at

different stages of

development

As Comera continues to

execute on its business plan,

it should have ability to trade

similarly to more developed

biologics & novel formulation.

companies that tend to trade

at higher valuations.

n

Comera

LIFE SCIENCES

CURRENT ENTERPRISE VALUES OF COMPARABLE PUBLICLY TRADED BIOLOGICS COMPANIES (USD $M)

High unmet needs

Diversified pipeline

Multiple sources of

revenue

Revenue-generating

model

Extensive IP

protection

Strategic

collaborations &

partnerships

Assets under

development

Near term

milestones

$151.3¹

I

I

I

I

Early-Stage

Biosimilar

Arecor

$110.0

OUTLOOK

THERAPEUTICS

$306.9

Source: Comera Management, CapitallQ, Company Filings; Market data as of 1/28/22

1. Pro form a diluted enterprise value at $10.00 per share, assumes no redemptions and excludes impact of unvested stock-based compensation and unvested

shares pursuant to the new, to-be-established equity incentive plan, earn-out shares and warrants

Early-Stage

Biobetter

EAGLE

PHARMACEUTICALS

$518.2

Rani

THERAPEUTICS

:)<

$911.5

Comera

alvotech

LIFE SCIENCES

Late-Stage/

Biologics

Formulation

$2,250.0

Halozyme

$4,647.2

30View entire presentation