NextNav SPAC Presentation Deck

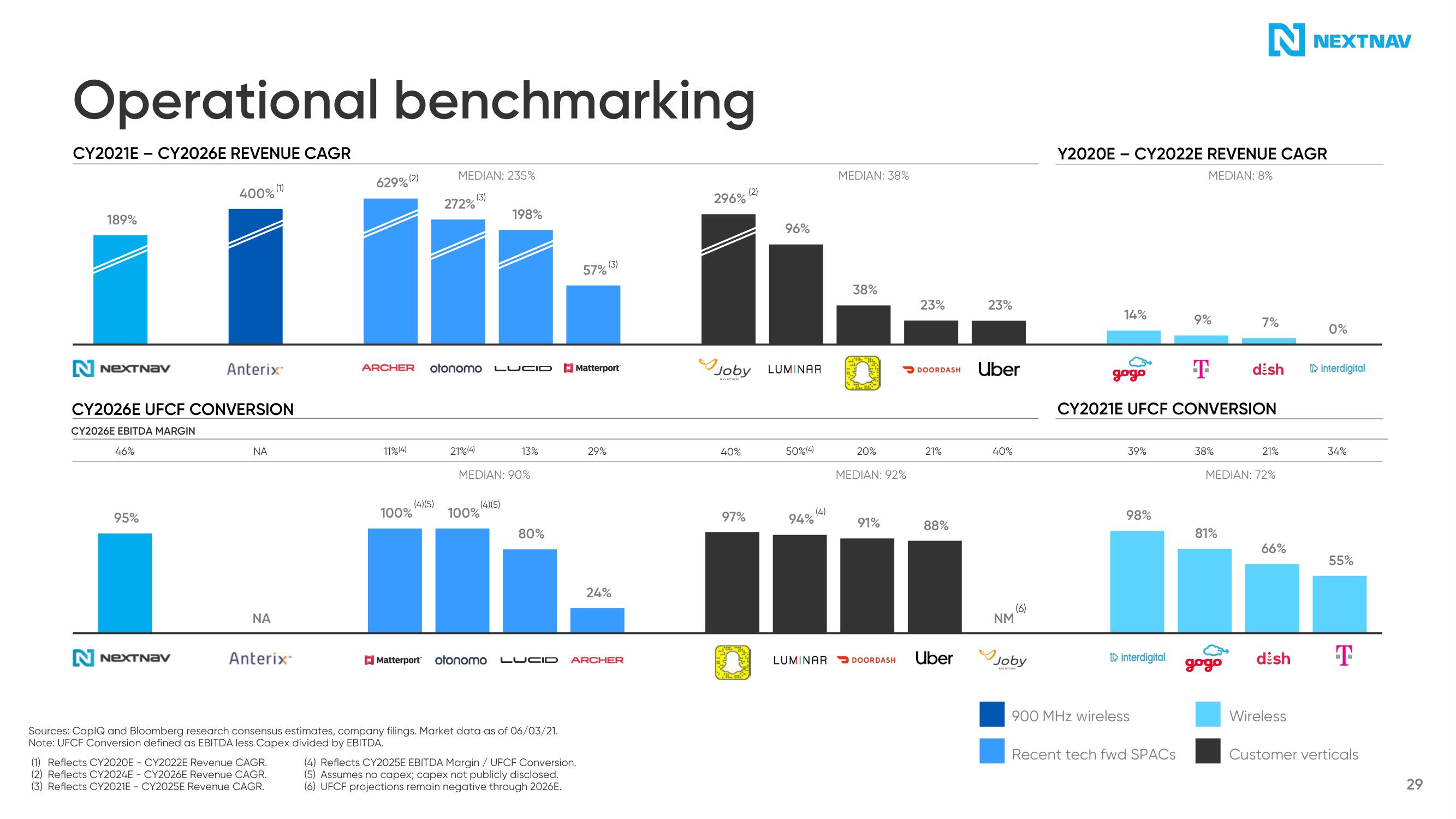

Operational benchmarking

CY2021E CY2026E REVENUE CAGR

189%

N NEXTNAV

46%

CY2026E UFCF CONVERSION

CY2026E EBITDA MARGIN

95%

400% (1)

N NEXTNav

Anterix™

ΝΑ

ΝΑ

Anterix™

629% (2)

(1) Reflects CY2020E - CY2022E Revenue CAGR.

(2) Reflects CY2024E-CY2026E Revenue CAGR.

(3) Reflects CY2021E - CY2025E Revenue CAGR.

11% (4)

ARCHER otonomo

100%

MEDIAN: 235%

(3)

(4)(5)

272%

21% (4)

198%

LUCID

(4)(5)

100%

MEDIAN: 90%

13%

80%

Matterport otonomo LUCID

Sources: CapIQ and Bloomberg research consensus estimates, company filings. Market data as of 06/03/21.

Note: UFCF Conversion defined as EBITDA less Capex divided by EBITDA.

57%

Matterport

(4) Reflects CY2025E EBITDA Margin / UFCF Conversion.

(5) Assumes no capex; capex not publicly disclosed.

(6) UFCF projections remain negative through 2026E.

(3)

29%

24%

ARCHER

296%

40%

Joby LUMINAR

97%

(2)

Nitt

96%

50% (4)

94%

MEDIAN: 38%

38%

D

20%

MEDIAN: 92%

91%

23%

DOORDASH

21%

88%

LUMINAR DOORDASH Uber

23%

Uber

40%

NM

(6)

Joby

Y2020E - CY2022E REVENUE CAGR

MEDIAN: 8%

14%

gogo

39%

98%

interdigital

900 MHz wireless

9%

CY2021E UFCF CONVERSION

Recent tech fwd SPACs

T

38%

N NEXTNAV

81%

7%

gogo

desh

MEDIAN: 72%

21%

66%

dish

Wireless

0%

interdigital.

34%

55%

T

Customer verticals

29View entire presentation