Oaktree Real Estate Opportunities Fund VII, L.P.

OAKTREE REAL ESTATE OPPORTUNITIES FUND VII, L.P.

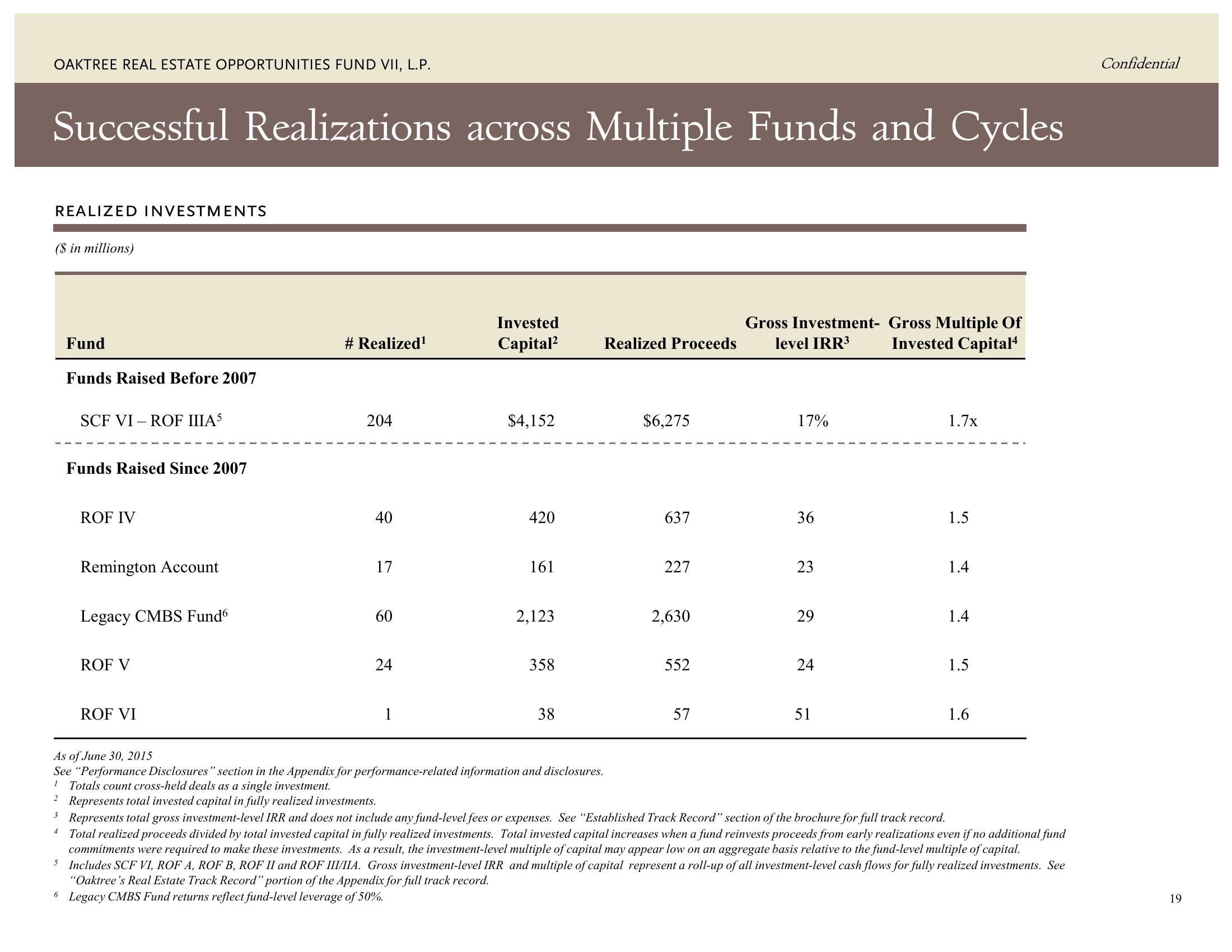

Successful Realizations across Multiple Funds and Cycles

REALIZED INVESTMENTS

($ in millions)

Fund

4

Funds Raised Before 2007

SCF VI - ROF IIIA5

Funds Raised Since 2007

ROF IV

Remington Account

Legacy CMBS Fund6

ROF V

ROF VI

# Realized¹

204

40

17

60

24

1

Invested

Capital² Realized Proceeds

$4,152

420

161

2,123

358

38

$6,275

637

227

2,630

552

57

Gross Investment- Gross Multiple Of

level IRR³ Invested Capital4

17%

36

23

29

24

51

As of June 30, 2015

See "Performance Disclosures" section in the Appendix for performance-related information and disclosures.

1 Totals count cross-held deals as a single investment.

2 Represents total invested capital in fully realized investments.

3 Represents total gross investment-level IRR and does not include any fund-level fees or expenses. See "Established Track Record" section of the brochure for full track record.

1.7x

1.5

1.4

1.4

1.5

1.6

Total realized proceeds divided by total invested capital in fully realized investments. Total invested capital increases when a fund reinvests proceeds from early realizations even if no additional fund

commitments were required to make these investments. As a result, the investment-level multiple of capital may appear low on an aggregate basis relative to the fund-level multiple of capital.

5 Includes SCF VI, ROF A, ROF B, ROF II and ROF III/IIA. Gross investment-level IRR and multiple of capital represent a roll-up of all investment-level cash flows for fully realized investments. See

"Oaktree's Real Estate Track Record" portion of the Appendix for full track record.

6 Legacy CMBS Fund returns reflect fund-level leverage of 50%.

Confidential

19View entire presentation